St Louis Withholding Tax Forms

What is the St Louis Withholding Tax Forms

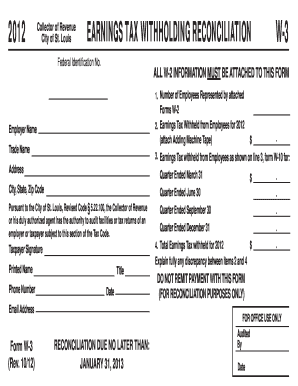

The St Louis Withholding Tax Forms are essential documents used by employers in St Louis to report and remit the city’s withholding tax. This tax applies to employees working within the city limits, and it is crucial for companies to ensure compliance with local tax regulations. The forms help employers calculate the appropriate amount of tax to withhold from employee wages and submit these amounts to the city’s revenue department. Understanding the purpose and requirements of these forms is vital for both employers and employees to avoid penalties.

How to obtain the St Louis Withholding Tax Forms

Employers can obtain the St Louis Withholding Tax Forms through various channels. The most common method is to visit the official website of the St Louis City Revenue Division, where the forms are available for download. Additionally, employers can request physical copies by contacting the revenue office directly. It is important to ensure that the forms are the most current versions, as tax regulations may change over time.

Steps to complete the St Louis Withholding Tax Forms

Completing the St Louis Withholding Tax Forms involves several key steps:

- Gather necessary employee information, including names, addresses, and Social Security numbers.

- Calculate the gross wages for each employee for the pay period.

- Determine the appropriate withholding amount based on the current tax rate and any exemptions claimed by the employee.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors before submission.

Legal use of the St Louis Withholding Tax Forms

The St Louis Withholding Tax Forms must be used in accordance with local tax laws to be considered legally binding. Employers are required to maintain accurate records of withheld taxes and ensure timely submission of the forms to avoid penalties. The forms serve as official documentation of tax compliance and can be requested by the city’s revenue department during audits.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines associated with the St Louis Withholding Tax Forms. Typically, these forms are due on a monthly or quarterly basis, depending on the amount of tax withheld. It is essential to stay informed about any changes to these deadlines to ensure compliance and avoid late fees. Marking these important dates on a calendar can help employers manage their tax obligations effectively.

Penalties for Non-Compliance

Failure to comply with the requirements of the St Louis Withholding Tax Forms can result in significant penalties for employers. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to understand the implications of non-compliance and take proactive measures to ensure that all forms are completed accurately and submitted on time.

Quick guide on how to complete st louis withholding tax forms

Prepare St Louis Withholding Tax Forms effortlessly on any device

Digital document management has surged in popularity among companies and individuals. It offers an ideal environmentally-friendly substitute to traditional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without any holdups. Manage St Louis Withholding Tax Forms on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign St Louis Withholding Tax Forms effortlessly

- Obtain St Louis Withholding Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate reprinting new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and eSign St Louis Withholding Tax Forms and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st louis withholding tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are St Louis Withholding Tax Forms?

St Louis Withholding Tax Forms are essential documents that businesses in St. Louis must file to report employee income tax withheld. These forms help ensure compliance with local tax regulations and simplify payroll processes. Accurate completion of these forms is crucial for avoiding penalties and maintaining good standing with tax authorities.

-

How can airSlate SignNow assist with St Louis Withholding Tax Forms?

airSlate SignNow offers an intuitive platform for electronically signing and sending St Louis Withholding Tax Forms, streamlining the submission process. By using our service, businesses can ensure that their tax forms are completed accurately and securely. This not only saves time but also reduces the risk of errors associated with traditional paper-based submissions.

-

What is the pricing structure for using airSlate SignNow for St Louis Withholding Tax Forms?

airSlate SignNow offers flexible pricing plans based on the needs of your business, starting with affordable monthly subscriptions. Our pricing is transparent and designed to provide cost-effective solutions for handling St Louis Withholding Tax Forms. Be sure to check our website for the latest deals and options that suit your requirements.

-

Are there any integrations available for handling St Louis Withholding Tax Forms?

Yes, airSlate SignNow integrates seamlessly with various accounting and payroll software, making it easier to manage St Louis Withholding Tax Forms. This integration allows users to sync data automatically, reducing manual entry errors and improving efficiency. Additionally, these integrations help streamline compliance and reporting processes.

-

What features does airSlate SignNow offer for St Louis Withholding Tax Forms?

airSlate SignNow provides features such as customizable templates, secure eSignature capabilities, and document tracking for St Louis Withholding Tax Forms. These tools help users simplify the form-filling process and maintain compliance without any hassle. Our user-friendly interface ensures that you can quickly navigate through the necessary steps to complete your forms.

-

Can I edit St Louis Withholding Tax Forms using airSlate SignNow?

Absolutely! airSlate SignNow allows you to edit and customize St Louis Withholding Tax Forms according to your business needs. You can easily add or modify information in the fields to ensure accuracy before sending. This flexibility makes it easier for businesses to handle any specific tax-related requirements.

-

Is airSlate SignNow secure for handling sensitive data like St Louis Withholding Tax Forms?

Yes, airSlate SignNow prioritizes security and uses advanced encryption protocols to protect sensitive data, including St Louis Withholding Tax Forms. Our platform complies with industry standards, ensuring that your documents are safe and secure throughout the signing process. You can confidently manage your tax forms without worrying about data bsignNowes.

Get more for St Louis Withholding Tax Forms

Find out other St Louis Withholding Tax Forms

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word