T4 Slip Form

What is the T4 Slip

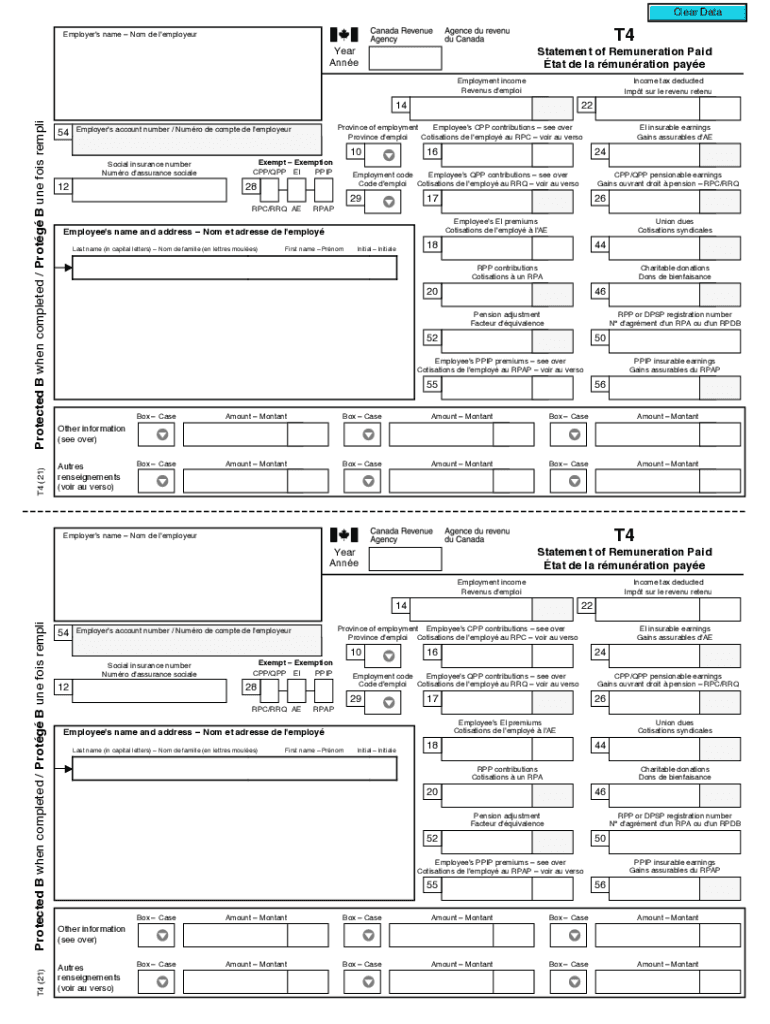

The T4 slip, also known as the T4 form, is a tax document used in Canada to report income earned by employees. It summarizes an employee's earnings and the taxes withheld by the employer during the tax year. This form is essential for individuals when filing their income tax returns, as it provides the necessary information to calculate taxable income. The T4 slip includes details such as the employee's name, Social Security Number, total earnings, and deductions for federal and provincial taxes.

How to obtain the T4 Slip

Employees typically receive their T4 slips from their employers by the end of February each year. Employers are required to issue these slips to all employees who have earned income during the previous tax year. If an employee does not receive their T4 slip, they should first contact their employer to request it. Additionally, some employers may provide electronic copies of the T4 slip, which can be accessed through employee portals or payroll systems.

Steps to complete the T4 Slip

Completing the T4 slip involves several steps to ensure accuracy and compliance. First, gather all relevant income documents and personal information, including your Social Security Number. Next, accurately report your total earnings, including wages, bonuses, and any other compensations. Then, calculate the total deductions for taxes, benefits, and other withholdings. Finally, ensure that all information is correctly filled out before submitting the form to the appropriate tax authority. It is essential to keep a copy of the completed T4 slip for your records.

Key elements of the T4 Slip

The T4 slip contains several key elements that are crucial for tax reporting. These include:

- Employee Information: Name, Social Security Number, and address.

- Employer Information: Name, business number, and address.

- Total Earnings: Sum of all income earned during the tax year.

- Deductions: Total amounts withheld for federal and provincial taxes, as well as any other deductions.

- Box Numbers: Specific boxes that categorize different types of income and deductions.

Legal use of the T4 Slip

The T4 slip is a legally binding document that must be completed accurately to comply with tax regulations. It serves as proof of income and tax deductions for employees when filing their annual tax returns. Misreporting or failing to provide a T4 slip can result in penalties from tax authorities. Therefore, it is essential for both employers and employees to understand the legal implications of the T4 slip and ensure that all information is reported correctly.

Digital vs. Paper Version

Both digital and paper versions of the T4 slip are acceptable for tax reporting purposes. The digital version can be more convenient, allowing for easier storage and retrieval. However, some individuals may prefer paper copies for their records. Regardless of the format, it is important to ensure that all information is accurate and complete, as both versions hold the same legal weight in tax filings.

Quick guide on how to complete t4 fillable form

Complete T4 Slip effortlessly on any device

Digital document management has gained tremendous traction among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documentation, as you can access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage T4 Slip on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign T4 Slip with ease

- Locate T4 Slip and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and select the Done button to save your modifications.

- Decide how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign T4 Slip to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

-

How do I send a fillable form by email?

Well, contrary to the belief of some people, you CAN send a fillable form by email, the platform just has to support the Interactive Email feature(which is basically a micro site).

-

How can I edit a PDF or fillable PDF form?

You can try out Fill which has a free forever plan and requires no download.This works best if you just want to complete or fill in an fillable PDF.You simply upload your PDF and then fill it in within the browser:If the fields are live, as in the example above, simple fill them in. If the fields are not live you can drag on the fields to complete it quickly.Upload your PDF to get started here

Create this form in 5 minutes!

How to create an eSignature for the t4 fillable form

How to create an eSignature for the T4 Fillable Form online

How to make an eSignature for your T4 Fillable Form in Chrome

How to make an electronic signature for signing the T4 Fillable Form in Gmail

How to make an electronic signature for the T4 Fillable Form straight from your mobile device

How to make an electronic signature for the T4 Fillable Form on iOS

How to create an eSignature for the T4 Fillable Form on Android

People also ask

-

What is a T4 Slip and why is it important?

A T4 Slip is a tax document issued by employers in Canada that summarizes an employee's earnings and deductions for the tax year. It is essential for employees as it provides the information needed to file income tax returns accurately. Understanding your T4 Slip can help you ensure that your reported income matches your employer's records.

-

How does airSlate SignNow help with T4 Slip management?

airSlate SignNow simplifies the process of sending, signing, and managing T4 Slips digitally. With its user-friendly interface, businesses can quickly prepare T4 Slips for employees, ensuring compliance and accuracy. This streamlines the document workflow, making it easier to manage tax documents efficiently.

-

What features does airSlate SignNow offer for T4 Slip eSigning?

airSlate SignNow offers features such as customizable templates, secure electronic signatures, and real-time tracking for T4 Slips. These tools ensure that the signing process is quick and compliant with legal standards. Additionally, users can store and retrieve signed documents with ease, enhancing organization and accessibility.

-

Is airSlate SignNow a cost-effective solution for handling T4 Slips?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing T4 Slips and other documents. With flexible pricing plans, businesses of all sizes can find an option that fits their budget while benefiting from robust features. This affordability allows companies to handle their document processes without incurring high costs.

-

Can I integrate airSlate SignNow with other accounting software for T4 Slip processing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, making T4 Slip processing more efficient. This integration allows for smooth data transfer and management, reducing manual entry errors and saving time during tax season.

-

What are the security measures in place for handling T4 Slips with airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption and authentication methods to protect sensitive information like T4 Slips. Documents are stored securely, and access is controlled to ensure that only authorized personnel can view or edit them. This level of security gives businesses peace of mind when managing critical tax documents.

-

How do I get started with airSlate SignNow for T4 Slip management?

Getting started with airSlate SignNow for T4 Slip management is easy! Simply sign up for an account, explore our user-friendly interface, and access our templates for T4 Slips. You'll find step-by-step guidance to help you send and eSign your documents quickly and efficiently.

Get more for T4 Slip

Find out other T4 Slip

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form