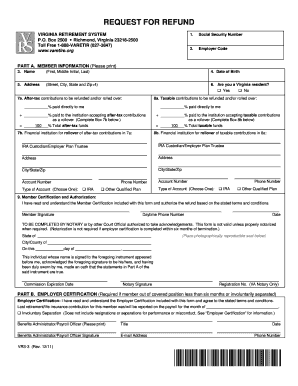

Vrs Refund Time Form

What is the VRS Refund Time?

The VRS refund time refers to the specific period during which individuals can request a refund for overpayments or errors related to their VRS (Virginia Retirement System) contributions. This time frame is crucial for ensuring that taxpayers can rectify any discrepancies in their contributions and receive the appropriate refunds. Understanding the VRS refund time helps individuals manage their finances effectively and ensures compliance with state regulations.

How to Use the VRS Refund Time

Using the VRS refund time involves several steps to ensure that your request is processed smoothly. First, gather all necessary documentation related to your contributions. This may include pay stubs, tax returns, and any correspondence from the VRS. Next, complete the required forms accurately, ensuring that all information is correct. Finally, submit your request within the designated refund time frame to avoid complications.

Steps to Complete the VRS Refund Time

Completing the VRS refund time process involves a systematic approach:

- Review your contribution records to identify any overpayments.

- Obtain the necessary forms from the VRS website or office.

- Fill out the forms with accurate and complete information.

- Attach any supporting documents required for your refund request.

- Submit your request through the preferred method, whether online or by mail.

Legal Use of the VRS Refund Time

The legal use of the VRS refund time is governed by state regulations that dictate how and when individuals can request refunds. It is essential to adhere to these guidelines to ensure that your request is valid. This includes understanding the eligibility criteria, the time limits for filing, and any documentation required to support your claim. Compliance with these legal aspects protects your rights as a taxpayer and facilitates a smoother refund process.

Required Documents

When applying for a VRS refund, specific documents are required to support your request. These typically include:

- Proof of identity, such as a government-issued ID.

- Documentation of your VRS contributions, including pay stubs or tax forms.

- Any previous correspondence with the VRS regarding your contributions.

Having these documents ready can expedite the processing of your refund request.

Filing Deadlines / Important Dates

Filing deadlines for the VRS refund time are critical for ensuring that your request is considered. Typically, these deadlines align with the end of the tax year or specific fiscal periods set by the VRS. It is advisable to check the VRS website or contact their office for the most current deadlines to avoid missing your opportunity for a refund.

Quick guide on how to complete vrs refund time

Complete Vrs Refund Time seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Vrs Refund Time on any operating system with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Vrs Refund Time effortlessly

- Find Vrs Refund Time and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select relevant sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Vrs Refund Time and ensure effective communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vrs refund time

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VRS refund and how does it work with airSlate SignNow?

A VRS refund refers to the process where customers can return products or services and receive their money back through a Virtual Return System. With airSlate SignNow, you can easily manage refund requests by creating e-signatures for return authorizations, streamlining the VRS refund process and reducing turnaround times.

-

How can airSlate SignNow help streamline my VRS refund process?

airSlate SignNow simplifies the VRS refund process by allowing users to send, sign, and manage documents electronically. This ensures that all refund requests are processed quickly and efficiently, enhancing customer satisfaction and reducing administrative burdens on your team.

-

Is there a cost associated with using airSlate SignNow for VRS refunds?

Yes, airSlate SignNow offers a variety of pricing plans tailored to fit different business needs. Each plan provides access to our features that facilitate VRS refund management, helping you save time and effort while processing returns.

-

What features does airSlate SignNow offer for managing VRS refunds?

airSlate SignNow includes features such as customizable templates, real-time tracking, and automated workflows for VRS refunds. These tools help ensure that your refund requests are handled smoothly, keeping both your team and customers informed throughout the process.

-

Can I integrate airSlate SignNow with my existing systems for VRS refunds?

Absolutely! airSlate SignNow offers integration capabilities with various platforms and CRMs to effectively manage VRS refunds. This allows you to keep your existing workflows while enhancing your document management capabilities.

-

What benefits does airSlate SignNow provide for businesses processing VRS refunds?

Using airSlate SignNow for VRS refunds can signNowly reduce the time spent on document management. The ease of electronic signatures and automated workflows improves accuracy, compliance, and customer experience, making the return process seamless for both you and your customers.

-

How secure is airSlate SignNow for handling VRS refunds?

airSlate SignNow prioritizes security with features such as encryption and secure access controls, ensuring that all documents related to VRS refunds are protected. You can trust that sensitive information is kept safe throughout the e-signature process.

Get more for Vrs Refund Time

Find out other Vrs Refund Time

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now