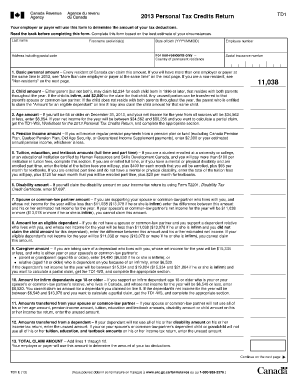

Td12013 Form

What is the Td12013 Form

The Td12013 Form is a specific document used in the United States for tax purposes. It serves as a declaration for certain financial transactions and is often required by various government agencies. This form is essential for individuals and businesses to report specific income, deductions, or credits accurately. Understanding its purpose is crucial for compliance with federal tax regulations.

How to use the Td12013 Form

Using the Td12013 Form involves several steps to ensure that all necessary information is accurately reported. Begin by gathering relevant financial documents and data that pertain to the income or deductions you plan to declare. Carefully read the instructions provided with the form to understand what information is required. Fill out the form completely, ensuring that all entries are accurate and legible. Once completed, review the form for any errors before submitting it to the appropriate agency.

Steps to complete the Td12013 Form

Completing the Td12013 Form involves a systematic approach:

- Gather all necessary financial documents, such as income statements and receipts.

- Read the form instructions thoroughly to understand the requirements.

- Fill out the personal and financial information sections accurately.

- Double-check all entries for accuracy and completeness.

- Sign and date the form as required.

- Submit the form either electronically or via mail, depending on the submission guidelines.

Legal use of the Td12013 Form

The Td12013 Form is legally binding when completed correctly and submitted according to federal regulations. It must be filled out truthfully, as any discrepancies or false information can lead to penalties. Compliance with all relevant tax laws is essential to ensure that the form serves its intended purpose without legal repercussions. Utilizing a reliable digital platform can enhance the security and legality of the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the Td12013 Form vary depending on the specific circumstances of the taxpayer. Generally, forms must be submitted by the annual tax filing deadline, which is typically April 15 for individual taxpayers. It is crucial to stay informed about any changes to deadlines, as extensions may be available in certain situations. Marking these dates on your calendar can help ensure timely submission and compliance.

Required Documents

To complete the Td12013 Form, several documents may be required. These typically include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Any previous tax returns that may provide relevant information.

- Identification documents, if necessary.

Having these documents ready can streamline the completion process and reduce the likelihood of errors.

Quick guide on how to complete td12013 form

Complete Td12013 Form effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without any delays. Handle Td12013 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related processes today.

The easiest way to alter and eSign Td12013 Form without hassle

- Find Td12013 Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Td12013 Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the td12013 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Td12013 Form and how does airSlate SignNow help with it?

The Td12013 Form is a necessary document for Canadian tax compliance. airSlate SignNow simplifies the completion and signing process of this form, allowing businesses to securely manage their documentation online, ensuring compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow for the Td12013 Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to essential features for managing documents, including the Td12013 Form, making it a cost-effective solution for your eSigning needs.

-

What features does airSlate SignNow provide for managing the Td12013 Form?

airSlate SignNow includes features such as document templates, customizable workflows, and real-time tracking for the Td12013 Form. These features streamline the signing process and ensure that users can efficiently manage their documents.

-

Can I integrate airSlate SignNow with other software for handling the Td12013 Form?

Absolutely! airSlate SignNow offers integrations with various popular applications, enhancing the management of the Td12013 Form. This allows businesses to seamlessly incorporate eSigning into their existing workflows, improving overall productivity.

-

How does airSlate SignNow ensure the security of the Td12013 Form?

Security is a priority at airSlate SignNow, and the platform utilizes advanced encryption and secure storage methods for the Td12013 Form. Additionally, user authentication processes ensure that only authorized individuals can access or sign the documents.

-

Can I use airSlate SignNow to automate reminders for the Td12013 Form?

Yes, airSlate SignNow allows businesses to set up automated reminders for the Td12013 Form. This feature ensures that all parties involved stay informed about signing deadlines, enhancing efficiency and accountability.

-

What are the benefits of using airSlate SignNow for the Td12013 Form?

Using airSlate SignNow for the Td12013 Form offers numerous benefits, including increased efficiency, reduced error rates, and enhanced compliance. The platform’s user-friendly interface makes it easy to navigate and manage documents effectively.

Get more for Td12013 Form

Find out other Td12013 Form

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast