8836 Form

What is the 8836 Form

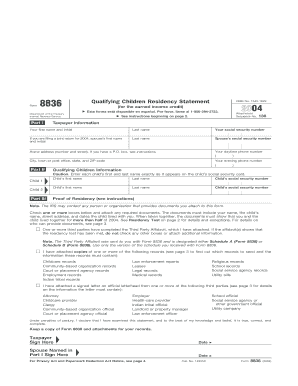

The 8836 form, officially known as IRS Form 8836, is a tax document used by individuals and businesses to claim the credit for federal tax on fuels. This form is particularly relevant for those who have incurred expenses related to the use of certain types of fuel in their operations. Understanding the purpose and requirements of this form is essential for ensuring compliance and maximizing potential tax credits.

How to use the 8836 Form

Using the 8836 form involves several steps. First, gather all necessary documentation related to fuel purchases and usage. Next, accurately fill out the form, providing details such as your name, address, and the specific fuel types used. After completing the form, it must be submitted along with your tax return. It is crucial to ensure that all information is correct to avoid delays in processing or issues with the IRS.

Steps to complete the 8836 Form

Completing the 8836 form requires attention to detail. Begin by entering your personal information, including your taxpayer identification number. Next, list the types of fuel for which you are claiming a credit, along with the corresponding amounts. Be sure to include any necessary supporting documentation as required by the IRS. Finally, review the form for accuracy before submitting it with your tax return.

Legal use of the 8836 Form

The legal use of the 8836 form is governed by IRS regulations. To ensure that your submission is valid, it is essential to comply with all applicable guidelines. This includes accurately reporting fuel usage and maintaining proper records. Failure to adhere to these regulations can result in penalties or disallowance of the claimed credits.

Filing Deadlines / Important Dates

Filing deadlines for the 8836 form align with the standard tax return deadlines. Typically, individual taxpayers must submit their forms by April 15 of the following year. However, if you file for an extension, you may have until October 15 to submit your tax return and the accompanying 8836 form. It is important to be aware of these dates to avoid late filing penalties.

Eligibility Criteria

Eligibility for claiming credits on the 8836 form depends on specific criteria set by the IRS. Generally, individuals and businesses that use qualified fuel types in their operations may qualify. It is important to review the IRS guidelines to determine if your fuel usage meets the necessary requirements for claiming credits.

Required Documents

To successfully complete the 8836 form, certain documents are required. These typically include receipts for fuel purchases, records of fuel usage, and any other supporting documentation that verifies your claims. Keeping organized records will facilitate the completion of the form and ensure compliance with IRS regulations.

Quick guide on how to complete 8836 form

Access 8836 Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents promptly without delays. Manage 8836 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign 8836 Form effortlessly

- Find 8836 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign 8836 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8836 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 8836 used for?

The form 8836 is utilized for claiming the energy-efficient home credit by eligible taxpayers. This form allows you to calculate and claim the maximum credit amount related to energy-efficient improvements made to your home. It is crucial for ensuring you receive the correct tax benefits on your qualifying renovations.

-

How can airSlate SignNow help with form 8836 submission?

airSlate SignNow simplifies the submission of form 8836 by enabling users to digitally sign and send documents securely. With our platform, you can easily manage and track the completion of your form 8836 and ensure it's submitted on time. Our intuitive interface makes the eSigning process quick and efficient.

-

What are the pricing options for using airSlate SignNow for form 8836?

airSlate SignNow offers various pricing plans to cater to businesses of all sizes needing to submit form 8836. Our cost-effective solutions provide flexibility, allowing you to select a plan that best fits your eSigning needs. Each plan includes robust features designed to enhance your document management experience.

-

Is airSlate SignNow secure for handling sensitive information on form 8836?

Yes, airSlate SignNow is designed with high-level security protocols to protect your sensitive information when handling form 8836. We utilize encryption and secure cloud storage to ensure data integrity and confidentiality. You can confidently eSign and manage your documents knowing that your information is secure.

-

What features does airSlate SignNow offer for managing form 8836?

airSlate SignNow provides a range of features tailored for efficient handling of form 8836, including customizable templates and real-time tracking. Users can collaborate with multiple parties, receive notifications, and store completed forms securely within our platform. These features streamline the preparation and submission process.

-

Can I integrate airSlate SignNow with other software for form 8836 management?

Absolutely! airSlate SignNow offers seamless integration with various applications, making it easier to manage form 8836 alongside your other business tools. This integration allows you to automate workflows and ensure that all your documents are in sync. You can enhance your efficiency by connecting with CRM systems, cloud storage solutions, and more.

-

What are the benefits of using airSlate SignNow for document signing related to form 8836?

Using airSlate SignNow for document signing related to form 8836 offers numerous benefits, including reduced turnaround time and increased efficiency. With our electronic signature solutions, you can eliminate the hassle of printing, signing, and scanning documents. This convenience accelerates the overall process of claiming your tax credits.

Get more for 8836 Form

Find out other 8836 Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation