Life Insurance Policy Document Sample Form

What is the Life Insurance Policy Document Sample

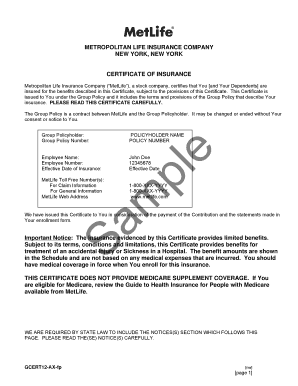

The life insurance policy document sample serves as a template that outlines the key components and terms of a life insurance contract. This document typically includes essential information such as the policyholder's details, coverage amounts, premium payments, and the beneficiaries designated to receive the policy's benefits upon the policyholder's passing. Understanding this sample can help individuals grasp the structure and important clauses found in actual insurance policies, making it easier to compare different offerings from various insurers.

Key Elements of the Life Insurance Policy Document Sample

Several critical elements are commonly found in a life insurance policy document sample, including:

- Policyholder Information: Details about the individual who owns the policy.

- Coverage Amount: The total amount the insurer will pay upon the policyholder's death.

- Premium Details: Information about the payments required to keep the policy active.

- Beneficiary Designation: Names of individuals or entities entitled to receive benefits.

- Exclusions and Limitations: Specific circumstances under which the policy may not pay out.

- Terms and Conditions: Legal stipulations governing the policy's operation.

Steps to Complete the Life Insurance Policy Document Sample

Completing a life insurance policy document sample involves several straightforward steps:

- Gather Personal Information: Collect necessary details such as your name, address, and Social Security number.

- Determine Coverage Needs: Assess the amount of coverage required based on financial obligations and dependents.

- Select Beneficiaries: Choose who will receive the policy benefits and ensure their information is accurate.

- Review Terms: Carefully read through the terms and conditions to understand exclusions and limitations.

- Sign the Document: Provide your signature and date the document to validate it.

Legal Use of the Life Insurance Policy Document Sample

The life insurance policy document sample can be used legally as a reference when drafting or reviewing an actual policy. It is important to note that while the sample provides a framework, the final document must comply with state regulations and insurance laws. This ensures that the policy is enforceable and meets all legal requirements, including the proper signatures and notarization if necessary.

How to Obtain the Life Insurance Policy Document Sample

Obtaining a life insurance policy document sample can be done in various ways:

- Insurance Company Websites: Many insurers provide sample documents on their websites for prospective clients.

- Insurance Agents: Licensed agents can provide samples and explain the nuances of different policies.

- Online Resources: Various financial and legal websites offer downloadable samples for educational purposes.

Examples of Using the Life Insurance Policy Document Sample

Using a life insurance policy document sample can be beneficial in several scenarios:

- Comparing Policies: Individuals can use the sample to identify differences in coverage and terms among various insurers.

- Understanding Clauses: The sample helps clarify complex legal jargon and policy clauses.

- Preparing for Discussions: It serves as a helpful tool when discussing options with insurance agents or financial advisors.

Quick guide on how to complete life insurance policy document sample

Complete Life Insurance Policy Document Sample seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Life Insurance Policy Document Sample on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Life Insurance Policy Document Sample effortlessly

- Obtain Life Insurance Policy Document Sample and click on Get Form to begin.

- Make use of the tools available to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device. Modify and eSign Life Insurance Policy Document Sample and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the life insurance policy document sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a life insurance policy document sample?

A life insurance policy document sample serves as a template illustrating the essential components of a life insurance policy. It typically includes information on coverage, premiums, beneficiaries, and terms. Reviewing a life insurance policy document sample can help you understand the key elements to consider when choosing a policy.

-

How can I use a life insurance policy document sample?

You can use a life insurance policy document sample to familiarize yourself with the terminology and structure of an actual policy. This can aid in making informed decisions when evaluating or purchasing life insurance. Additionally, it can serve as a guide when discussing options with insurance agents.

-

Are there costs associated with obtaining a life insurance policy document sample?

Generally, life insurance policy document samples are available for free from various online sources, including insurance companies and financial advisors. However, note that these samples are for educational purposes and may not reflect specific policy features or pricing. Use them as a reference to better understand actual policy costs.

-

What features should I look for in a life insurance policy document sample?

When examining a life insurance policy document sample, look for features such as coverage amounts, premium rates, exclusions, and riders. Pay attention to the definitions of terms and conditions as well. Ensuring that these features align with your personal needs is crucial for selecting the right policy.

-

How does using a life insurance policy document sample help with my purchasing decisions?

Using a life insurance policy document sample can help you visualize and compare different policies more effectively. It provides clarity on what to expect from your insurance plan. This understanding empowers you to ask the right questions and make more strategic choices when engaging with providers.

-

Can airSlate SignNow assist in handling life insurance policy documents?

Yes, airSlate SignNow offers a user-friendly solution for sending and eSigning life insurance policy documents. This simplifies the paperwork process, allowing you to quickly manage your policy documents while keeping them secure. It streamlines your experience whether you are a client or an insurance provider.

-

What are the benefits of using airSlate SignNow for life insurance documents?

Using airSlate SignNow for life insurance documents provides quick and secure eSignature capabilities. It eliminates the hassle of printing, scanning, and physically delivering documents. Additionally, it offers integration options that enhance workflow efficiency, making it easier to manage your life insurance policy document sample and related documents.

Get more for Life Insurance Policy Document Sample

Find out other Life Insurance Policy Document Sample

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later