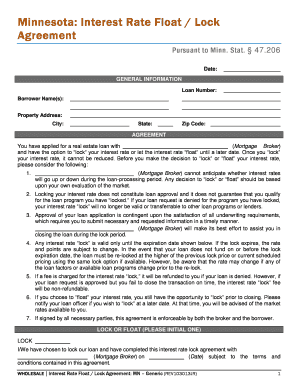

Minnesota Interest Rate Float Lock Agreement InterBank Form

What is the Minnesota rate lock agreement?

The Minnesota rate lock agreement is a legal document that allows borrowers to secure a specific interest rate on a loan for a defined period. This agreement is particularly relevant in the context of mortgage lending, where fluctuations in interest rates can significantly impact monthly payments and overall loan costs. By locking in a rate, borrowers can protect themselves from potential increases during the loan processing period.

Key elements of the Minnesota rate lock agreement

Several essential components must be included in a Minnesota rate lock agreement to ensure its validity and effectiveness:

- Borrower and lender information: The agreement should clearly state the names and contact details of both parties.

- Loan details: This includes the loan amount, type, and purpose.

- Interest rate: The specific rate being locked must be explicitly stated.

- Lock period: The duration for which the rate is locked should be defined, typically ranging from 30 to 90 days.

- Conditions of the lock: Any conditions that could affect the lock, such as changes in the borrower's financial situation, should be outlined.

Steps to complete the Minnesota rate lock agreement

Completing a Minnesota rate lock agreement involves several critical steps:

- Gather necessary information: Collect all relevant details about the loan and the parties involved.

- Draft the agreement: Use a template or consult with a legal expert to ensure all required elements are included.

- Review the terms: Both parties should carefully review the agreement to ensure clarity and mutual understanding.

- Sign the agreement: Both the borrower and lender must sign the document to make it legally binding.

- Keep a copy: Each party should retain a copy of the signed agreement for their records.

Legal use of the Minnesota rate lock agreement

The Minnesota rate lock agreement is legally binding, provided it meets specific requirements under state law. To be enforceable, the agreement must be clear, mutually agreed upon, and signed by both parties. Additionally, compliance with electronic signature laws, such as the ESIGN Act and UETA, is essential if the agreement is executed digitally. This ensures that the document holds the same legal weight as a traditional paper agreement.

State-specific rules for the Minnesota rate lock agreement

In Minnesota, certain state-specific rules apply to rate lock agreements. These may include:

- Disclosure requirements: Lenders must provide borrowers with clear disclosures regarding the terms of the rate lock.

- Regulatory compliance: Lenders must adhere to state regulations governing lending practices and consumer protection.

- Record-keeping: Both parties are advised to maintain comprehensive records of the agreement and any communications related to it.

How to obtain the Minnesota rate lock agreement

Obtaining a Minnesota rate lock agreement typically involves working with a lender or mortgage broker. Borrowers can request the agreement during the loan application process. Many lenders provide standard templates that can be customized to fit specific loan scenarios. It is advisable to consult with a financial advisor or legal expert to ensure that the agreement meets all necessary legal requirements.

Quick guide on how to complete minnesota interest rate float lock agreement interbank

Complete Minnesota Interest Rate Float Lock Agreement InterBank effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Minnesota Interest Rate Float Lock Agreement InterBank on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to alter and eSign Minnesota Interest Rate Float Lock Agreement InterBank effortlessly

- Find Minnesota Interest Rate Float Lock Agreement InterBank and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to submit your form: via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Minnesota Interest Rate Float Lock Agreement InterBank and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota interest rate float lock agreement interbank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic minnesota rate lock agreement requirements?

The Minnesota rate lock agreement requirements typically include clear terms regarding the locking period, the interest rate, and any conditions for locking the rate. It's essential to ensure that all parties involved understand these requirements to avoid any potential disputes. Familiarizing yourself with the local laws can also aid compliance.

-

How can airSlate SignNow help with managing minnesota rate lock agreements?

AirSlate SignNow provides an efficient platform for managing Minnesota rate lock agreements through electronic signatures and document tracking. Users can create customized templates, making it easier to fulfill the Minnesota rate lock agreement requirements. This streamlines the process, reduces errors, and enhances efficiency.

-

What features does airSlate SignNow offer for rate lock agreements?

AirSlate SignNow offers features such as secure eSignature, document templates, and real-time tracking that align with the Minnesota rate lock agreement requirements. These features ensure that all agreements are executed securely and efficiently, adhering to legal standards and improving the user experience.

-

Are there any costs associated with using airSlate SignNow for rate lock agreements?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The pricing is designed to be cost-effective while providing robust features to meet the Minnesota rate lock agreement requirements. You can choose a plan that best fits your volume of documents and specific needs.

-

What are the benefits of using electronic signatures for minnesota rate lock agreements?

Utilizing electronic signatures for Minnesota rate lock agreements offers several benefits, such as reduced turnaround times and enhanced security. It simplifies the signing process, ensuring compliance with the Minnesota rate lock agreement requirements and enabling quicker decisions in a competitive market.

-

Can I integrate airSlate SignNow with other software for rate lock agreements?

Absolutely! AirSlate SignNow can be seamlessly integrated with various software applications to enhance document management for Minnesota rate lock agreement requirements. This integration allows for a streamlined workflow, ensuring that all documents are efficiently handled within your existing systems.

-

What support does airSlate SignNow provide for users managing rate lock agreements?

AirSlate SignNow offers comprehensive support to users managing Minnesota rate lock agreements, including detailed documentation, tutorials, and customer service channels. Whether you have questions about compliance or need assistance with features, the support team is readily available to address your queries.

Get more for Minnesota Interest Rate Float Lock Agreement InterBank

Find out other Minnesota Interest Rate Float Lock Agreement InterBank

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast