Fiscal Agent Document Form

What is the Fiscal Agent Document

The fiscal agent document is a crucial legal form used in various financial and administrative contexts. It serves as a formal agreement that designates a fiscal agent to manage funds or perform specific duties on behalf of another party. This document outlines the responsibilities and authorities granted to the fiscal agent, ensuring clarity in financial transactions and management. It is commonly utilized by organizations and individuals who require a trusted representative to handle fiscal matters, such as fund disbursement, record-keeping, and reporting.

Who Can Sign the Fiscal Agent Document

Typically, the fiscal agent document can be signed by individuals authorized by the organization or entity that the fiscal agent represents. This may include executives, board members, or other designated representatives. It is essential that the signers have the appropriate authority to enter into agreements on behalf of the organization. In some cases, specific legal requirements may dictate who can sign, depending on the nature of the fiscal responsibilities involved.

Steps to Complete the Fiscal Agent Document

Completing the fiscal agent document involves several key steps to ensure its validity and compliance. First, identify the appropriate signers within the organization who have the authority to execute the document. Next, gather all necessary information, including the fiscal agent's details and the scope of their responsibilities. After drafting the document, have it reviewed for accuracy and compliance with any relevant regulations. Finally, ensure that all authorized parties sign the document, either in person or electronically, to finalize the agreement.

Legal Use of the Fiscal Agent Document

The fiscal agent document is legally binding when executed properly, meaning it must meet specific legal requirements to be enforceable. This includes having the appropriate signatures from authorized individuals and ensuring that the document is completed in accordance with applicable laws. Compliance with eSignature laws, such as the ESIGN Act and UETA, is also crucial when signing electronically. Utilizing a reputable electronic signature platform can enhance the legal standing of the document by providing security features and an audit trail.

Key Elements of the Fiscal Agent Document

Several key elements must be included in the fiscal agent document to ensure its effectiveness. These elements typically include:

- Identification of Parties: Clearly state the names and roles of the principal and the fiscal agent.

- Scope of Authority: Define the specific responsibilities and powers granted to the fiscal agent.

- Duration of Agreement: Specify the time frame for which the fiscal agent will operate under this agreement.

- Signatures: Ensure that all necessary parties sign the document to validate it.

Who Issues the Fiscal Agent Document

The fiscal agent document is typically issued by the organization or entity that requires the services of a fiscal agent. This may include non-profit organizations, government agencies, or private companies. In some cases, specific regulatory bodies may have templates or guidelines for creating these documents, ensuring compliance with industry standards and legal requirements. It is essential to follow any prescribed formats to avoid potential issues during the execution of the document.

Quick guide on how to complete fiscal agent services

Complete fiscal agent services effortlessly on any device

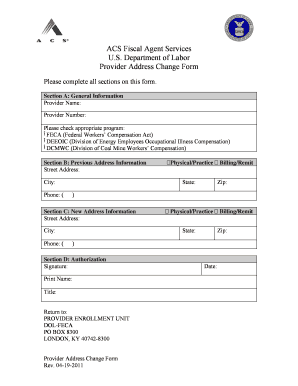

Digital document management has surged in popularity among organizations and individuals. It offers a perfect eco-conscious alternative to traditional printed and signed papers, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents promptly without delays. Manage who can sign acs fiscal agent services provider change of address form on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to edit and electronically sign fiscal agent services without hassle

- Find fiscal agent document and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign who can sign acs fiscal agent services provider change of address form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the who can sign acs fiscal agent services provider change of address form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask fiscal agent document

-

Who can sign ACS fiscal agent services provider change of address form?

Individuals authorized by the service provider or organization can sign the ACS fiscal agent services provider change of address form. Typically, this includes administrators, fiscal agents, or designated representatives. It's crucial to ensure that the signatory has the authority to make address updates on behalf of the organization.

-

What is the process for signing the ACS fiscal agent services provider change of address form?

The process for signing the ACS fiscal agent services provider change of address form involves filling out the necessary fields and choosing the appropriate person to sign. With airSlate SignNow, this can be done electronically, ensuring a quick and efficient process. Make sure the signatory understands the implications of the changes being made.

-

How much does it cost to use airSlate SignNow for the ACS fiscal agent services provider change of address form?

Pricing for airSlate SignNow varies based on the subscription plan chosen. However, it remains a cost-effective solution that caters to different organizational needs. To get specific pricing details, it is best to visit our website or contact sales for more information.

-

What features does airSlate SignNow offer for remote signing?

airSlate SignNow offers features such as a user-friendly interface, customizable templates, and secure electronic signatures. These functionalities ensure that signing important documents, like the ACS fiscal agent services provider change of address form, is smooth and hassle-free. Additionally, it supports audit trails and reminders to keep track of the signing process.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various platforms, including CRM systems, cloud storage services, and project management tools. This ensures that you can manage your documents and processes efficiently. Such integrations can streamline operations when handling forms like the ACS fiscal agent services provider change of address form.

-

What benefits can I expect from using airSlate SignNow?

Using airSlate SignNow allows for faster turnaround times on document signing, improved accuracy, and reduced paperwork. By facilitating electronic signatures, it eliminates the delays associated with traditional methods. Businesses can efficiently manage the ACS fiscal agent services provider change of address form without sacrificing security or compliance.

-

Can multiple people sign the ACS fiscal agent services provider change of address form?

Yes, multiple people can sign the ACS fiscal agent services provider change of address form using airSlate SignNow. The platform supports sequential or parallel signing workflows, allowing for flexibility based on your needs. This feature is particularly useful for organizations that require approval from several stakeholders before making address changes.

Get more for who can sign acs fiscal agent services provider change of address form

- Verification of research andor oralwritten exam completion form

- Instructional program sign up austin peay state university form

- Apsu freshman welcome wagon august 26 8 am 3 pm form

- Dsmv312 medical card mailingdoc nh form

- Cdl medical card and certification form

- Direct debit form rents

- Sport scholarship application form

- St cyprians schoolsport scholarship application fo form

Find out other fiscal agent services

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed