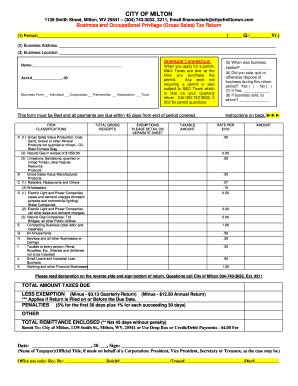

Work Tax Form

What is the Work Tax

The work tax is a specific tax imposed on individuals based on their employment income. This tax is essential for funding various public services, including education, infrastructure, and healthcare. Understanding the work tax is crucial for residents of the city of Milton, WV, as it directly affects their financial responsibilities and obligations. The work tax is typically calculated as a percentage of an individual's earnings and is subject to local regulations.

How to use the Work Tax

Utilizing the work tax involves accurately reporting your income and calculating the tax owed based on local guidelines. Residents must gather all relevant income documents, such as pay stubs and tax forms, to ensure accurate reporting. It is important to stay informed about any changes in tax rates or regulations specific to the city of Milton, WV. This ensures compliance and helps avoid potential penalties.

Steps to complete the Work Tax

Completing the work tax involves several key steps:

- Gather necessary documents, including income statements and previous tax returns.

- Calculate total income for the tax year, ensuring all sources are included.

- Apply the appropriate tax rate as defined by city regulations.

- Complete the work tax form accurately, ensuring all information is correct.

- Submit the completed form by the designated deadline.

Legal use of the Work Tax

The legal use of the work tax requires adherence to local laws and regulations governing tax collection and reporting. It is essential for residents to understand their rights and responsibilities regarding the work tax. Compliance with these regulations not only ensures that individuals fulfill their civic duties but also protects them from potential legal repercussions.

Required Documents

To complete the work tax, certain documents are required. These typically include:

- W-2 forms from employers, detailing annual earnings.

- Any 1099 forms for additional income sources.

- Previous year's tax returns for reference.

- Identification documents, such as a driver's license or Social Security number.

Filing Deadlines / Important Dates

Filing deadlines for the work tax are critical to ensure compliance. Residents of the city of Milton, WV, should be aware of the following important dates:

- Annual filing deadline, typically April 15 of the following year.

- Quarterly estimated tax payment deadlines for self-employed individuals.

- Any local deadlines specific to the city or state regulations.

Quick guide on how to complete work tax

Prepare Work Tax effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork since you can locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Work Tax on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Work Tax without hassle

- Find Work Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Modify and eSign Work Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the work tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for businesses in the city of Milton WV B O?

airSlate SignNow provides a range of features including document templates, electronic signatures, and comprehensive tracking for documents. Businesses in the city of Milton WV B O can simplify their document workflow with these tools, enabling faster transactions and better organization.

-

How much does airSlate SignNow cost for users in the city of Milton WV B O?

The pricing for airSlate SignNow is competitive and varies based on the plan you select. Businesses in the city of Milton WV B O can choose from several subscription options to find the plan that best fits their budget and needs.

-

Is there a trial period available for airSlate SignNow in the city of Milton WV B O?

Yes, airSlate SignNow offers a free trial period for businesses in the city of Milton WV B O. This allows users to explore the platform’s features and functionality without any commitment, helping them assess its suitability for their needs.

-

Can airSlate SignNow integrate with other software used in the city of Milton WV B O?

Absolutely! airSlate SignNow seamlessly integrates with a variety of third-party applications to enhance functionality. Businesses in the city of Milton WV B O can connect their existing tools with airSlate SignNow for a more streamlined workflow.

-

What are the benefits of using airSlate SignNow for document signing in the city of Milton WV B O?

Using airSlate SignNow in the city of Milton WV B O allows businesses to improve their document signing efficiency, reduce paper use, and enhance security. The platform is designed to save time and money while providing a secure method for obtaining electronic signatures.

-

Is airSlate SignNow compliant with legal standards in the city of Milton WV B O?

Yes, airSlate SignNow complies with various legal standards for electronic signatures, ensuring that documents signed through the platform are legally binding. Businesses in the city of Milton WV B O can have peace of mind knowing that their electronic signatures are secure and recognized.

-

How easy is it to use airSlate SignNow for new users in the city of Milton WV B O?

airSlate SignNow is designed with user-friendliness in mind, making it easy for new users in the city of Milton WV B O to navigate. The intuitive interface and helpful resources ensure that businesses can quickly get started with eSigning documents.

Get more for Work Tax

- Hhs llc application for employment form

- Battelle developmental inventory download form

- Refund and copy brequestb form sigue bmoneyb transfer services

- Marine cargo insurance claim form asuransidayinmitracom

- Form h1003

- Point loma overseas screening form

- Ommp registration form

- Class t shirt order form vermilioncatholiccom

Find out other Work Tax

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template