5305 Sep Form

What is the 5305 SEP?

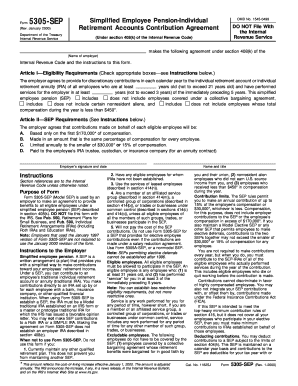

The 5305 SEP, or Simplified Employee Pension plan, is a type of retirement plan that allows employers to make contributions to their employees' retirement savings. This form is primarily used by small businesses and self-employed individuals in the United States. It provides a straightforward way to set up a retirement plan without the complexities of traditional pension plans. The 5305 SEP form outlines the terms of the plan, including contribution limits and eligibility criteria for employees.

How to use the 5305 SEP

To utilize the 5305 SEP, an employer must complete the form and provide it to all eligible employees. The form serves as an agreement that details how contributions will be made to each employee's retirement account. Employers can choose to contribute a percentage of their income or a fixed dollar amount, adhering to IRS guidelines on contribution limits. Once the form is completed, it should be kept on file for record-keeping purposes, and contributions can be made directly to an individual retirement account (IRA) for each employee.

Steps to complete the 5305 SEP

Completing the 5305 SEP involves several key steps:

- Determine eligibility criteria for employees, such as age and length of service.

- Fill out the form with the necessary details, including the employer's information and contribution amounts.

- Distribute the completed form to all eligible employees to ensure they understand the plan.

- Maintain a copy of the form for your records, as it may be required for IRS compliance.

Legal use of the 5305 SEP

The 5305 SEP must be used in compliance with IRS regulations to ensure that it is legally binding. This includes adhering to contribution limits and ensuring that all eligible employees are treated fairly. The plan must be established by the employer and communicated to employees clearly. Additionally, employers should keep records of contributions and employee eligibility to avoid potential penalties for non-compliance.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 5305 SEP. Employers must ensure that contributions do not exceed the limits set by the IRS each year. For the 2023 tax year, the contribution limit is the lesser of twenty-five percent of compensation or sixty-one thousand dollars. Employers must also ensure that the plan is established before the tax return due date for the year in which contributions are made. Following these guidelines helps maintain the plan's tax-advantaged status.

Eligibility Criteria

Eligibility for the 5305 SEP is generally open to any employee who is at least twenty-one years old, has worked for the employer for at least three of the last five years, and has received at least six hundred dollars in compensation during the year. Employers have the discretion to set more lenient criteria if desired, but they must apply the same standards uniformly to all eligible employees to comply with IRS regulations.

Quick guide on how to complete 5305 sep

Complete 5305 Sep effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Handle 5305 Sep on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign 5305 Sep seamlessly

- Locate 5305 Sep and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your requirements in document management within a few clicks from any device you choose. Alter and eSign 5305 Sep to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5305 sep

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the main differences between the 5305 vs 5305a?

The primary difference between the 5305 vs 5305a lies in their specific features and usability tailored to different business needs. While the 5305 is more suited for standard document signing, the 5305a offers additional functionalities that enhance workflow automation. Understanding these differences can help you choose the best option for your organization.

-

Which is more cost-effective, 5305 vs 5305a?

In terms of pricing, the 5305 is generally more cost-effective for small businesses that require basic e-signature solutions. However, if your organization needs advanced features, the additional investment in the 5305a may provide greater long-term value. It’s essential to consider what features your business truly needs when comparing the 5305 vs 5305a.

-

What features are included in the 5305 vs 5305a?

Both the 5305 and 5305a include essential e-signature functionalities, but the 5305a offers expanded capabilities like advanced templates and integration tools. The 5305 is more straightforward, making it ideal for users who need a simple solution. Evaluating the features can help you determine which option better meets your business requirements.

-

How do the integrations differ between the 5305 vs 5305a?

The 5305a generally supports a wider range of integrations compared to the 5305, providing more flexibility for businesses that rely on various applications. If your workflow involves using multiple software solutions, the 5305a may be the better choice. Thus, examining your integration needs can guide your decision in the 5305 vs 5305a comparison.

-

What are the benefits of choosing the 5305a over the 5305?

Choosing the 5305a offers additional benefits such as automation features and enhanced security options that are not available with the 5305. These features can streamline your processes and ensure compliance with industry standards. Therefore, if your business requires these capabilities, the 5305a is likely the better investment.

-

How does customer support differ for the 5305 vs 5305a?

Customer support for both the 5305 and 5305a is robust, but users of the 5305a may have access to specialized support options related to the advanced features. This means that if you encounter issues with the comprehensive tools of the 5305a, you may receive more tailored assistance. Understanding the support structure can be crucial when deciding between the 5305 vs 5305a.

-

Can I upgrade from the 5305 to the 5305a easily?

Yes, upgrading from the 5305 to the 5305a is a straightforward process, allowing users to access advanced features without a complete overhaul of their existing setup. This flexibility ensures that as your business grows and requires more functionality, you can seamlessly transition to the 5305a. This adaptability is a signNow advantage in the 5305 vs 5305a discussion.

Get more for 5305 Sep

- Ocf 12 form

- Tdg certificate template form

- Just animals wellness clinic form

- Form b232 e 98

- Achievement goal questionnaire form

- Energy performance level epl display card city of gainesville

- Animal foster application application form to become a pet foster

- Archery range release and waiver of liability form

Find out other 5305 Sep

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word