Etides Form

What is the Etides

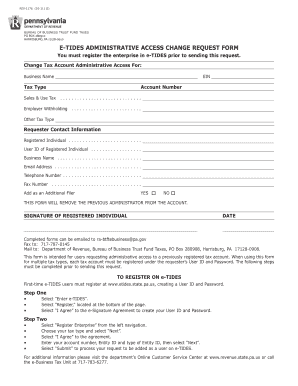

The Etides form is a crucial document used in various administrative processes within the United States. It serves as a standardized method for submitting specific information related to employment, taxation, or regulatory compliance. Understanding the purpose and structure of the Etides is essential for individuals and businesses alike, as it facilitates efficient communication with government entities and ensures compliance with relevant laws.

How to use the Etides

Using the Etides form involves several straightforward steps. First, gather all necessary information required for completion, such as personal identification details and relevant financial data. Next, access the digital version of the form through a secure platform like airSlate SignNow, which allows for easy filling and signing. After completing the form, ensure that all information is accurate before submitting it electronically or via traditional methods, depending on your preference and requirements.

Steps to complete the Etides

Completing the Etides form can be broken down into clear steps:

- Gather necessary documents and information.

- Access the Etides form through a reliable digital platform.

- Fill out the form, ensuring all fields are completed accurately.

- Review the completed form for any errors or omissions.

- Sign the form digitally to ensure its authenticity.

- Submit the form according to the specified guidelines.

Legal use of the Etides

The legal validity of the Etides form hinges on compliance with specific regulations governing electronic signatures and documentation. To ensure that your submission is legally binding, it is essential to utilize a platform that adheres to the ESIGN Act and UETA standards. This compliance guarantees that the digital signature is recognized as equivalent to a handwritten signature, thus providing legal protection for both the signer and the receiving entity.

Key elements of the Etides

Several key elements define the Etides form, making it effective for its intended purpose. These include:

- Identification Information: Essential details such as name, address, and identification numbers.

- Signature Section: A designated area for electronic signatures to validate the document.

- Submission Instructions: Clear guidelines on how to submit the completed form.

- Compliance Statements: Affirmations that the form adheres to legal requirements.

Examples of using the Etides

The Etides form can be utilized in various scenarios. For instance, businesses may use it to report employee information for tax purposes, while individuals might submit it for regulatory compliance in specific industries. Understanding these applications can help users leverage the form effectively, ensuring that they meet their obligations while streamlining their administrative processes.

Quick guide on how to complete etides

Effortlessly prepare Etides on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary template and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents rapidly and without delays. Manage Etides on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The easiest way to edit and electronically sign Etides effortlessly

- Find Etides and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight key areas of your documents or redact sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to share your form, either via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Etides and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the etides

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are etides in the context of airSlate SignNow?

Etides refer to electronic signatures that allow users to sign documents digitally. With airSlate SignNow, etides simplify the signing process, making it quick and secure for both senders and recipients. Companies can save time and reduce paperwork while ensuring compliance with legal standards.

-

How does airSlate SignNow handle etides for business contracts?

AirSlate SignNow allows businesses to create, send, and manage contracts requiring etides seamlessly. The platform provides templates, customizable workflows, and tracking features to ensure contracts are signed promptly. This efficiency can enhance business operations and improve cash flow.

-

Are there any costs associated with using airSlate SignNow for etides?

Yes, while airSlate SignNow offers a free trial, there are various pricing plans designed to accommodate different business needs. By choosing the right plan, you can leverage the full potential of etides without overspending. The value gained through increased efficiency and reduced paperwork justifies the investment.

-

What features support etides in airSlate SignNow?

AirSlate SignNow includes several features that facilitate the use of etides, such as document templates, customizable workflows, and automatic reminders. Additionally, it provides secure cloud storage and compliance auditing to protect sensitive information. These features enhance the overall signing experience.

-

Can I integrate airSlate SignNow with other applications to manage etides?

Absolutely! AirSlate SignNow offers seamless integration with various applications like Google Drive, Salesforce, and many others. These integrations enhance the efficiency of managing etides by connecting your existing workflows with the power of airSlate SignNow. This means you can have a more unified digital experience.

-

What benefits do etides offer businesses using airSlate SignNow?

Etides provide signNow benefits such as time savings, cost reduction, and improved organizational efficiency. Businesses can streamline their document workflows, reduce the risk of errors, and enhance customer satisfaction with faster turnaround times. In essence, etides transform how businesses handle documents.

-

Is airSlate SignNow secure for handling etides?

Yes, security is a top priority for airSlate SignNow when handling etides. The platform complies with data protection regulations and uses robust encryption methods to safeguard your documents. This ensures that your sensitive information remains confidential and protected from unauthorized access.

Get more for Etides

- Printable chemical peel consent form

- No dues form 29571544

- Wine club sign up form

- Receipt of certificate form

- Pony club medical armband form

- Rowlett police department alarm permit application form

- Rowlett police departmentalarm permit application form

- W va code r 48 3 2 criteria for health and safety form

Find out other Etides

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement