Form 2848 Instructions

What is the Form 2848 Instructions

The Form 2848 instructions provide detailed guidance for taxpayers who need to authorize an individual to represent them before the IRS. This form is essential for granting power of attorney to another person, allowing them to handle tax matters on behalf of the taxpayer. The instructions outline the necessary steps and requirements to ensure that the form is completed accurately and effectively. Understanding these instructions is crucial for compliance with IRS regulations and for ensuring that the appointed representative can act on behalf of the taxpayer without any legal complications.

Steps to complete the Form 2848 Instructions

Completing the Form 2848 requires careful attention to detail. Here are the key steps to follow:

- Begin by entering the taxpayer's information, including name, address, and Social Security number or Employer Identification Number.

- Provide details about the representative, including their name, address, and the specific tax matters they are authorized to handle.

- Specify the tax years or periods for which the authorization is valid.

- Sign and date the form to validate the authorization.

- Ensure that the representative also signs the form, confirming their acceptance of the role.

Each of these steps must be completed accurately to ensure the form is legally binding and accepted by the IRS.

Legal use of the Form 2848 Instructions

The legal use of Form 2848 hinges on compliance with IRS guidelines and the proper execution of the document. When completed correctly, the form grants the appointed representative the authority to act on behalf of the taxpayer in tax matters. It is essential that the taxpayer understands the implications of granting this authority, as the representative will have access to sensitive financial information. Adhering to the instructions ensures that the form meets legal standards, which is critical for its acceptance by the IRS.

Form Submission Methods (Online / Mail / In-Person)

Submitting Form 2848 can be done through various methods, depending on the taxpayer's preference and the urgency of the request:

- Online: Taxpayers can submit the form electronically through the IRS e-Services platform, which allows for faster processing.

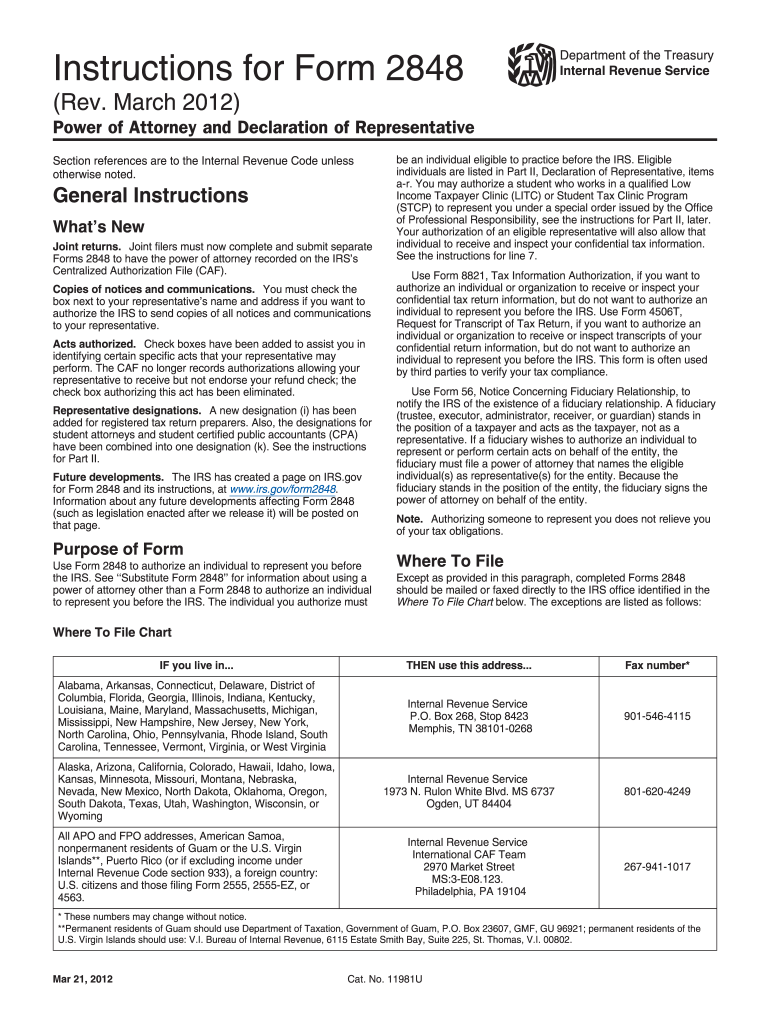

- Mail: The form can be printed and mailed to the appropriate IRS office. It is important to check the IRS website for the correct mailing address based on the taxpayer's location.

