Form 461

What is the Form 461

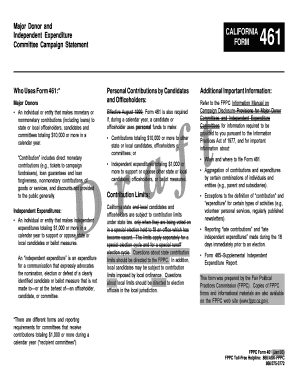

The Form 461, also known as the California Form 461 or FPPC Form 461, is a document used primarily for reporting campaign contributions and expenditures in California. This form is essential for candidates, political parties, and committees to disclose financial activities related to elections. It ensures transparency and accountability in campaign financing, which is crucial for maintaining the integrity of the electoral process.

Steps to complete the Form 461

Completing the Form 461 involves several key steps to ensure accuracy and compliance with California regulations. First, gather all necessary financial information, including contributions received and expenditures made. Next, accurately fill out each section of the form, providing detailed descriptions of the contributions and expenditures. It is important to double-check all entries for accuracy before submission. Finally, ensure that the form is signed and dated appropriately, as a handwritten signature is required for the form to be considered valid.

Legal use of the Form 461

The legal use of the Form 461 is governed by California election laws, which mandate that candidates and committees must file this form to report their financial activities. A properly completed Form 461 serves as a legally binding document, provided it meets specific requirements, including the inclusion of a handwritten signature. Compliance with these regulations is crucial, as failure to submit the form or inaccuracies can lead to penalties or legal repercussions.

State-specific rules for the Form 461

California has specific rules governing the use and submission of the Form 461. These rules include deadlines for filing the form, requirements for the information disclosed, and guidelines for maintaining records of contributions and expenditures. It is essential for individuals and organizations using this form to stay informed about any changes in state regulations to ensure compliance and avoid potential issues.

Form Submission Methods

The Form 461 can be submitted through various methods, including online submission, mail, or in-person delivery to the appropriate election office. Each method has its own guidelines and deadlines, so it is important to choose the most suitable option based on individual circumstances. Online submission is often the most efficient, allowing for quicker processing and confirmation of receipt.

Key elements of the Form 461

Key elements of the Form 461 include sections for reporting contributions, expenditures, and the identification of the candidate or committee involved. Each section must be filled out with precise details, including the names of contributors, the amounts contributed, and the purpose of expenditures. Ensuring that all required information is included is vital for the form's validity and compliance with legal standards.

Quick guide on how to complete form 461

Complete Form 461 effortlessly on any device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without any holdups. Handle Form 461 on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

The easiest way to modify and eSign Form 461 without any hassle

- Obtain Form 461 and select Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form: via email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs within a few clicks from any device you prefer. Edit and eSign Form 461 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 461

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 461 handwritten signature requirements?

The form 461 handwritten signature requirements specify the necessary elements for a legally binding signature on this particular form. This typically includes the use of a clear and distinct signature, the date of signing, and any other pertinent information as per the official guidelines. It's important to follow these requirements to ensure compliance and validity.

-

How does airSlate SignNow ensure compliance with form 461 handwritten signature requirements?

airSlate SignNow provides customizable templates and tools that ensure adherence to form 461 handwritten signature requirements. Our platform allows users to easily integrate signature fields that meet all regulatory standards, ensuring that each document is legally sound. By using our service, you can streamline the signing process while remaining compliant.

-

Can I use airSlate SignNow for multiple forms besides form 461?

Absolutely! airSlate SignNow is designed to handle a variety of forms beyond form 461, accommodating diverse document signing needs. You can create, send, and manage numerous types of documents while adhering to their respective handwritten signature requirements. This flexibility makes our platform ideal for businesses of all sizes.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored for individuals and businesses looking to comply with form 461 handwritten signature requirements. Our plans range from basic to advanced features, allowing you to choose the best option that fits your needs. You can benefit from a cost-effective solution that does not compromise on quality.

-

What features does airSlate SignNow offer to assist with handwritten signatures?

airSlate SignNow boasts several features designed to facilitate easy compliance with handwritten signature requirements, including electronic signature options, template customization, and user-friendly document management tools. Additionally, users can track the signing process in real-time, ensuring that all signatures are collected as required. This not only simplifies the workflow but also enhances security.

-

Is it easy to integrate airSlate SignNow with other tools?

Yes, airSlate SignNow offers seamless integration with various tools and applications, enhancing your ability to capture form 461 handwritten signatures efficiently. Our platform connects with popular software such as Google Workspace, Dropbox, and CRM solutions, allowing for a streamlined process. These integrations ensure you can manage your documents effortlessly across different systems.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business will enjoy improved efficiency, enhanced compliance with form 461 handwritten signature requirements, and a better overall signing experience. Our easy-to-use interface and robust features help reduce turnaround time for document approvals and ensure you meet legal standards without hassle. This ultimately leads to higher productivity and customer satisfaction.

Get more for Form 461

- Td4 form

- Foia request form the city of country club hills countryclubhills

- The clean architecture pdf form

- How soccer can help us understand physics answer key form

- Technical sindh form

- Does the organization maintain records to substantiate the amount of its grants and form

- Subaward agreement gates foundation form

- Supervision log template form

Find out other Form 461

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement