Strategy 7 Working it Out Take Home Pay Benefits and Taxes Answers Form

What is the Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers

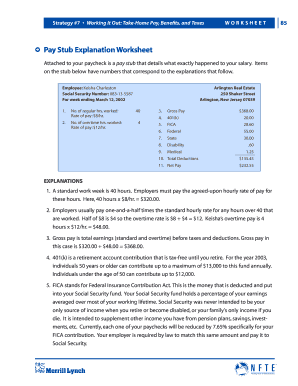

The Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers form is designed to help individuals calculate their net income after taxes and deductions. This form provides clarity on how various factors, such as tax rates, benefits, and other deductions, impact take-home pay. It is particularly useful for employees who want to understand their financial situation better and make informed decisions regarding their earnings and benefits.

How to use the Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers

Using the Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers form involves several steps. First, gather your financial documents, including your pay stubs and any relevant tax information. Next, input your gross income, along with any pre-tax deductions such as retirement contributions and health insurance premiums. The form will guide you through calculating your taxable income and estimating your total tax liability, allowing you to arrive at your estimated take-home pay.

Steps to complete the Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers

Completing the Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers form can be done systematically. Follow these steps:

- Gather necessary documents, including your latest pay stub and tax forms.

- Enter your gross income for the period in question.

- List any pre-tax deductions, such as 401(k) contributions and health insurance premiums.

- Calculate your taxable income by subtracting deductions from your gross income.

- Apply the appropriate tax rates to determine your total tax liability.

- Subtract the total tax liability from your taxable income to find your estimated take-home pay.

Key elements of the Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers

Several key elements are crucial for accurately using the Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers form. These include:

- Gross Income: The total earnings before any deductions.

- Pre-Tax Deductions: Contributions to retirement plans or health insurance that reduce taxable income.

- Tax Rates: The federal and state tax rates applicable to your income level.

- Net Income: The final amount you take home after all deductions and taxes.

Legal use of the Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers

The legal use of the Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers form is essential for ensuring compliance with tax regulations. It is important to accurately report income and deductions to avoid penalties. The form serves as a tool for individuals to understand their financial obligations and rights, making it a valuable resource for personal financial management.

Examples of using the Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers

Examples of using the Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers form can illustrate its practical applications. For instance:

- A full-time employee can use the form to estimate their monthly take-home pay after accounting for federal and state taxes.

- A freelancer may calculate their expected income after accounting for self-employment taxes and deductible expenses.

- A recent graduate assessing job offers can compare potential salaries by estimating take-home pay using the form.

Quick guide on how to complete strategy 7 working it out take home pay benefits and taxes answers

Complete Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers easily on any device

Online document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to edit and eSign Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers with ease

- Find Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for such tasks.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and then click the Done button to save your modifications.

- Choose how you would prefer to submit your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers to ensure seamless communication at any point of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the strategy 7 working it out take home pay benefits and taxes answers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of 'strategy 7 working it out take home pay benefits and taxes answers'?

The 'strategy 7 working it out take home pay benefits and taxes answers' provides businesses insight into calculating net income after taxes and benefits. This helps in decision-making about employee compensation and business expenses, ensuring clarity in financial planning.

-

How does airSlate SignNow relate to 'strategy 7 working it out take home pay benefits and taxes answers'?

airSlate SignNow simplifies the process of sending and signing documents, which is essential for employee compensation agreements tied to the 'strategy 7 working it out take home pay benefits and taxes answers'. It streamlines communication, ensuring that all parties are well-informed about pay structures.

-

What features does airSlate SignNow offer that support financial strategy planning?

airSlate SignNow offers features like document templates, real-time collaboration, and eSigning capabilities that help businesses execute financial strategy planning efficiently. These features can directly aid in executing the 'strategy 7 working it out take home pay benefits and taxes answers' for better financial outcomes.

-

Can I integrate airSlate SignNow with other financial software?

Yes, airSlate SignNow integrates seamlessly with many financial and HR software solutions. This flexibility allows businesses to align their 'strategy 7 working it out take home pay benefits and taxes answers' with existing systems, improving overall productivity and accuracy.

-

What are the benefits of using airSlate SignNow for handling employee compensation?

Using airSlate SignNow for employee compensation management ensures accuracy, compliance, and quick turnaround times. This efficiency enhances your understanding of the 'strategy 7 working it out take home pay benefits and taxes answers', allowing for better financial decision-making.

-

What pricing plans does airSlate SignNow offer for businesses?

airSlate SignNow provides various pricing plans to meet different business needs, from small startups to large enterprises. These affordable options can streamline processes related to 'strategy 7 working it out take home pay benefits and taxes answers', ensuring that you get value for your investment.

-

How can airSlate SignNow improve the document workflow related to pay and benefits?

By automating document workflows, airSlate SignNow minimizes manual errors and speeds up the signing process. This improvement directly supports the evaluation and execution of 'strategy 7 working it out take home pay benefits and taxes answers', leading to more efficient management of pay and benefits.

Get more for Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers

- Covering letter for caste validity 496836934 form

- Cr12 form

- Arkansas quit claim deed form

- Power of attorney form rhode island

- Nevada divorce papers pdf form

- Manage and maintain small medium business operations ppt form

- Your electricity bill byumarvmobilehomeparksbbcomb form

- Citibankbranchkyc citi com form

Find out other Strategy 7 Working It Out Take Home Pay Benefits And Taxes Answers

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online