Ir795 Form Online

What is the IR795 Form Online

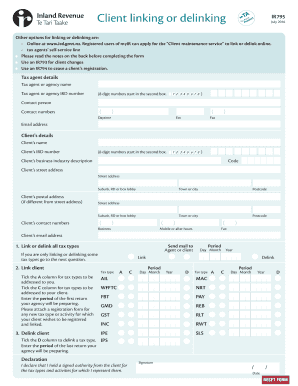

The IR795 form online, also known as the IR795 linking delinking form, is a crucial document used in specific tax-related scenarios. It primarily serves to link or delink certain tax accounts, which can be essential for individuals or businesses managing multiple tax obligations. Understanding this form is vital for ensuring compliance with IRS regulations and for maintaining accurate tax records.

How to use the IR795 Form Online

Using the IR795 form online involves a straightforward process. First, access the form through a reliable digital platform that supports eSigning. Fill out the necessary fields with accurate information, ensuring that all details align with your tax accounts. Once completed, you can electronically sign the document. This method not only saves time but also enhances the security and legality of your submission.

Steps to complete the IR795 Form Online

Completing the IR795 form online requires several key steps:

- Access the IR795 form through a trusted eSigning platform.

- Enter your personal information, including your name, address, and tax identification number.

- Specify the accounts you wish to link or delink.

- Review the information for accuracy.

- Sign the form electronically to validate your submission.

- Submit the completed form as directed by the platform.

Legal use of the IR795 Form Online

The IR795 form online is legally binding when completed and signed according to established eSignature laws, such as the ESIGN Act and UETA. These regulations ensure that electronic signatures hold the same weight as traditional handwritten signatures, provided that the signing process meets specific criteria. Using a reputable eSigning service can help guarantee compliance and security throughout the process.

Key elements of the IR795 Form Online

Several key elements are essential when completing the IR795 form online:

- Identification Information: Accurate personal and tax identification details are crucial.

- Account Details: Clearly specify which accounts are being linked or delinked.

- Signature: An electronic signature is necessary to validate the form.

- Date of Submission: Ensure the submission date is recorded to maintain a timeline of your tax records.

Filing Deadlines / Important Dates

Filing deadlines for the IR795 form can vary based on individual circumstances and IRS regulations. It is important to stay informed about specific dates related to your tax situation. Generally, forms should be submitted promptly to avoid penalties and ensure compliance with tax obligations. Check the IRS website or consult a tax professional for the most accurate and current deadlines.

Form Submission Methods (Online / Mail / In-Person)

The IR795 form can be submitted through various methods, including:

- Online: The most efficient method, allowing for immediate processing and confirmation.

- Mail: Physical submission is possible, but it may result in delays.

- In-Person: Some individuals may choose to deliver the form directly to a tax office for assistance.

Quick guide on how to complete ir795 form online

Effortlessly prepare Ir795 Form Online on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the necessary forms and securely store them digitally. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Ir795 Form Online on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Ir795 Form Online with ease

- Find Ir795 Form Online and click Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Ir795 Form Online while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ir795 form online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ir795 and how does it benefit my business?

The ir795 is a powerful tool provided by airSlate SignNow that streamlines document signing and management for businesses. By utilizing ir795, companies can improve efficiency, reduce paper waste, and enhance the overall signing experience for their clients.

-

How much does it cost to implement ir795 in my organization?

airSlate SignNow offers various pricing plans to accommodate different business needs. The cost associated with implementing ir795 depends on the selected plan, but it remains an affordable solution for businesses looking to enhance their document signing process.

-

What features are included with ir795?

The ir795 includes a range of features, such as customizable templates, real-time tracking, and advanced security options. These features make it easy to send documents for eSignature and monitor their progress, all while ensuring data protection.

-

Can I integrate ir795 with my existing business tools?

Yes, ir795 can be integrated with various popular business applications, enabling a seamless workflow. This ensures that you can leverage existing tools while enhancing your document management processes through airSlate SignNow.

-

Is ir795 user-friendly for all employees?

Absolutely! The ir795 is designed with user experience in mind, making it accessible for employees at any technical skill level. Its intuitive interface ensures that anyone can quickly learn how to send and manage documents with ease.

-

What types of documents can I send using ir795?

Using ir795, you can send a wide variety of documents, including contracts, agreements, and forms that require signatures. This versatility makes it a valuable tool for businesses across different industries.

-

How secure is the ir795 platform for sensitive documents?

Security is a top priority with ir795. AirSlate SignNow employs advanced encryption and secure cloud storage to ensure that your sensitive documents are protected throughout the signing process.

Get more for Ir795 Form Online

- Printable state of indiana new hire form

- Sales disclosure form 46021 hendricks

- Edding fax form

- Notarial certificate sample philippines form

- Geography skills 3 recognizing continents and oceans answer key form

- Banner health former employee w2

- Ex parte petition for amended letters form

- Complaint form 771479180

Find out other Ir795 Form Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy