Connecticut Foprm Au 933 Form 2001-2026

What is the Connecticut Foprm Au 933 Form

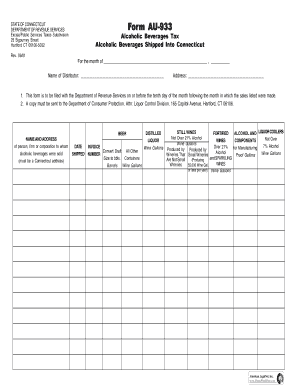

The Connecticut Foprm Au 933 Form is a specific document used within the state of Connecticut, primarily for tax-related purposes. This form is essential for individuals and businesses to report certain financial information to the state authorities. It ensures compliance with state regulations and facilitates accurate tax assessments. Understanding the purpose of this form is crucial for proper filing and adherence to Connecticut tax laws.

How to use the Connecticut Foprm Au 933 Form

Using the Connecticut Foprm Au 933 Form involves several key steps. First, gather all necessary financial information and documentation relevant to the form. Next, fill out the form accurately, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions. Finally, submit the form to the appropriate state agency, either electronically or by mail, depending on the submission guidelines provided by the state.

Steps to complete the Connecticut Foprm Au 933 Form

Completing the Connecticut Foprm Au 933 Form involves a systematic approach:

- Collect all necessary financial records, including income statements and previous tax returns.

- Access the form through the official state website or authorized platforms.

- Fill in personal or business identification information as required.

- Complete the financial sections, ensuring accuracy in reporting income and deductions.

- Double-check all entries for correctness before submission.

- Submit the form according to the specified methods, either online or via postal mail.

Legal use of the Connecticut Foprm Au 933 Form

The Connecticut Foprm Au 933 Form holds legal significance as it serves as an official record of financial reporting to the state. To ensure its legal validity, it must be completed in compliance with applicable state laws. Proper execution of the form, including accurate information and timely submission, is essential to avoid potential legal issues or penalties. Understanding the legal implications of this form helps users navigate their responsibilities effectively.

Required Documents

When preparing to complete the Connecticut Foprm Au 933 Form, certain documents are typically required. These may include:

- Income statements or pay stubs to verify earnings.

- Previous tax returns for reference and consistency.

- Records of any deductions or credits claimed in prior filings.

- Identification documents, such as a driver's license or Social Security number.

Form Submission Methods

The Connecticut Foprm Au 933 Form can be submitted through various methods, ensuring flexibility for users. Common submission options include:

- Online submission via the official state tax website, which is often the quickest method.

- Mailing a printed copy of the completed form to the designated state agency address.

- In-person submission at local tax offices, if available, for those who prefer direct interaction.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Connecticut Foprm Au 933 Form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate filing. It is advisable to stay informed about deadlines and requirements to avoid these penalties.

Quick guide on how to complete connecticut foprm au 933 form

Complete Connecticut Foprm Au 933 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Connecticut Foprm Au 933 Form on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

The easiest way to modify and eSign Connecticut Foprm Au 933 Form without effort

- Find Connecticut Foprm Au 933 Form and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive data with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form: via email, SMS, an invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Connecticut Foprm Au 933 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the connecticut foprm au 933 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Connecticut Foprm Au 933 Form?

The Connecticut Foprm Au 933 Form is a critical document required for various administrative and legal processes in Connecticut. It ensures compliance with state regulations and helps facilitate the efficient handling of official documents. Understanding this form is essential for businesses operating in Connecticut.

-

How can airSlate SignNow assist with the Connecticut Foprm Au 933 Form?

AirSlate SignNow provides an intuitive platform to easily fill out, sign, and send the Connecticut Foprm Au 933 Form. Our solution simplifies the document management process, ensuring that you can complete and submit this form without hassle. Additionally, our electronic signature feature guarantees quick and secure approvals.

-

What are the pricing options for using airSlate SignNow for the Connecticut Foprm Au 933 Form?

AirSlate SignNow offers competitive pricing tailored to meet various business needs, including options for small businesses and larger organizations. Our plans provide robust features for managing the Connecticut Foprm Au 933 Form and other documents without breaking the bank. You can explore our pricing page for detailed information and choose the best option for your requirements.

-

Can I integrate airSlate SignNow with other software for handling the Connecticut Foprm Au 933 Form?

Yes, airSlate SignNow offers seamless integrations with a variety of popular software applications, which can enhance your workflow when dealing with the Connecticut Foprm Au 933 Form. This means you can connect tools you're already using for a more efficient document management experience. Explore our integration options to learn more.

-

What security features does airSlate SignNow provide for the Connecticut Foprm Au 933 Form?

AirSlate SignNow prioritizes security with advanced measures to protect your documents, including the Connecticut Foprm Au 933 Form. Our platform uses encryption and secure data storage to ensure that your sensitive information remains safe. With our commitment to security, you can trust that your documents are handled with the utmost care.

-

Is airSlate SignNow user-friendly for completing the Connecticut Foprm Au 933 Form?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, making it simple for anyone to complete the Connecticut Foprm Au 933 Form. Our intuitive interface allows you to navigate easily through the document process, whether you're a seasoned professional or a newcomer to electronic signatures. You'll find that getting your forms signed has never been easier.

-

What benefits does using airSlate SignNow offer for the Connecticut Foprm Au 933 Form?

Using airSlate SignNow for the Connecticut Foprm Au 933 Form can greatly enhance your document workflow. Benefits include reduced processing time, improved accuracy, and lower costs associated with printing and mailing. Our e-signature solution not only speeds up transactions but also helps maintain a clear and organized record of all signed documents.

Get more for Connecticut Foprm Au 933 Form

- Free minnesota name change forms how to change your

- Fillable online application for name change form nam102 fax

- Five things to know about changing your name in minnesota form

- For a change of name to new name of minors form

- On behalf of current name of minors form

- Name change guide for people with criminal records form

- Affidavit in support of order form

- State that i am at least form

Find out other Connecticut Foprm Au 933 Form

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter