Bank Capability Letter Form

Understanding the Bank Capability Letter

A bank capability letter, also known as a letter of financial capability, is a formal document issued by a financial institution. It serves as proof of an individual's or business's financial capacity to undertake specific transactions or commitments. This letter typically includes details such as the account holder's name, account balance, and the bank's confirmation of the account's good standing. It is often required in situations like loan applications, real estate transactions, or business partnerships to assure third parties of the financial reliability of the applicant.

How to Obtain the Bank Capability Letter

To obtain a bank capability letter, follow these steps:

- Contact your bank or financial institution directly through their customer service or visit a local branch.

- Request the letter by providing necessary information, such as your account details and the purpose for which the letter is needed.

- Be prepared to show identification and any required documentation that supports your request.

- Some banks may allow you to request this letter online through their banking portal.

Steps to Complete the Bank Capability Letter

When filling out a bank capability letter, ensure you include the following key elements:

- Your full name and contact information.

- The name and address of the bank issuing the letter.

- Your account number and type of account.

- The purpose of the letter, clearly stating what it is intended for.

- Any specific details requested by the recipient of the letter.

After completing the letter, review it for accuracy and clarity before submitting it to the relevant parties.

Legal Use of the Bank Capability Letter

The bank capability letter holds legal significance as it serves as a formal declaration of financial status. It can be used in various legal contexts, such as loan approvals, contract negotiations, or as part of due diligence in business transactions. To ensure its legal standing, the letter must be signed by an authorized bank representative and include the bank's official seal or letterhead. This adds credibility and assures recipients of the authenticity of the document.

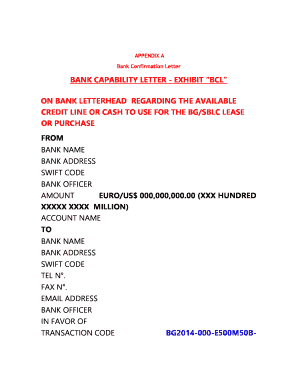

Key Elements of the Bank Capability Letter

A well-structured bank capability letter should contain the following essential components:

- The date of issuance.

- The bank's name and contact information.

- The account holder's name and address.

- A statement confirming the account's status and balance.

- The signature of an authorized bank official.

- The bank's official seal or letterhead for authenticity.

Including these elements ensures that the letter meets the requirements of the requesting party and is legally recognized.

Examples of Using the Bank Capability Letter

Bank capability letters are commonly used in various scenarios, including:

- Applying for a mortgage or personal loan, where lenders require proof of financial stability.

- Engaging in real estate transactions, where sellers may ask for financial assurance from buyers.

- Establishing business partnerships, where potential partners need to verify each other's financial standing.

These examples illustrate the importance of having a bank capability letter readily available for significant financial dealings.

Quick guide on how to complete bank capability letter

Manage Bank Capability Letter easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Bank Capability Letter on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign Bank Capability Letter effortlessly

- Find Bank Capability Letter and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that function.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Bank Capability Letter and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank capability letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a letter of financial capability?

A letter of financial capability is a document that outlines an individual's or business's financial status, demonstrating their ability to handle financial commitments. It is often required in transactions such as loans or contracts to assure the other party of financial reliability.

-

How can airSlate SignNow help me create a letter of financial capability?

With airSlate SignNow, you can easily create a letter of financial capability using customizable templates. Our platform allows you to fill in the necessary details and eSign the document, ensuring a professional appearance and compliance with legal requirements.

-

What are the benefits of using airSlate SignNow for my letter of financial capability?

Using airSlate SignNow for your letter of financial capability offers numerous benefits, including ease of use, cost-effectiveness, and secure storage. You can manage and send documents efficiently while maintaining a clear audit trail for your records.

-

Is there a free trial available for creating a letter of financial capability with airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore the features and capabilities of the platform. You can experiment with creating and signing a letter of financial capability without any costs involved during the trial period.

-

Can I integrate airSlate SignNow with other software for managing my letter of financial capability?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions like CRM systems and cloud storage services. This allows you to streamline your workflow while efficiently managing your letter of financial capability and other essential documents.

-

What formats can I use to create a letter of financial capability?

airSlate SignNow allows you to create a letter of financial capability in multiple formats, including PDF and Word documents. This flexibility enables you to choose the format that best suits your needs and ensures compatibility with other users.

-

Is airSlate SignNow suitable for businesses of all sizes when creating a letter of financial capability?

Yes, airSlate SignNow is designed to meet the needs of businesses of all sizes, from startups to large enterprises. Our platform scales according to your requirements, making it easy for any business to create a professional letter of financial capability.

Get more for Bank Capability Letter

- Cslb ca form

- Appendix g checklist 2017 2019 form

- The connection the exception series volume 2 pdf epub mobi form

- State of california department of business oversight notice of transaction pursuant to corporations code section 25102f dbo 260 form

- Notice of transaction pursuant to corporations form

- For mass merchandisers form

- Forms dmv state of california

- Denver county zoning department compliance letter 2015 2018 form

Find out other Bank Capability Letter

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document