Income Tax Declaration Form

What is the Income Tax Declaration

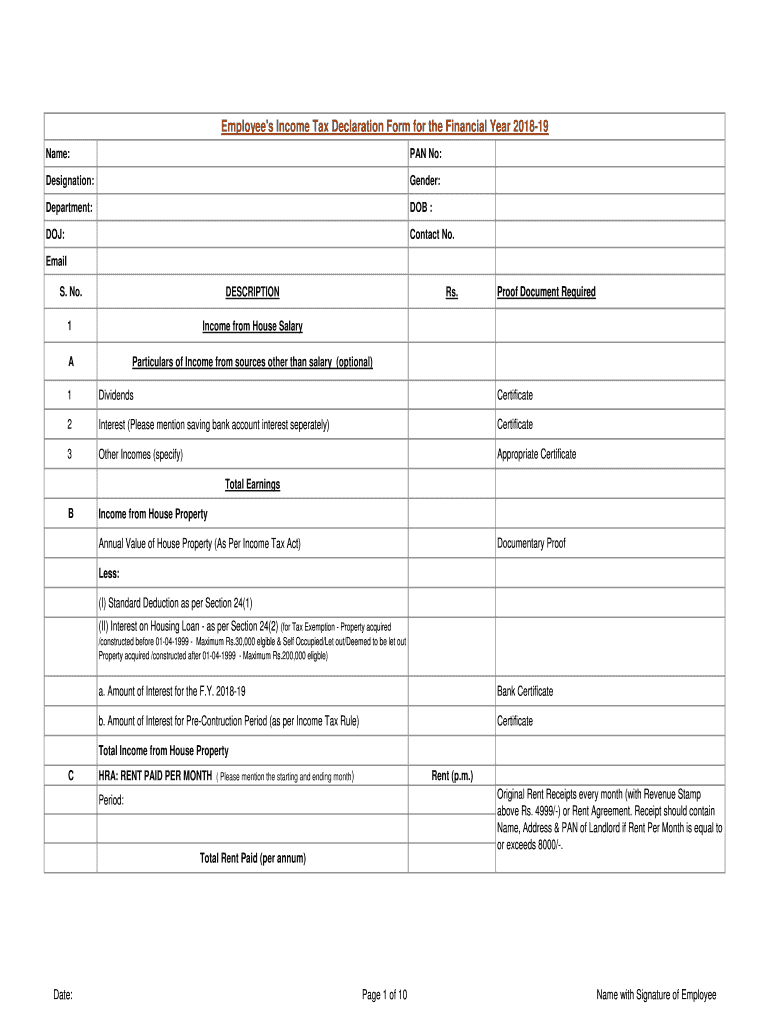

The employees income tax declaration is a formal document that individuals submit to report their income and calculate their tax obligations. This declaration is essential for ensuring compliance with federal and state tax laws. It typically includes information about various income sources, deductions, and credits that may apply to the taxpayer's situation. Understanding this form is crucial for employees, as it directly impacts their tax liabilities and potential refunds.

Steps to Complete the Income Tax Declaration

Completing the employees income tax declaration involves several important steps:

- Gather necessary documents, including W-2 forms, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for certain credits.

- Enter all income information accurately, including wages, interest, dividends, and any other sources of income.

- Identify and apply any deductions or credits that may be available to you, such as student loan interest or mortgage interest deductions.

- Review your calculations to ensure accuracy before submission.

Legal Use of the Income Tax Declaration

The income tax declaration serves as a legally binding document that must be completed truthfully and accurately. Falsifying information on this form can lead to penalties, including fines or criminal charges. It is important to understand the legal implications of submitting this declaration, as it is used by the IRS and state tax authorities to assess tax liabilities. Compliance with tax laws not only protects individuals from legal repercussions but also contributes to the overall integrity of the tax system.

Required Documents

To accurately complete the employees income tax declaration, several key documents are required:

- W-2 forms from employers, detailing annual earnings and withheld taxes.

- 1099 forms for any freelance or contract work, reporting income received outside of traditional employment.

- Receipts and records for deductible expenses, such as medical bills or charitable contributions.

- Any relevant tax forms related to investments or other income sources.

Filing Deadlines / Important Dates

Timely submission of the employees income tax declaration is critical to avoid penalties. The standard deadline for filing is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of the possibility of requesting an extension, which can provide additional time to file, but not to pay any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the employees income tax declaration:

- Online submission through the IRS e-file system or authorized tax software, which is often the fastest and most efficient method.

- Mailing a paper form directly to the appropriate IRS address, which may take longer for processing.

- In-person submission at designated IRS offices, which may be available for specific situations or assistance.

Quick guide on how to complete income tax declaration

Prepare Income Tax Declaration easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without interruptions. Manage Income Tax Declaration on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Income Tax Declaration effortlessly

- Obtain Income Tax Declaration and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, frustrating form navigation, or errors that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Income Tax Declaration and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an employees income tax declaration?

An employees income tax declaration is a document that individuals complete to report their earnings and determine their tax obligations. It typically includes details such as income sources, deductions, and credits. Using airSlate SignNow, you can easily create and eSign this document, ensuring compliance and accuracy.

-

How can airSlate SignNow help with employees income tax declaration?

AirSlate SignNow provides a seamless platform for preparing, signing, and managing employees income tax declaration forms. Our solution simplifies document workflows, allowing for quick eSignature collection and secure storage. This helps streamline your tax preparation process and ensures that declarations are filed efficiently.

-

Is airSlate SignNow affordable for small businesses handling employees income tax declaration?

Yes, airSlate SignNow is a cost-effective solution tailored for businesses of all sizes, including small businesses. With our flexible pricing plans, you can access features that streamline your employees income tax declaration processes without breaking the bank. Save time and money while ensuring compliance with tax requirements.

-

Can I integrate airSlate SignNow with other tools for employees income tax declaration?

Absolutely! AirSlate SignNow offers integrations with various applications and platforms to enhance your employees income tax declaration process. Connect with popular tools like Google Drive, Salesforce, and more, ensuring that your workflows remain efficient and interconnected throughout the tax filing season.

-

What are the benefits of using airSlate SignNow for employees income tax declaration?

Using airSlate SignNow for employees income tax declaration offers numerous benefits, including faster processing times and improved accuracy. The platform's user-friendly interface makes it easy for employees to complete and sign their documents. Additionally, with secure storage and easy access, you can manage your tax documents effortlessly.

-

How secure is airSlate SignNow for handling employees income tax declaration documents?

Security is a top priority at airSlate SignNow. Our platform employs industry-leading encryption and security measures to protect your employees income tax declaration documents. You can ensure sensitive information remains confidential and is accessible only to authorized users.

-

Is there any training available for using airSlate SignNow for employees income tax declaration?

Yes, airSlate SignNow offers comprehensive training resources, including tutorials, webinars, and customer support designed to help you navigate the platform for employees income tax declaration. Our support team is available to assist you with any questions you may have, ensuring you can utilize our features effectively.

Get more for Income Tax Declaration

- Golf cart rental key biscayne form

- Conditional probability worksheet with answers pdf 91995760 form

- Osse child care employee appointment promotion r seperation sheet form

- Proxyfish form

- Pif version 5 excel download form

- Chapter 8 test form 2b answer key

- Credit application form pdf

- Nyc dof mails second quarter property tax bills for form

Find out other Income Tax Declaration

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online