Ct W3 Hhe Form

What is the Ct W3 Hhe

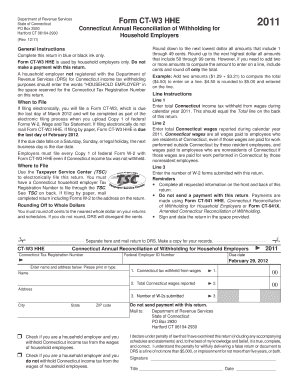

The Ct W3 Hhe form is a critical document used in the state of Connecticut for reporting income tax withheld from employees. This form is essential for employers to accurately report the amount of state income tax they have withheld during the tax year. It serves as a summary of the withholding for all employees, ensuring compliance with state tax regulations. The form must be submitted to the Connecticut Department of Revenue Services, and it plays a vital role in the overall tax filing process for both employers and employees.

How to use the Ct W3 Hhe

Using the Ct W3 Hhe involves several steps to ensure accurate completion and submission. Employers need to gather all relevant payroll information for the tax year, including total wages paid and the total amount of state income tax withheld. The form requires specific details, such as the employer's identification number and the number of employees for whom taxes were withheld. Once the information is compiled, it can be entered into the form, ensuring all fields are filled out correctly before submission.

Steps to complete the Ct W3 Hhe

Completing the Ct W3 Hhe involves a systematic approach:

- Gather payroll records for the tax year.

- Calculate the total wages paid to employees.

- Determine the total amount of state income tax withheld.

- Fill out the form with accurate employer and employee information.

- Review the completed form for accuracy.

- Submit the form to the Connecticut Department of Revenue Services by the specified deadline.

Legal use of the Ct W3 Hhe

The Ct W3 Hhe form is legally required for employers in Connecticut to report their state income tax withholding. Failure to file this form can result in penalties and interest charges. It is crucial for employers to ensure that the information reported is accurate and submitted on time to avoid any legal repercussions. Compliance with state tax laws not only protects the employer but also ensures that employees receive proper credit for their tax withholdings.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Ct W3 Hhe to ensure compliance. The form is typically due on the last day of January following the end of the tax year. For example, for the tax year ending December 31, the form must be filed by January 31 of the following year. It is essential to keep track of these deadlines to avoid late fees and potential penalties.

Required Documents

To complete the Ct W3 Hhe, employers will need several documents, including:

- Payroll records for the entire tax year.

- W-2 forms for each employee.

- Employer identification number (EIN).

- Any prior year tax documents relevant to withholdings.

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy.

Quick guide on how to complete ct w3 hhe

Complete Ct W3 Hhe effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Ct W3 Hhe on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The simplest way to modify and electronically sign Ct W3 Hhe without hassle

- Find Ct W3 Hhe and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark essential sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, link invitation, or download it to your computer.

Forget about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Ct W3 Hhe and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct w3 hhe

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct w3 hhe and how does it relate to airSlate SignNow?

Ct w3 hhe refers to a specific standard in document management that airSlate SignNow adopts to streamline eSignature processes. By implementing ct w3 hhe features, businesses can ensure compliance and enhanced security while managing their documents electronically.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow varies based on plans that cater to different business sizes and needs. Companies can take advantage of competitive pricing that includes features aligned with ct w3 hhe for enhanced document management without breaking the bank.

-

What features does airSlate SignNow offer?

AirSlate SignNow offers a range of features that include customizable templates, real-time tracking, and secure cloud storage. One of the standout features is its adherence to ct w3 hhe standards, ensuring that documents are handled efficiently and securely.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow provides businesses with a streamlined process for document signing and management, improving efficiency and reducing turnaround times. Additionally, its compliance with ct w3 hhe ensures that your documents meet industry standards, boosting client trust.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integration with various third-party applications, allowing for a more robust workflow. This compatibility is essential for businesses looking to enhance processes while adhering to ct w3 hhe standards.

-

Is it easy to use airSlate SignNow for eSigning?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, making the eSigning process straightforward for anyone. Its interface is optimized for efficiency, ensuring that users can navigate its features quickly while complying with ct w3 hhe requirements.

-

What types of documents can I sign with airSlate SignNow?

AirSlate SignNow allows users to sign a wide variety of documents, from contracts and agreements to HR forms and invoices. The versatility of document types is crucial for businesses wanting to maintain compliance with ct w3 hhe and streamline their workflows.

Get more for Ct W3 Hhe

Find out other Ct W3 Hhe

- Sign Colorado Profit Sharing Agreement Template Secure

- Sign Connecticut Profit Sharing Agreement Template Computer

- How Can I Sign Maryland Profit Sharing Agreement Template

- How To Sign New York Profit Sharing Agreement Template

- Sign Pennsylvania Profit Sharing Agreement Template Simple

- Help Me With Sign Delaware Electrical Services Contract

- Sign Louisiana Electrical Services Contract Safe

- How Can I Sign Mississippi Electrical Services Contract

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement