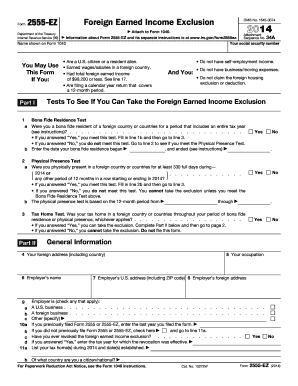

Form 2555 EZ Foreign Earned Income Exclusion

What is the Form 2555 EZ Foreign Earned Income Exclusion

The Form 2555 EZ is a simplified version of the Form 2555, designed for U.S. citizens and resident aliens who earn income while living abroad. This form allows eligible individuals to exclude a certain amount of their foreign earned income from U.S. taxation, which can significantly reduce their tax liability. The primary purpose of the form is to provide a straightforward way for taxpayers to claim the foreign earned income exclusion and the housing exclusion or deduction, if applicable.

Eligibility Criteria for Form 2555 EZ

To qualify for the Form 2555 EZ, individuals must meet specific criteria. They must have foreign earned income, which is income received for services performed in a foreign country. Additionally, the taxpayer must have a tax home in a foreign country and meet either the bona fide residence test or the physical presence test. The bona fide residence test requires that the individual resides in a foreign country for an uninterrupted period that includes an entire tax year, while the physical presence test necessitates being physically present in a foreign country for at least 330 full days during a 12-month period.

Steps to Complete the Form 2555 EZ

Completing the Form 2555 EZ involves several key steps. First, gather all necessary documentation, including proof of foreign earned income and residency. Next, fill out the form by providing personal information, details about your foreign earned income, and any applicable housing expenses. Ensure that all figures are accurate and that you meet the eligibility requirements. After completing the form, review it for any errors before submitting it to the IRS, either electronically or by mail.

Legal Use of the Form 2555 EZ Foreign Earned Income Exclusion

The legal validity of the Form 2555 EZ hinges on compliance with IRS regulations and guidelines. To ensure that the form is recognized as legally binding, it must be filled out correctly, and all required signatures must be provided. Utilizing a secure platform for electronic signatures can enhance the legal standing of the document. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws is essential for the digital submission of the form.

Required Documents for Form 2555 EZ

When preparing to file the Form 2555 EZ, certain documents are necessary to support your claims. These typically include proof of foreign earned income, such as pay stubs or tax returns from the foreign country, documentation of your tax home, and evidence of residency in the foreign country. Additional documentation may be required if you are claiming the housing exclusion or deduction. Keeping organized records will facilitate the completion of the form and ensure compliance with IRS requirements.

Filing Deadlines for Form 2555 EZ

Filing deadlines for the Form 2555 EZ align with the standard tax filing deadlines for U.S. citizens. Typically, the due date for filing individual income tax returns is April 15. However, individuals living abroad may qualify for an automatic extension, allowing them to file until June 15. If additional time is needed, a further extension can be requested, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete form 2555 ez foreign earned income exclusion

Complete Form 2555 EZ Foreign Earned Income Exclusion effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 2555 EZ Foreign Earned Income Exclusion on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Form 2555 EZ Foreign Earned Income Exclusion without hassle

- Find Form 2555 EZ Foreign Earned Income Exclusion and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes moments and carries the same legal validity as a standard wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow satisfies your needs in document management in just a few clicks from any device you prefer. Edit and eSign Form 2555 EZ Foreign Earned Income Exclusion and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2555 ez foreign earned income exclusion

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2555 ez form and who needs to use it?

The 2555 ez form is a streamlined version of the 2555 form that allows U.S. citizens or residents living abroad to claim the Foreign Earned Income Exclusion. If you meet the requirements of the Physical Presence Test or the Bona Fide Residence Test, you may benefit from using the 2555 ez to simplify your tax filing process.

-

How does airSlate SignNow simplify the signing of the 2555 ez form?

airSlate SignNow provides an intuitive platform that allows you to easily upload, edit, and electronically sign the 2555 ez form. It streamlines the document management process, ensuring you can complete your tax return quickly and safely, without the hassle of printing and scanning documents.

-

What features does airSlate SignNow offer for handling the 2555 ez form?

With airSlate SignNow, you get features such as eSignature capabilities, customizable templates, and secure cloud storage, making it easy to manage your 2555 ez form. These tools ensure that you can efficiently prepare and submit your form, maintaining compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the 2555 ez form?

Yes, airSlate SignNow offers various pricing plans that accommodate different needs. Depending on your usage, you can choose a plan that offers the features necessary for handling documents like the 2555 ez form at a cost-effective rate.

-

Can I integrate airSlate SignNow with other applications for managing the 2555 ez form?

Absolutely! airSlate SignNow integrates with numerous applications, allowing you to manage the 2555 ez form alongside your existing tools. Whether you use CRM systems or cloud storage services, these integrations help create a seamless workflow.

-

How does airSlate SignNow ensure the security of the 2555 ez form?

airSlate SignNow prioritizes security with encrypted documents and compliant storage, ensuring that sensitive information on the 2555 ez form is protected. With features like two-factor authentication and audit trails, you can trust that your data remains safe.

-

What are the benefits of electronically signing the 2555 ez form with airSlate SignNow?

Using airSlate SignNow to electronically sign the 2555 ez form enhances efficiency and reduces paper usage. E-signatures are legally recognized and can expedite the filing process, meaning you can submit your tax documents faster.

Get more for Form 2555 EZ Foreign Earned Income Exclusion

Find out other Form 2555 EZ Foreign Earned Income Exclusion

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT