Uct 115 E Form

What is the Uct 115 E

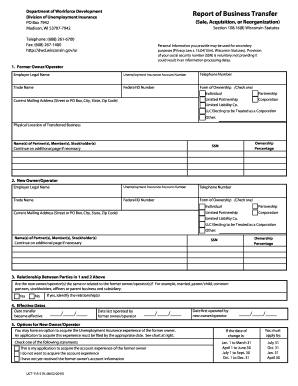

The Uct 115 E form is a specific document used in the state of Wisconsin for reporting business transfers. This form is essential for businesses undergoing ownership changes, ensuring that all necessary information is documented and compliant with state regulations. The purpose of the Uct 115 E is to provide a clear record of the transfer, which is crucial for legal and tax purposes. It includes details such as the names of the parties involved, the nature of the business, and the specifics of the transfer.

How to use the Uct 115 E

Using the Uct 115 E form involves several straightforward steps. First, ensure that you have the correct version of the form, as it may be updated periodically. Next, gather all required information, including business details and the identities of the parties involved in the transfer. Once you have completed the form, review it for accuracy to avoid any potential issues. Finally, submit the form according to the guidelines provided by the state, ensuring that you keep a copy for your records.

Steps to complete the Uct 115 E

Completing the Uct 115 E requires careful attention to detail. Follow these steps for a smooth process:

- Obtain the latest version of the Uct 115 E form from the appropriate state resources.

- Fill in the business name and address accurately.

- Provide the names and addresses of all parties involved in the transfer.

- Detail the nature of the business and the specifics of the transfer.

- Review all information for accuracy and completeness.

- Sign and date the form where required.

- Submit the form as directed, either online or by mail.

Legal use of the Uct 115 E

The Uct 115 E form is legally binding when completed and submitted in accordance with Wisconsin state laws. It serves as an official record of the business transfer, which can be crucial in the event of disputes or audits. To ensure legal compliance, it is important to adhere to all instructions provided with the form and to maintain accurate records of the transaction.

State-specific rules for the Uct 115 E

Wisconsin has specific regulations governing the use of the Uct 115 E form. These rules dictate who must file the form, the timelines for submission, and any additional documentation that may be required. It is essential to familiarize yourself with these state-specific guidelines to ensure that your business transfer is processed correctly and legally. Failure to comply with these regulations may result in penalties or delays in the transfer process.

Required Documents

When completing the Uct 115 E form, certain documents may be required to support the information provided. These can include:

- Proof of identity for all parties involved.

- Documentation of the business's current status, such as registration or licensing information.

- Any existing agreements related to the business transfer.

Having these documents ready can facilitate a smoother submission process and help avoid potential issues.

Quick guide on how to complete uct 115 e

Complete Uct 115 E effortlessly on any device

Online document handling has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents rapidly without delays. Manage Uct 115 E on any platform with the airSlate SignNow mobile applications for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign Uct 115 E without hassle

- Obtain Uct 115 E and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your adjustments.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form retrieval, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and electronically sign Uct 115 E to ensure seamless communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uct 115 e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the uct 115 e and how does it benefit businesses?

The uct 115 e is an advanced eSigning solution offered by airSlate SignNow. It streamlines the document signing process, enabling businesses to send and sign documents quickly and efficiently, thereby enhancing productivity and reducing turnaround times.

-

What features does the uct 115 e include?

The uct 115 e includes features like document templates, bulk sending, real-time tracking, and robust security measures. These functionalities ensure a seamless signing experience while maintaining the integrity and confidentiality of your documents.

-

How much does the uct 115 e cost?

Pricing for the uct 115 e varies based on the plan chosen, offering flexible pricing options that cater to different business needs. airSlate SignNow provides a competitive rate, ensuring you get value for your investment in document management solutions.

-

Can the uct 115 e integrate with other software?

Yes, the uct 115 e seamlessly integrates with various software applications such as CRM systems, cloud storage, and project management tools. This integration capability enhances workflow automation and simplifies document handling across platforms.

-

Is the uct 115 e secure for sensitive documents?

Absolutely! The uct 115 e employs advanced encryption and security protocols to protect sensitive documents. AirSlate SignNow prioritizes data security, ensuring that your information remains confidential and protected during the signing process.

-

How user-friendly is the uct 115 e for new users?

The uct 115 e is designed with user experience in mind, featuring an intuitive interface that makes it easy for anyone to navigate. Even new users can quickly learn to send and sign documents without extensive training or technical support.

-

What types of documents can I sign with the uct 115 e?

You can sign a wide variety of documents using the uct 115 e, including contracts, agreements, and forms. This flexibility makes it an ideal solution for businesses across different industries looking to streamline their document workflows.

Get more for Uct 115 E

- Cdi order form

- Declaration of support payment history form

- Pcp selection and change form coordinated care

- Auto insurance claim form template

- Beachbody military coach application form

- Como preencher o formulrio de contestao da caixa

- Ala jv 002 attorney or party without attorney name state bar number and address for court use only fax no alameda courts ca form

- Vendor partnership agreement template form

Find out other Uct 115 E

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word