Fillable Wi Form 1x

What is the Fillable Wi Form 1x

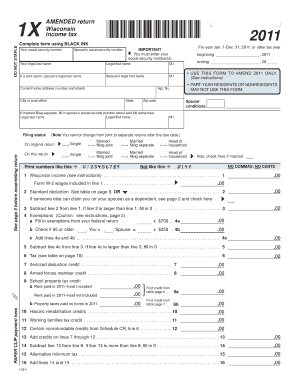

The Fillable Wi Form 1x is a tax form used in the state of Wisconsin for various purposes, including income reporting and tax calculations. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It allows taxpayers to provide necessary information regarding their income, deductions, and credits, which ultimately determines their tax liability.

How to use the Fillable Wi Form 1x

Using the Fillable Wi Form 1x is straightforward. Taxpayers can access the form online, fill it out digitally, and submit it electronically or via mail. It is important to read the instructions carefully to ensure all required information is accurately provided. Users should gather necessary documents, such as W-2s or 1099s, to facilitate the completion of the form.

Steps to complete the Fillable Wi Form 1x

To complete the Fillable Wi Form 1x, follow these steps:

- Download the form from an official source or access it through a digital platform.

- Gather all relevant financial documents, including income statements and deduction records.

- Fill in personal information, such as name, address, and Social Security number.

- Report income sources and amounts accurately.

- Calculate deductions and credits based on the provided guidelines.

- Review the form for accuracy before submission.

Legal use of the Fillable Wi Form 1x

The Fillable Wi Form 1x is legally binding when completed and submitted in accordance with state regulations. To ensure its legal validity, taxpayers must adhere to guidelines set forth by the Wisconsin Department of Revenue. This includes providing accurate information and maintaining compliance with eSignature laws if submitting electronically.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines associated with the Fillable Wi Form 1x. Typically, the deadline for submission aligns with the federal tax filing deadline, which is April fifteenth. However, specific circumstances may warrant different deadlines, such as extensions or special situations. Taxpayers should check for any updates or changes each tax year.

Form Submission Methods (Online / Mail / In-Person)

The Fillable Wi Form 1x can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to submit the form electronically via authorized platforms, ensuring faster processing.

- Mail: Completed forms can be printed and sent to the appropriate Wisconsin Department of Revenue address.

- In-Person: Taxpayers may also choose to deliver their forms directly to local tax offices for immediate processing.

Quick guide on how to complete fillable wi form 1x

Complete Fillable Wi Form 1x with ease on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without obstacles. Manage Fillable Wi Form 1x on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Fillable Wi Form 1x effortlessly

- Obtain Fillable Wi Form 1x and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), invite link, or download it directly to your PC.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Fillable Wi Form 1x to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable wi form 1x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Fillable Wi Form 1x?

The Fillable Wi Form 1x is a standardized document used for various business purposes in Wisconsin. It allows users to easily fill out important information and submit it electronically. This form streamlines the documentation process, making it efficient and user-friendly.

-

How does airSlate SignNow facilitate the completion of the Fillable Wi Form 1x?

airSlate SignNow provides an intuitive platform that enables users to fill out the Fillable Wi Form 1x online. With features like drag-and-drop fields and easy access to digital signing, completing the form has never been simpler. Users can collaborate in real time, ensuring accuracy and timeliness.

-

Is there a cost associated with using the Fillable Wi Form 1x on airSlate SignNow?

Yes, there is a pricing plan for using the Fillable Wi Form 1x on airSlate SignNow. The plans vary based on the features you require and the number of documents you plan to send. Overall, it's a cost-effective solution designed to meet the needs of businesses of all sizes.

-

What are the key features of the Fillable Wi Form 1x in airSlate SignNow?

Key features of the Fillable Wi Form 1x include customizable templates, real-time collaboration, and secure digital signatures. Users can also track document statuses for better workflow management. These features ensure a seamless signing experience for both senders and recipients.

-

Can I integrate the Fillable Wi Form 1x with other applications?

Absolutely! airSlate SignNow allows integration with a variety of applications, enhancing the functionality of the Fillable Wi Form 1x. Users can connect with popular tools such as Google Drive, CRM systems, and more to streamline their workflows.

-

What are the benefits of using airSlate SignNow for the Fillable Wi Form 1x?

Using airSlate SignNow for the Fillable Wi Form 1x offers numerous benefits, including increased efficiency and reduced document turnaround times. Additionally, the platform enhances security and provides users with a user-friendly interface. This makes completing and managing forms straightforward and reliable.

-

Is the Fillable Wi Form 1x compliant with state regulations?

Yes, the Fillable Wi Form 1x provided through airSlate SignNow complies with state regulations. The platform ensures that all documents meet legal standards, allowing you to process your forms with confidence. This compliance is crucial for businesses operating in Wisconsin.

Get more for Fillable Wi Form 1x

- Paint adhesive products from windows floors ceramic tile and bathroom fixtures site form

- Outletfixture blocks form

- Insulated spaces temperature insulation air conditioning units systems or coolers ducts form

- Particular area or worksite form

- Slump form

- City of laguna niguel plumbing contract services request for form

- Garages walls floors or other structures form

- Sizeweight form

Find out other Fillable Wi Form 1x

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy