Form W 8 BEN Rev January Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Indiv

Understanding the Form W-8 BEN

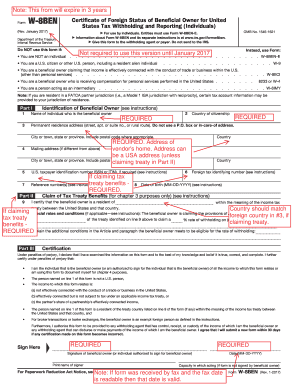

The Form W-8 BEN, officially known as the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals), is a critical document for non-U.S. residents. It is used to certify that the individual is a foreign person and to claim any applicable benefits under an income tax treaty. This form helps to ensure that the correct amount of U.S. tax is withheld from income earned in the United States.

Steps to Complete the Form W-8 BEN

Completing the Form W-8 BEN involves several key steps:

- Provide personal identification information, including name, country of citizenship, and address.

- Indicate the type of income you are receiving, such as dividends, interest, or royalties.

- Claim any applicable tax treaty benefits by providing the relevant country and treaty article.

- Sign and date the form to certify its accuracy.

Each section of the form must be filled out accurately to avoid delays in processing or issues with tax withholding.

Legal Use of the Form W-8 BEN

The Form W-8 BEN is legally recognized by the IRS for the purpose of establishing foreign status and claiming tax treaty benefits. It is essential for non-resident aliens who receive income from U.S. sources. By submitting this form, individuals can often reduce or eliminate U.S. tax withholding on certain types of income. However, it is important to ensure that the information provided is truthful and accurate, as providing false information can lead to penalties.

Filing Deadlines for the Form W-8 BEN

While there is no specific deadline for submitting the Form W-8 BEN, it should be provided to the withholding agent before any payment is made to ensure that the correct withholding rate is applied. If the form is not submitted in a timely manner, the withholding agent may be required to withhold taxes at the maximum rate.

Examples of Using the Form W-8 BEN

Common scenarios for using the Form W-8 BEN include:

- A foreign individual receiving dividends from a U.S. corporation.

- A non-resident receiving interest income from a U.S. bank account.

- A foreign artist receiving royalties for performances in the United States.

In each case, the form helps to establish the individual's foreign status and claim any applicable tax treaty benefits.

Eligibility Criteria for the Form W-8 BEN

To be eligible to use the Form W-8 BEN, an individual must be a non-U.S. person, which includes foreign citizens and residents. The form is specifically designed for individuals, while entities must use other variants such as the Form W-8 BEN-E. Additionally, the individual must be receiving income that is subject to U.S. tax withholding.

Quick guide on how to complete form w 8 ben rev january certificate of foreign status of beneficial owner for united states tax withholding and reporting

Complete Form W 8 BEN Rev January Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It presents a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without holdups. Manage Form W 8 BEN Rev January Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv on any platform using airSlate SignNow Android or iOS applications and simplify any document-based process today.

The easiest way to adjust and eSign Form W 8 BEN Rev January Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv with ease

- Locate Form W 8 BEN Rev January Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv and select Get Form to begin.

- Employ the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form W 8 BEN Rev January Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 8 ben rev january certificate of foreign status of beneficial owner for united states tax withholding and reporting

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a certificate of foreign status?

A certificate of foreign status is an official document that certifies an individual's or entity's non-U.S. status for tax purposes. This certificate is often required by businesses and financial institutions to ensure proper tax withholding. Utilizing airSlate SignNow, you can easily eSign and manage your certificate of foreign status in a secure environment.

-

How can airSlate SignNow help with managing certificates of foreign status?

airSlate SignNow streamlines the process of sending and eSigning certificates of foreign status. The platform provides a user-friendly interface that allows you to create, distribute, and sign important documents swiftly. By utilizing our features, you can ensure compliance and maintain the integrity of your documentation.

-

What is the pricing for airSlate SignNow when handling certificates of foreign status?

AirSlate SignNow offers flexible pricing plans that cater to various business needs, including handling certificates of foreign status. Each plan is designed to provide value while keeping costs manageable. Visit our pricing page to find a plan that suits your organization's requirements.

-

Are there any benefits to using airSlate SignNow for certificates of foreign status?

Using airSlate SignNow for certificates of foreign status enhances efficiency and reduces paper clutter. Our digital platform allows for rapid eSigning, ensuring that your documents are processed quickly. Additionally, our secure storage helps you maintain compliance while improving document accessibility.

-

Can I integrate airSlate SignNow with other applications for managing certificates of foreign status?

Yes, airSlate SignNow offers robust integrations with various applications that can help you manage certificates of foreign status. These integrations facilitate seamless data transfer and enhance your workflow efficiency. Explore our integration options to find compatible solutions that fit your business needs.

-

Is airSlate SignNow compliant with regulations regarding certificates of foreign status?

Absolutely! airSlate SignNow is designed to comply with necessary regulations associated with certificates of foreign status. We prioritize data security and regulatory compliance to protect your information, ensuring that all your digital signatures and document transactions are legally valid.

-

What features does airSlate SignNow offer for signing certificates of foreign status?

AirSlate SignNow provides several features for signing certificates of foreign status, including customizable templates, secure eSigning, and real-time tracking. These features help you manage documents effortlessly while ensuring that every signature is captured securely. Join the thousands of businesses that trust us with their digital documentation.

Get more for Form W 8 BEN Rev January Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv

Find out other Form W 8 BEN Rev January Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template