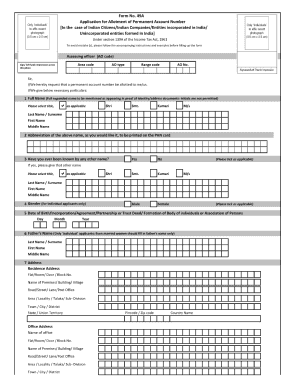

Form No 49a

What is the Form No 49a

The Form No 49a is a crucial document used primarily for applying for a Permanent Account Number (PAN) in India. This form is essential for individuals and entities who need to conduct financial transactions, file taxes, or engage in business activities. The PAN serves as a unique identifier for taxpayers and is mandatory for various financial operations, including opening bank accounts and filing income tax returns. Understanding the purpose and requirements of Form No 49a is vital for ensuring compliance with tax regulations.

How to use the Form No 49a

Using Form No 49a involves several key steps to ensure accurate completion and submission. First, gather all necessary personal information, including your name, address, date of birth, and identification details. Next, fill out the form carefully, ensuring that all information is accurate and matches your identification documents. Once completed, you can submit the form either online or in person at designated centers. It's essential to keep a copy of the filled form for your records, as it may be required for future reference.

Steps to complete the Form No 49a

Completing Form No 49a requires attention to detail. Follow these steps for a smooth process:

- Obtain the latest version of Form No 49a from an authorized source.

- Fill in your personal details, including your full name, date of birth, and address.

- Provide identification proof, such as a driver's license or passport number.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with any required documents to the appropriate authority.

Legal use of the Form No 49a

The legal use of Form No 49a is governed by tax regulations in India. It is essential for establishing a PAN, which is legally required for various financial activities. Failure to obtain a PAN can result in penalties and complications in conducting business or filing taxes. Therefore, understanding the legal implications of using Form No 49a is crucial for compliance with tax laws.

Required Documents

When filling out Form No 49a, specific documents are required to verify your identity and address. Commonly required documents include:

- Proof of identity (e.g., passport, voter ID, or driver's license)

- Proof of address (e.g., utility bill, rental agreement, or bank statement)

- Passport-sized photographs

Ensure that all documents are current and valid to avoid delays in processing your application.

Form Submission Methods

Form No 49a can be submitted through various methods, providing flexibility for applicants. The primary submission methods include:

- Online submission through the official tax department website

- In-person submission at designated tax offices or centers

- Mailing the completed form to the appropriate address

Choosing the right submission method depends on your convenience and the urgency of obtaining your PAN.

Quick guide on how to complete form no 49a

Effortlessly prepare Form No 49a on any device

Managing documents online has become popular among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow offers all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form No 49a on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Form No 49a without effort

- Find Form No 49a and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form No 49a and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 49a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 49a feature in airSlate SignNow?

The 49a feature in airSlate SignNow allows users to easily send and eSign documents within a streamlined platform. This feature enhances workflow efficiency and simplifies the signing process for businesses of all sizes.

-

How does airSlate SignNow's 49a benefit businesses?

By utilizing the 49a feature, businesses can reduce turnaround times for document signing, leading to quicker transactions and improved customer satisfaction. Additionally, it helps eliminate paperwork, making document management more efficient.

-

What pricing plans are available for the 49a feature in airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to various business needs. The 49a feature is included in all plans, allowing businesses to choose a plan that best fits their document signing and management requirements.

-

Are there any integrations available with the 49a feature in airSlate SignNow?

Yes, airSlate SignNow's 49a feature integrates seamlessly with popular applications like Google Drive, Salesforce, and more. This integration capability enhances productivity by allowing users to manage documents across platforms effortlessly.

-

Is the 49a feature user-friendly for non-technical users?

Absolutely! The 49a feature is designed with user-friendliness in mind, making it accessible even for non-technical users. The intuitive interface ensures that anyone can send and eSign documents with ease.

-

Can I customize documents using the 49a feature in airSlate SignNow?

Yes, the 49a feature allows for document customization, enabling users to add text fields, checkboxes, and signature blocks as needed. This customization ensures that documents meet specific business requirements.

-

How secure is the 49a feature for document eSigning?

The 49a feature in airSlate SignNow employs advanced security measures to ensure that all documents are protected during the eSigning process. With encryption and secure cloud storage, users can trust that their sensitive information is safe.

Get more for Form No 49a

Find out other Form No 49a

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form