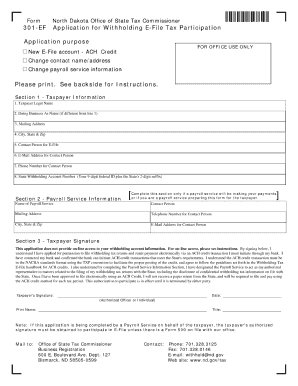

301 Ef Form

What is the 301 Ef Form

The 301 Ef Form is a specific document used primarily for electronic filing of tax-related information in the United States. This form is essential for individuals and businesses who need to report certain financial data to the Internal Revenue Service (IRS). It streamlines the process of submitting tax information electronically, ensuring compliance with federal regulations. The form is designed to capture necessary details that facilitate accurate tax reporting and help taxpayers meet their obligations efficiently.

How to use the 301 Ef Form

Using the 301 Ef Form involves several straightforward steps. First, ensure you have all necessary financial documents on hand, including income statements and deduction records. Next, access the form through a reliable electronic filing platform. Fill in the required fields accurately, ensuring that all information is complete and correct. After completing the form, review it for any errors before submitting it electronically. This process helps ensure that your tax information is filed correctly and on time.

Steps to complete the 301 Ef Form

Completing the 301 Ef Form can be done in a few organized steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Access the form through an electronic filing service that supports the 301 Ef Form.

- Enter your personal information, including your name, address, and Social Security number.

- Input your income details and any applicable deductions or credits.

- Review all entries for accuracy and completeness.

- Submit the form electronically to the IRS.

Legal use of the 301 Ef Form

The 301 Ef Form is legally binding when completed and submitted according to IRS regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal issues. Electronic signatures, when used in conjunction with the form, must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. Utilizing a secure platform for submission enhances the legal validity of the form.

Key elements of the 301 Ef Form

Several key elements must be included in the 301 Ef Form to ensure its validity:

- Personal Information: Name, address, and Social Security number or Employer Identification Number (EIN).

- Income Reporting: Accurate reporting of all income sources, including wages, salaries, and investments.

- Deductions and Credits: Detailed information on any deductions or tax credits claimed.

- Signature: An electronic signature that meets legal requirements.

Form Submission Methods

The 301 Ef Form can be submitted through various methods, primarily focusing on electronic filing. Taxpayers can use approved e-filing software or platforms to submit the form directly to the IRS. This method is preferred for its speed and efficiency. Alternatively, the form can be printed and mailed to the IRS, although this method may result in longer processing times. Ensuring that the form is submitted correctly and on time is crucial to avoid penalties.

Quick guide on how to complete 301 ef form

Complete 301 Ef Form seamlessly on any device

Digital document management has become widespread among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage 301 Ef Form on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest method to modify and eSign 301 Ef Form with ease

- Obtain 301 Ef Form and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues related to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign 301 Ef Form and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 301 ef form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 301 Ef Form?

The 301 Ef Form is a critical document used for tax reporting. It enables businesses to provide necessary information to the IRS, ensuring compliance with federal tax laws. airSlate SignNow simplifies the process of completing and signing the 301 Ef Form electronically.

-

How can airSlate SignNow help with the 301 Ef Form?

airSlate SignNow allows users to easily fill out and eSign the 301 Ef Form online. Our platform streamlines the document workflow, making it quicker to send and receive signed documents securely. This functionality can signNowly reduce the time spent on tax documentation.

-

Is there a cost associated with using airSlate SignNow for the 301 Ef Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans include features specifically designed for efficient handling of documents like the 301 Ef Form. You can choose a plan that best fits your budget and operational requirements.

-

What features does airSlate SignNow offer for signing the 301 Ef Form?

airSlate SignNow provides essential features such as drag-and-drop document upload, customizable templates, and real-time tracking. These tools specifically enhance the management of the 301 Ef Form, ensuring that signing is seamless and efficient. Additionally, our platform supports multiple formats to accommodate user preferences.

-

Can I integrate airSlate SignNow with other applications for managing the 301 Ef Form?

Absolutely! airSlate SignNow integrates with a variety of applications, including CRM systems and cloud storage platforms. This capability allows for a streamlined workflow while handling the 301 Ef Form and other documents, making data management more efficient.

-

What are the benefits of using airSlate SignNow for the 301 Ef Form?

Using airSlate SignNow for the 301 Ef Form brings numerous benefits such as enhanced accessibility, improved security, and faster processing times. It reduces the hassle of paperwork and minimizes errors associated with manual handling. These advantages make it an ideal solution for businesses looking to simplify their document management.

-

Is airSlate SignNow secure for handling sensitive documents like the 301 Ef Form?

Yes, airSlate SignNow employs industry-standard encryption and security measures to protect sensitive documents, including the 301 Ef Form. This ensures that your data is kept safe and confidential throughout the signing process. Our commitment to security allows users to sign documents with peace of mind.

Get more for 301 Ef Form

- Shoulder pain and disability index form

- Fax 210 674 7766 gifted and talented education program hsasa form

- Chapter 37 respiration circulation and excretion answer key form

- 0619 form k 30 page 1 of 1 georgia conditional employee

- Sr gl life claimant statement cl g012f original doc form

- Price hvac handbook form

- Change of broker dealerrepresentative authorization form

- Kcc renewal form

Find out other 301 Ef Form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract