Axis Bank Letter of Credit Format

What is the Axis Bank Letter of Credit Format

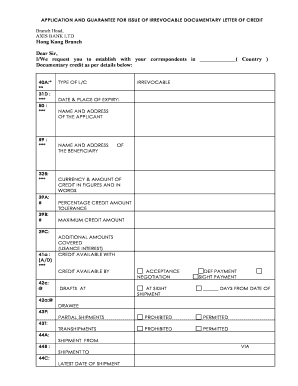

The Axis Bank letter of credit format is a financial document that guarantees payment to a seller on behalf of a buyer, provided that the seller meets specific terms and conditions outlined in the letter. This format is essential in international trade, as it assures sellers that they will receive payment for goods or services. The letter includes details such as the amount, the expiry date, and the conditions under which payment will be made. Understanding this format is crucial for businesses engaged in cross-border transactions.

Key Elements of the Axis Bank Letter of Credit Format

The Axis Bank letter of credit format contains several key elements that ensure clarity and compliance. These elements typically include:

- Applicant Information: Details about the buyer requesting the letter.

- Beneficiary Information: Information about the seller who will receive payment.

- Amount: The total sum guaranteed by the bank.

- Expiry Date: The date by which the seller must present documents to receive payment.

- Terms and Conditions: Specific requirements that must be met for payment to be released.

These elements are crucial for ensuring that all parties involved understand their rights and obligations under the letter of credit.

How to Use the Axis Bank Letter of Credit Format

Using the Axis Bank letter of credit format involves several steps to ensure that the document is completed accurately. First, the applicant must fill out the necessary details, including the beneficiary's name, the amount, and the terms of the transaction. Next, the applicant submits the completed form to Axis Bank for approval. Once the bank issues the letter, the beneficiary can present it to their bank to receive payment upon fulfilling the specified conditions. It is essential to ensure that all information is accurate to avoid delays or disputes.

Steps to Complete the Axis Bank Letter of Credit Format

Completing the Axis Bank letter of credit format requires careful attention to detail. Here are the steps to follow:

- Gather all necessary information, including details about the buyer and seller.

- Fill out the letter of credit format with accurate data, ensuring all fields are completed.

- Review the terms and conditions to ensure they align with the agreement between the buyer and seller.

- Submit the completed letter to Axis Bank for verification and approval.

- Once approved, provide a copy to the beneficiary to facilitate payment.

Following these steps helps ensure a smooth transaction process and reduces the risk of errors.

Legal Use of the Axis Bank Letter of Credit Format

The Axis Bank letter of credit format is legally binding when issued by a bank. It serves as a guarantee that the bank will provide payment to the seller once the terms outlined in the letter are met. To maintain its legal standing, all parties must adhere to the conditions specified in the letter. This includes presenting the required documents within the stipulated timeframe. Understanding the legal implications of this format is essential for both buyers and sellers to protect their interests in commercial transactions.

Examples of Using the Axis Bank Letter of Credit Format

There are various scenarios in which the Axis Bank letter of credit format can be utilized. For instance:

- A company importing goods from a foreign supplier may request a letter of credit to ensure payment upon shipment.

- A seller may use a letter of credit to secure payment for services rendered, providing assurance to both parties.

- In real estate transactions, a letter of credit can be used to guarantee payment for property purchases.

These examples illustrate the versatility and importance of the Axis Bank letter of credit format in different business contexts.

Quick guide on how to complete axis bank letter of credit format

Complete Axis Bank Letter Of Credit Format effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Axis Bank Letter Of Credit Format on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Axis Bank Letter Of Credit Format with ease

- Find Axis Bank Letter Of Credit Format and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important parts of your documents or redact sensitive information with the tools airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your needs in document management within a few clicks from your chosen device. Edit and eSign Axis Bank Letter Of Credit Format while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the axis bank letter of credit format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the axis bank account ze release letter format?

The axis bank account ze release letter format is a specific document template used to formally request the release of your account funds. It includes relevant account details, signatures, and necessary identification. Using an efficient eSigning tool like airSlate SignNow can streamline this process signNowly.

-

How can airSlate SignNow help with axis bank account ze release letter format?

airSlate SignNow simplifies the preparation and signing of the axis bank account ze release letter format through its user-friendly interface. Users can quickly draft, customize, and send the letter for electronic signatures, reducing paperwork and saving time.

-

Is there a cost associated with using airSlate SignNow for axis bank account ze release letter format?

airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effective solution provides a valuable way to manage documents, including the axis bank account ze release letter format, without incurring high expenses. Check our pricing page for more details.

-

What features does airSlate SignNow include for creating the axis bank account ze release letter format?

airSlate SignNow provides multiple features, including customizable templates, secure cloud storage, and tracking for your axis bank account ze release letter format. These capabilities allow you to manage the letter efficiently and ensure it’s sent for signing seamlessly.

-

Can I integrate airSlate SignNow with other tools for the axis bank account ze release letter format?

Yes, airSlate SignNow supports integrations with various third-party applications, making it easy to manage your axis bank account ze release letter format alongside your existing tools. This integration helps automate workflows and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for axis bank account ze release letter format?

Using airSlate SignNow enhances the efficiency of handling the axis bank account ze release letter format. Benefits include faster document turnaround times, high-level security for sensitive information, and reduced need for physical paperwork, making it an ideal solution for businesses.

-

Is support available for creating the axis bank account ze release letter format with airSlate SignNow?

Absolutely! airSlate SignNow provides robust customer support to assist you with creating and managing the axis bank account ze release letter format. Whether you have questions or need assistance with features, our support team is here to help you.

Get more for Axis Bank Letter Of Credit Format

- Chapter 25 test form a

- Chapter 8 assessment world history answers form

- Automatic bank draft withdrawal silverscript form

- Customer setup form

- Bolo template 460640315 form

- Carefirst health benefits claim form fillable

- Justification for laptop request form fill out and sign

- Application for referral of case to the individual calendaring program form

Find out other Axis Bank Letter Of Credit Format

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself