Vat 604 Form

What is the VAT 604 Form?

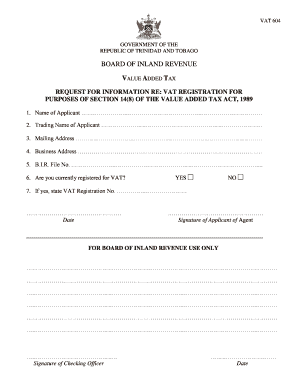

The VAT 604 form is a crucial document used in the context of Value Added Tax (VAT) applications, particularly in Trinidad and Tobago. This form is essential for businesses seeking to register for VAT or to apply for a VAT refund. It serves as a formal request to the Board of Inland Revenue, outlining the necessary details about the business and its VAT obligations. Understanding the purpose and requirements of the VAT 604 form is vital for compliance with tax regulations.

How to Use the VAT 604 Form

Using the VAT 604 form involves several steps to ensure that all information provided is accurate and complete. First, gather all necessary business information, including the legal name, address, and tax identification number. Next, fill out the form with relevant details regarding VAT registration or refund requests. It is important to review the completed form for any errors before submission. Utilizing digital tools can streamline this process, allowing for easy eSigning and submission.

Steps to Complete the VAT 604 Form

Completing the VAT 604 form requires careful attention to detail. Follow these steps for successful completion:

- Gather all required documentation, such as business registration papers and financial records.

- Fill in the business details accurately, including the type of business entity.

- Specify the reason for the VAT application, whether for registration or refund.

- Double-check all entries for accuracy and completeness.

- Sign the form digitally to ensure it meets legal requirements.

Legal Use of the VAT 604 Form

The legal use of the VAT 604 form is governed by tax regulations in Trinidad and Tobago. To ensure that the form is legally binding, it must be filled out correctly and submitted to the Board of Inland Revenue. Utilizing a secure digital platform for eSigning can enhance the legal validity of the submission, as it complies with relevant eSignature laws. It is essential to keep a copy of the submitted form for record-keeping and potential audits.

Required Documents

When preparing to submit the VAT 604 form, several supporting documents are typically required. These may include:

- Business registration certificate.

- Tax identification number.

- Financial statements or records demonstrating VAT-related transactions.

- Any previous VAT returns, if applicable.

Ensuring that all required documents are included with the VAT 604 form submission can help prevent delays in processing.

Form Submission Methods

The VAT 604 form can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient method, allowing for immediate processing and confirmation. When submitting by mail, ensure that the form is sent to the correct address and consider using a trackable mailing service. In-person submissions may be required in certain situations, such as when additional documentation needs to be presented.

Quick guide on how to complete vat 604 form

Prepare Vat 604 Form seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly and without issues. Manage Vat 604 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Vat 604 Form effortlessly

- Locate Vat 604 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for such tasks by airSlate SignNow.

- Craft your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your updates.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Vat 604 Form and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 604 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the board of inland revenue VAT application?

The board of inland revenue VAT application is a system designed to help businesses submit their VAT returns efficiently. This application ensures compliance with tax regulations and simplifies the file submission process, making it easier for businesses to manage their tax obligations.

-

How can airSlate SignNow enhance the board of inland revenue VAT application process?

airSlate SignNow enhances the board of inland revenue VAT application process by allowing users to eSign essential documents seamlessly. This means businesses can ensure faster turnaround times and enhance the overall efficiency of their VAT submissions.

-

Is there a cost associated with using the board of inland revenue VAT application through airSlate SignNow?

Yes, there is a pricing structure associated with using airSlate SignNow for the board of inland revenue VAT application. However, the solution is designed to be cost-effective, offering various plans to cater to businesses of different sizes.

-

What features does airSlate SignNow offer for managing the board of inland revenue VAT application?

airSlate SignNow offers features like document templates, customizable workflows, and real-time tracking for managing the board of inland revenue VAT application. These tools help streamline the submission process and ensure documents are easily accessible.

-

How does eSigning benefit the board of inland revenue VAT application?

eSigning benefits the board of inland revenue VAT application by reducing the time required for approvals and document processing. This results in faster VAT submissions, allowing businesses to stay compliant with tax deadlines efficiently.

-

Can airSlate SignNow integrate with other accounting software for VAT applications?

Absolutely! airSlate SignNow can easily integrate with various accounting software, enhancing the data flow for the board of inland revenue VAT application. This integration ensures a seamless experience and reduces the likelihood of errors in VAT reporting.

-

What are the benefits of using airSlate SignNow for the board of inland revenue VAT application?

Using airSlate SignNow for the board of inland revenue VAT application provides benefits such as improved efficiency, reduced paperwork, and enhanced compliance. It allows businesses to focus more on their core activities while ensuring swift and secure document handling.

Get more for Vat 604 Form

- Probability word problems worksheet form

- Harry potter spells list a z pdf form

- Ablls assessment pdf form

- Uncle festers cookbook pdf form

- Vde 0100 teil 600 prfprotokoll excel download form

- Vtl acquisition vodacom app download form

- Shriram transport finance 15g form online submission

- Hicaps add provider 64632056 form

Find out other Vat 604 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors