Form C

What is the Form C

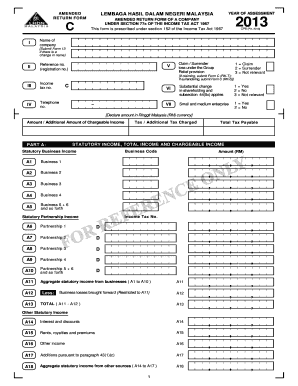

The Form C is a tax return form used primarily for reporting income and expenses by certain business entities in the United States. This form is essential for ensuring compliance with federal tax regulations. It is often utilized by various business structures, including corporations and partnerships, to accurately report their financial activities for a given tax year. Understanding the specific requirements and purpose of the Form C is crucial for any business owner or tax professional.

How to use the Form C

Using the Form C involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, expense records, and any relevant supporting documentation. Next, carefully fill out the form, ensuring that all figures are accurate and reflect your business activities. After completing the form, review it for any errors or omissions before submitting it to the appropriate tax authority. Utilizing electronic filing options can streamline this process and help maintain compliance.

Steps to complete the Form C

Completing the Form C requires careful attention to detail. Follow these steps for a successful submission:

- Gather documentation: Collect all financial records, including income and expenses.

- Fill out the form: Input accurate figures in the designated sections, ensuring clarity and correctness.

- Review the information: Double-check all entries for accuracy and completeness.

- Submit the form: Choose your preferred submission method, whether online or by mail, and ensure it is sent before the deadline.

Legal use of the Form C

The legal use of the Form C is governed by various tax laws and regulations. It is crucial for businesses to use this form correctly to avoid potential penalties or legal issues. Compliance with IRS guidelines ensures that the information reported is accurate and complete. Additionally, maintaining proper records and documentation can support the legitimacy of the submitted form in case of an audit.

Required Documents

To complete the Form C accurately, certain documents are required. These typically include:

- Income statements detailing revenue generated.

- Expense records, including receipts and invoices.

- Previous tax returns for reference.

- Any additional documentation that supports claims made on the form.

Form Submission Methods

The Form C can be submitted through various methods, providing flexibility for businesses. The primary submission methods include:

- Online filing: Many tax authorities allow for electronic submission, which can expedite processing times.

- Mail: Businesses can print and send the completed form via postal service to the designated tax office.

- In-person submission: Some may choose to deliver the form directly to a local tax office for immediate processing.

Quick guide on how to complete form c

Accomplish Form C seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary resources to generate, adjust, and eSign your documents rapidly without hindrances. Manage Form C on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to adjust and eSign Form C effortlessly

- Locate Form C and click Get Form to initiate.

- Utilize the features we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive content with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to preserve your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Form C and ensure excellent communication throughout the form preparation phase with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form c and how does it work with airSlate SignNow?

Form c is a specific document type that many businesses use for various purposes. With airSlate SignNow, you can easily create, send, and eSign form c using our intuitive interface, ensuring that all your documents are managed efficiently and securely.

-

How can I integrate form c with other applications using airSlate SignNow?

airSlate SignNow offers seamless integrations with numerous applications, allowing you to incorporate form c into your existing workflows. You can connect with popular services like Google Drive, Dropbox, and CRM software to enhance the functionality of your form c processing.

-

What are the pricing options for using airSlate SignNow for form c?

airSlate SignNow provides a variety of pricing plans to accommodate different business needs. You'll find flexible options that ensure you get the most value for managing documents like form c, with plans that scale based on your usage and features required.

-

Can I customize my form c templates in airSlate SignNow?

Yes, airSlate SignNow allows you to create and customize templates for form c to fit your specific needs. You can easily adjust fields, add branding, and modify workflows to streamline the completion process for form c.

-

What security measures are in place for form c documents in airSlate SignNow?

airSlate SignNow prioritizes security with state-of-the-art features like encryption and secure cloud storage. Your form c documents are safe, ensuring that sensitive information is protected throughout the signing process.

-

How does airSlate SignNow improve the efficiency of handling form c?

airSlate SignNow enhances the efficiency of managing form c by automating the workflow and reducing manual tasks. With quick eSigning and document tracking capabilities, you can streamline approvals and keep your processes moving smoothly.

-

Are there any limitations to using form c with airSlate SignNow?

While airSlate SignNow is highly versatile, some users may encounter limitations based on their plan. It's important to review the features included in your chosen plan to ensure that all your form c requirements are adequately met.

Get more for Form C

Find out other Form C

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy