Adreswijziging Belastingdienst Buitenland Form

What is the Adreswijziging Belastingdienst Buitenland

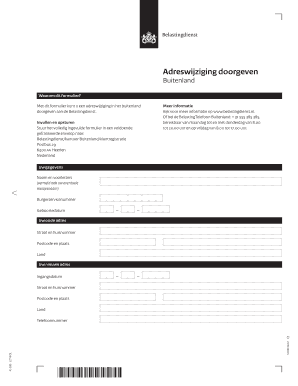

The adreswijziging belastingdienst buitenland is a formal notification to the Dutch tax authorities regarding a change of address for individuals living outside the Netherlands. This process is essential for ensuring that tax records are accurate and that individuals receive important correspondence from the belastingdienst. It applies to Dutch citizens and residents who have moved abroad and need to update their address for tax purposes.

Steps to Complete the Adreswijziging Belastingdienst Buitenland

Completing the adreswijziging belastingdienst buitenland involves several key steps:

- Gather necessary personal information, including your old and new addresses, tax identification number, and any relevant documentation.

- Access the appropriate form for address change, which can often be found on the belastingdienst website or through official channels.

- Fill out the form accurately, ensuring all details are correct to avoid delays.

- Submit the completed form either online, by mail, or in person, depending on the options provided by the belastingdienst.

- Keep a copy of the submitted form for your records and confirm receipt if possible.

Legal Use of the Adreswijziging Belastingdienst Buitenland

The legal validity of the adreswijziging belastingdienst buitenland hinges on compliance with specific regulations. Electronic submissions are recognized as legally binding, provided they meet the requirements set forth by relevant laws such as the ESIGN Act and UETA. It is crucial to use a reliable platform for eSigning that offers security features, ensuring that the submission is both secure and compliant.

Required Documents

When submitting the adreswijziging belastingdienst buitenland, certain documents may be required to verify your identity and address change. Typically, these documents include:

- A valid identification document, such as a passport or driver's license.

- Proof of your new address, which may include a utility bill or lease agreement.

- Your tax identification number or social security number, if applicable.

Form Submission Methods

There are multiple methods available for submitting the adreswijziging belastingdienst buitenland:

- Online: Many individuals prefer to submit their address change electronically through the belastingdienst website, which often allows for quicker processing.

- By Mail: You can send the completed form and any required documents to the appropriate tax office via postal service.

- In Person: For those who prefer face-to-face interaction, visiting a local tax office may be an option for submitting the form.

Penalties for Non-Compliance

Failing to update your address with the belastingdienst can lead to several consequences. These may include:

- Delayed receipt of important tax documents, which can affect your tax filings.

- Potential fines or penalties for not maintaining accurate records with the tax authorities.

- Issues with tax refunds or credits that may be sent to an outdated address.

Quick guide on how to complete adreswijziging belastingdienst buitenland

Complete Adreswijziging Belastingdienst Buitenland effortlessly on any gadget

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly replacement for traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and e-sign your documents quickly without any delays. Manage Adreswijziging Belastingdienst Buitenland on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Adreswijziging Belastingdienst Buitenland effortlessly

- Locate Adreswijziging Belastingdienst Buitenland and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your e-signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the data and click the Done button to apply your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form hunting, or errors that require reprinting new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Edit and eSign Adreswijziging Belastingdienst Buitenland and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the adreswijziging belastingdienst buitenland

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for submitting a belastingdienst adreswijziging using airSlate SignNow?

To submit a belastingdienst adreswijziging with airSlate SignNow, start by creating a digital document that contains your updated address information. You can then easily send it out for eSignature. Our user-friendly interface ensures that you can complete the entire process quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for belastingdienst adreswijziging?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that best fits your requirements and budget while ensuring that you can efficiently manage your belastingdienst adreswijziging and other document needs.

-

What features does airSlate SignNow offer for managing belastingdienst adreswijziging?

airSlate SignNow provides features such as template creation, bulk sending, and real-time tracking of your documents. These functionalities streamline the process for handling belastingdienst adreswijziging, making it easier to manage changes quickly and effectively.

-

How can airSlate SignNow benefit my business with regard to belastingdienst adreswijziging?

Using airSlate SignNow for belastingdienst adreswijziging can save your business time and reduce paperwork. The platform allows for rapid digital signature collection, ensuring that your address changes are processed promptly, which can enhance overall operational efficiency.

-

Can I integrate airSlate SignNow with other software for belastingdienst adreswijziging?

Absolutely! airSlate SignNow allows for seamless integration with numerous applications, making it easier to manage all your business documents, including belastingdienst adreswijziging. This flexibility helps you streamline your workflows and enhances productivity across various platforms.

-

Is it secure to use airSlate SignNow for belastingdienst adreswijziging?

Yes, security is a top priority for airSlate SignNow. Our platform employs industry-standard encryption protocols to protect your sensitive information, ensuring that your belastingdienst adreswijziging and other documents remain safe during transmission and storage.

-

Are there any limitations on the number of documents I can send for belastingdienst adreswijziging?

The number of documents you can send for belastingdienst adreswijziging may vary based on your chosen pricing plan. airSlate SignNow offers different plans that cater to both individual users and businesses, ensuring that you have the necessary capacity to meet your document needs efficiently.

Get more for Adreswijziging Belastingdienst Buitenland

- Vd 60 r form

- Employee self evaluation questions form

- Withholding tax ghana pdf form

- Army aup 398628421 form

- Guided reading activity 2 3 american enterprise answer key form

- Youth ministry cyo st joan of arc catholic church and form

- Corpus christi tx permit expediter service form

- 5959 park avenue form

Find out other Adreswijziging Belastingdienst Buitenland

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA