Debt Term Sheet Example Form

What is the debt term sheet example

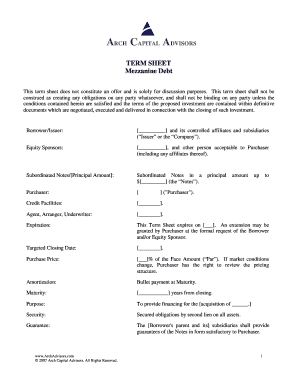

A debt term sheet example outlines the key terms and conditions of a debt financing arrangement between a borrower and a lender. It serves as a preliminary agreement that lays the groundwork for a more detailed loan agreement. This document typically includes essential details such as the loan amount, interest rate, repayment schedule, and any covenants or conditions that must be met by the borrower. Understanding this example is crucial for both parties to ensure clarity and alignment on the financing terms before moving forward with formal documentation.

Key elements of the debt term sheet example

The debt term sheet example includes several critical components that define the agreement between the borrower and lender. These elements typically encompass:

- Loan Amount: The total sum that the borrower is seeking to obtain.

- Interest Rate: The cost of borrowing, usually expressed as an annual percentage.

- Repayment Schedule: The timeline and frequency of payments, including any grace periods.

- Covenants: Conditions that the borrower must adhere to, which may include financial performance metrics.

- Fees: Any additional costs associated with the loan, such as origination fees or closing costs.

- Default Conditions: Circumstances under which the lender can declare a default on the loan.

How to use the debt term sheet example

Using a debt term sheet example involves several steps that facilitate the negotiation and agreement process between the borrower and lender. Begin by reviewing the example to understand the typical terms included. Next, customize the document to reflect the specific needs and circumstances of your financing arrangement. Engage in discussions with the lender to negotiate terms that are favorable and acceptable to both parties. Once the terms are agreed upon, the debt term sheet can serve as a reference point for drafting the final loan agreement.

Steps to complete the debt term sheet example

Completing a debt term sheet example requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather Information: Collect all necessary financial data, including current debts and income statements.

- Define Terms: Clearly outline the loan amount, interest rate, and repayment terms you wish to propose.

- Consult with Advisors: Seek input from financial advisors or legal counsel to ensure compliance and feasibility.

- Draft the Document: Use the debt term sheet example as a template, filling in the customized details.

- Review and Revise: Ensure that all terms are accurately represented and agreed upon by both parties.

Legal use of the debt term sheet example

The legal use of a debt term sheet example is significant as it establishes a framework for the relationship between the borrower and lender. While the term sheet itself is typically non-binding, it creates an expectation of good faith negotiations towards a formal agreement. To ensure legal validity, it is essential to comply with relevant laws and regulations governing debt financing in the United States. Additionally, both parties should consider having the term sheet reviewed by legal counsel to address any potential issues before finalizing the agreement.

Quick guide on how to complete debt term sheet example

Complete Debt Term Sheet Example effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle Debt Term Sheet Example on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Debt Term Sheet Example with ease

- Obtain Debt Term Sheet Example and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Debt Term Sheet Example to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the debt term sheet example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mezzanine financing term sheet?

A mezzanine financing term sheet is a document outlining the essential terms and conditions of a mezzanine financing agreement. It serves as a critical tool for borrowers and lenders to understand the scope of financing, including interest rates, repayment terms, and equity stakes. By having a clear mezzanine financing term sheet, both parties can ensure a smoother negotiation process.

-

How can airSlate SignNow help me manage my mezzanine financing term sheet?

airSlate SignNow offers a user-friendly platform where you can create, send, and eSign your mezzanine financing term sheet efficiently. Its intuitive interface ensures that all parties involved can review and agree on the terms without hassle. This streamlined process not only saves time but also enhances document accuracy and security.

-

Is there a cost associated with using airSlate SignNow for mezzanine financing term sheets?

Yes, while airSlate SignNow provides a cost-effective solution for document management, the pricing structure varies based on your usage and feature requirements. You can select from various pricing plans that cater to different business needs, ensuring you get the best value when handling your mezzanine financing term sheet.

-

What features does airSlate SignNow offer for managing contract documents like mezzanine financing term sheets?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and automated reminders, making it ideal for managing mezzanine financing term sheets. Additionally, it provides secure eSigning and document tracking capabilities, ensuring every detail is covered during negotiations. These features enhance efficiency and compliance throughout the process.

-

Can I integrate airSlate SignNow with other tools for managing mezanine financing term sheets?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications such as CRMs, project management tools, and cloud storage services. This means you can efficiently manage your entire workflow related to the mezzanine financing term sheet without switching between different platforms, enhancing productivity and accessibility.

-

What are the benefits of using airSlate SignNow for my mezzanine financing term sheet compared to traditional methods?

Using airSlate SignNow for your mezzanine financing term sheet offers several advantages over traditional methods, including speed, convenience, and enhanced security. Electronic signatures reduce the time taken for approvals, while built-in security features protect sensitive information. Overall, this modern approach signNowly improves document management and collaboration.

-

Is electronic signing of a mezzanine financing term sheet legally binding?

Yes, electronic signing of a mezzanine financing term sheet is legally binding in many jurisdictions, provided it meets the necessary legal criteria. airSlate SignNow adheres to regulations like the ESIGN Act and eIDAS, ensuring that your electronically signed documents are enforceable. This gives you peace of mind knowing that your agreements hold legal validity.

Get more for Debt Term Sheet Example

Find out other Debt Term Sheet Example

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter