Form R PDF

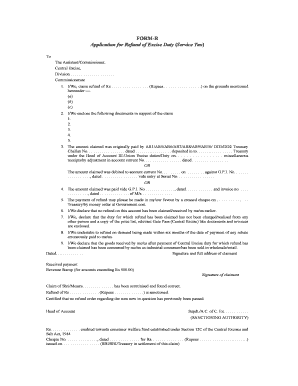

What is the application for refund of excise duty form R?

The application for refund of excise duty form R is a specific document used by individuals and businesses in the United States to request a refund of excise taxes that have been overpaid or incorrectly assessed. This form is crucial for ensuring that taxpayers can reclaim funds that they are entitled to, thereby promoting fairness in the taxation system. The form typically requires detailed information about the taxpayer, the nature of the excise duty, and the circumstances under which the refund is requested.

Steps to complete the application for refund of excise duty form R

Completing the application for refund of excise duty form R involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts and records of the excise duties paid. Next, fill out the form with precise details, including your personal information, the amount of excise duty you are claiming, and the reason for the refund. It is important to review the form for completeness and accuracy before submission. Finally, submit the form through the appropriate channels, which may include online submission or mailing it to the designated tax authority.

Required documents for the application for refund of excise duty form R

When submitting the application for refund of excise duty form R, several documents are typically required to support your claim. These may include:

- Proof of payment of excise duty, such as receipts or bank statements.

- Documentation that verifies the overpayment or error, such as invoices or tax returns.

- Any correspondence with the tax authority regarding the excise duty in question.

- Identification information, such as your Social Security number or Employer Identification Number (EIN).

Providing complete and accurate documentation is essential for the timely processing of your refund application.

Legal use of the application for refund of excise duty form R

The application for refund of excise duty form R is legally recognized as a valid request for the reimbursement of excise taxes under U.S. tax law. To ensure that the application is legally binding, it must be completed in accordance with the guidelines set forth by the Internal Revenue Service (IRS) and relevant state tax authorities. This includes adhering to deadlines for submission and ensuring that all provided information is truthful and accurate. Failure to comply with these legal requirements may result in delays or denials of the refund request.

Eligibility criteria for the application for refund of excise duty form R

To qualify for a refund using the application for refund of excise duty form R, certain eligibility criteria must be met. Generally, the applicant must have paid excise duties that exceed the amount owed or have made payments in error. Additionally, the claim must be made within a specified timeframe, usually within three years from the date of payment. It is also important that the applicant is the entity that originally paid the excise duty, as only the payer is entitled to request a refund.

Form submission methods for the application for refund of excise duty form R

The application for refund of excise duty form R can typically be submitted through various methods, depending on the requirements of the tax authority. Common submission methods include:

- Online submission through the official tax authority website.

- Mailing a hard copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Choosing the appropriate submission method is important for ensuring that your application is processed efficiently.

Quick guide on how to complete form r service tax

Complete form r service tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage application for refund of excise duty form r on any device using airSlate SignNow's Android or iOS applications and streamline any document-centered process today.

How to edit and eSign form r service tax effortlessly

- Find form r pdf and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or mask sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your updates.

- Choose how you'd like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign application for refund of excise duty form r to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form r pdf

Create this form in 5 minutes!

How to create an eSignature for the application for refund of excise duty form r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form r pdf

-

What is the application for refund of excise duty form R?

The application for refund of excise duty form R is a specific document used to request a refund on excise duties that have been overpaid. This form allows businesses to formalize their refund claims with the appropriate regulatory authorities. Understanding how to fill out this application accurately can streamline the refund process.

-

How can airSlate SignNow help with the application for refund of excise duty form R?

airSlate SignNow provides an easy-to-use platform that allows businesses to fill out and eSign the application for refund of excise duty form R efficiently. With customizable templates, users can save time and reduce errors in their applications. This streamlines the entire process, enabling quicker submissions and responses from authorities.

-

Is there a cost associated with using airSlate SignNow for this application?

airSlate SignNow offers a variety of pricing plans, including flexible options that cater to different business needs. The cost of using airSlate SignNow can vary based on the features chosen, such as document storage and the number of users. Investing in this solution can ultimately save time and resources when preparing the application for refund of excise duty form R.

-

What are the key features of airSlate SignNow for handling such applications?

Key features of airSlate SignNow include intuitive document editing, customizable templates, and secure eSigning capabilities. These features simplify the creation and submission of the application for refund of excise duty form R. Furthermore, the platform ensures that all documents are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other software for processing applications?

Yes, airSlate SignNow can be integrated with various software platforms, enhancing your workflow. These integrations can streamline the preparation and submission process of the application for refund of excise duty form R. This adaptability ensures that you can easily incorporate SignNow into your existing processes.

-

What benefits can be derived from using airSlate SignNow for tax refund applications?

Using airSlate SignNow for tax refund applications, including the application for refund of excise duty form R, offers numerous benefits. Efficiency in document handling, reduced processing time, and enhanced compliance are just a few. This comprehensive platform allows businesses to focus on their core activities rather than administrative paperwork.

-

Is the application for refund of excise duty form R compliant with current regulations?

Yes, the application for refund of excise duty form R created and submitted through airSlate SignNow is compliant with current regulations. The platform is updated regularly to reflect the latest legal requirements, ensuring that your submission adheres to all necessary guidelines. This compliance helps mitigate risks associated with tax refunds.

Get more for application for refund of excise duty form r

- Mnscu dwt registration form bemidji state university bemidjistate

- Faculty interview recruitment funds form doc bemidjistate

- Purchase lease application bf1 once the applicat form

- Lease agreement certificate azdot form

- K usdc forms mai ver wordperfect cr 14 wpd court cacd uscourts

- Zvirahwe nedudziro pdf form

- Beft applicationb form for individual shahjalal islami bank

- Verpleegkundige overdracht zorginstellingen goereeoverflakkee betreft zorgvrager naam meisjesnaam voorletters geboortedatum form

Find out other form r service tax

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document