Form 872

What is the Form 872

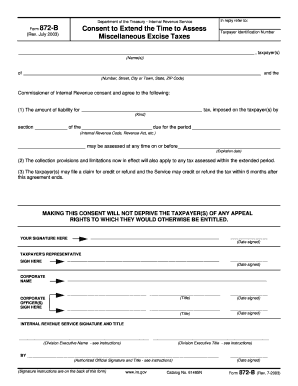

The Form 872, also known as the IRS Form 872, is a document used by taxpayers to authorize the IRS to extend the statute of limitations on the assessment of tax liabilities. This form is particularly relevant for individuals and businesses that may need additional time to resolve disputes or clarify their tax obligations. By signing this form, taxpayers agree to extend the period during which the IRS can assess additional taxes, ensuring that both parties have ample time to address any outstanding issues.

How to use the Form 872

To effectively use the Form 872, taxpayers must complete it accurately and submit it to the IRS. The form requires essential information, including the taxpayer's name, address, and taxpayer identification number. Additionally, the form must specify the tax years for which the extension is requested. Once completed, the taxpayer should sign and date the form before sending it to the appropriate IRS office. It is crucial to retain a copy of the signed form for personal records.

Steps to complete the Form 872

Completing the Form 872 involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including your personal details and tax identification number.

- Clearly indicate the tax years for which you are requesting an extension.

- Sign and date the form, ensuring that all information is correct.

- Submit the completed form to the designated IRS office, either by mail or electronically, if applicable.

- Keep a copy of the signed form for your records.

Legal use of the Form 872

The legal use of the Form 872 is crucial for ensuring that the extension of the statute of limitations is recognized by the IRS. When properly executed, the form serves as a binding agreement between the taxpayer and the IRS, allowing for the extension of time to assess tax liabilities. It is important to understand that this form does not waive the taxpayer's rights or obligations; rather, it provides a structured approach to resolving tax issues while ensuring compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 872. Taxpayers should be aware of the following:

- The form must be signed by the taxpayer or an authorized representative.

- Extensions granted through this form are generally limited to a specific period, typically up to three years.

- Taxpayers should submit the form promptly to avoid any potential penalties or complications.

- It is advisable to consult with a tax professional if there are any uncertainties regarding the completion or submission of the form.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Form 872 can lead to significant penalties. If the IRS assesses additional taxes after the statute of limitations has expired without a valid extension, taxpayers may face financial repercussions. It is essential to ensure that the form is completed and submitted correctly to avoid any issues with tax assessments. Understanding the implications of non-compliance can help taxpayers navigate their tax obligations more effectively.

Quick guide on how to complete form 872

Complete Form 872 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Form 872 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form 872 with ease

- Locate Form 872 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 872 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 872

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 872 B and how does it work?

Form 872 B is a consent form that allows the IRS to extend the time for assessing taxes owed. By using airSlate SignNow, businesses can easily eSign Form 872 B, ensuring a secure and efficient process for tax-related communications.

-

How can I use airSlate SignNow to manage Form 872 B?

With airSlate SignNow, you can create, send, and eSign Form 872 B seamlessly. Our platform provides templates that simplify the document preparation process, allowing you to focus on your business while we handle the details.

-

What are the pricing options for using airSlate SignNow for Form 872 B?

Our pricing plans for airSlate SignNow vary based on your needs, starting with a free trial to test the platform. For businesses looking to manage documents like Form 872 B efficiently, affordable subscription options are available for unlimited eSigning.

-

What features does airSlate SignNow offer for Form 872 B?

airSlate SignNow offers a range of features for managing Form 872 B, including templates, cloud storage, and detailed tracking of document status. These features enhance your workflow by making it easy to share and manage tax documents securely.

-

Are there integrations available for airSlate SignNow with other software?

Yes, airSlate SignNow integrates with various business applications to streamline the process of managing Form 872 B. Whether you use CRM systems or accounting software, our integrations help to automate workflows and keep everything organized.

-

How does airSlate SignNow ensure the security of Form 872 B?

Security is a priority at airSlate SignNow. When eSigning Form 872 B, we utilize encryption and compliance with industry standards to safeguard your sensitive information, ensuring that your documents remain confidential and secure.

-

Can multiple users sign Form 872 B on airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to eSign Form 872 B collaboratively. This feature makes it easier for teams to work together efficiently, regardless of their physical location.

Get more for Form 872

- Notification of rights for texas consumersexperian form

- Advice encourage your reader to take advantage of a new opportunity form

- Chester pa 19022 form

- Advice offer a suggestion to a customer form

- Advice encouragemotivate to increase sales form

- Legal formsattorneys feelawsuit scribd

- Get well message to a child suffering from illness or injury form

- Wage and hour laws for volunteers and interns ward and form

Find out other Form 872

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document