- In-Person: Taxpayers may also choose to deliver the form in person at their local IRS office, which can provide immediate confirmation of receipt.

Each submission method has its advantages, and taxpayers should choose the one that best fits their needs.

Examples of using the Form 2848 Instructions

Understanding practical applications of Form 2848 can help clarify its importance. Here are a few scenarios where this form is commonly used:

- A taxpayer who is unable to attend a tax audit may authorize a tax professional to represent them using Form 2848.

- Individuals who are facing tax disputes can appoint a representative to negotiate on their behalf.

- Business owners may use the form to authorize an accountant to manage their tax filings and communications with the IRS.

These examples illustrate the versatility of Form 2848 in various tax-related situations.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 2848, which are crucial for ensuring compliance. These guidelines include:

- Clear definitions of the powers granted to the representative.

- Requirements for signatures from both the taxpayer and the representative.

- Instructions on how to revoke the authorization if necessary.

Familiarity with these guidelines helps taxpayers navigate the complexities of tax representation effectively.

Quick guide on how to complete form 2848 instructions

Effortlessly Prepare Form 2848 Instructions on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct format and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Manage Form 2848 Instructions on any device with the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The Easiest Method to Modify and eSign Form 2848 Instructions Seamlessly

- Obtain Form 2848 Instructions and select Get Form to begin.

- Take advantage of the tools we offer to complete your document.

- Emphasize relevant parts of the documents or redact sensitive data using tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassles of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 2848 Instructions and maintain outstanding communication throughout the document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2848 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2848 electronic signature and how does it work?

The 2848 electronic signature is a legally binding digital signature that allows users to electronically sign documents securely and conveniently. It utilizes advanced encryption technology to ensure the integrity and authenticity of signatures. With airSlate SignNow, you can create, send, and manage your 2848 electronic signatures with ease.

-

Is the 2848 electronic signature solution compliant with regulations?

Yes, the 2848 electronic signature solution provided by airSlate SignNow complies with various legal standards including the ESIGN Act and UETA in the U.S. This compliance assures users that their electronic signatures are valid and enforceable in the eyes of the law. It offers peace of mind while signing important documents.

-

What are the pricing options for using 2848 electronic signature services?

airSlate SignNow offers a range of pricing plans to accommodate different business needs when it comes to 2848 electronic signature services. Whether you need basic features for small businesses or advanced functionalities for larger enterprises, there is a plan suitable for you. Visit our pricing page for detailed breakdowns and options.

-

What features does the airSlate SignNow 2848 electronic signature platform include?

The airSlate SignNow platform for 2848 electronic signatures includes features like document tracking, template creation, and customizable workflows. Users can also integrate with various applications and access detailed audit trails for each signed document. These features enhance productivity and streamline the eSigning process.

-

How does the 2848 electronic signature solution benefit businesses?

Utilizing the 2848 electronic signature solution streamlines the document signing process, reducing turnaround times signNowly. Businesses benefit from lower paper costs and improved efficiency since documents can be signed from anywhere, anytime. This modern approach helps enhance customer satisfaction and speeds up transaction times.

-

Can the 2848 electronic signature be integrated with other software?

Absolutely! The 2848 electronic signature services from airSlate SignNow can be easily integrated with several third-party applications, including CRM and project management tools. This allows for a seamless workflow across different platforms, making document management and eSigning more efficient and convenient.

-

Is the 2848 electronic signature secure?

Yes, the 2848 electronic signature from airSlate SignNow is highly secure. It employs state-of-the-art encryption to protect sensitive data and signatures, ensuring that documents remain confidential and secure throughout the signing process. This security is crucial for businesses that handle sensitive information.

Get more for Form 2848 Instructions

- Computer for second secondary second term form

- Police report form

- Ttbq form

- Post procedure pain log the spine and sports center form

- Bharat bank net banking registration form

- Text of h r 10104 89th an act to enact govtrack us form

- Phonecitysex form

- Ea 120 response to request for elder or dependent adult abuse restraining orders 790875933 form

Find out other Form 2848 Instructions

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement