City of Burien B O Tax Form

What is the City of Burien B O Tax?

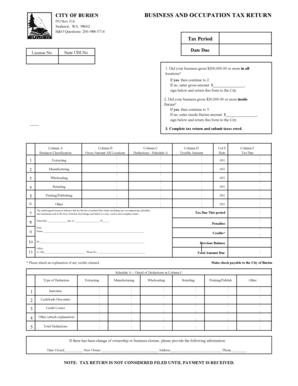

The City of Burien Business and Occupation (B O) Tax is a municipal tax imposed on businesses operating within the city limits. This tax is calculated based on the gross revenue generated by the business, ensuring that local enterprises contribute to the city's infrastructure and services. The tax framework is designed to support the local economy while providing necessary funding for public services.

Steps to Complete the City of Burien B O Tax

Completing the City of Burien B O Tax form involves several important steps. First, gather all necessary financial documentation, including revenue reports and any relevant business licenses. Next, access the fillable City of Burien B O Tax form, which can be completed electronically. Fill in the required fields accurately, ensuring that all figures reflect your business's gross income. After completing the form, review it for any errors before submitting it to avoid penalties.

Legal Use of the City of Burien B O Tax

The City of Burien B O Tax form must be completed in accordance with local regulations to ensure its legal validity. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This means that businesses can securely sign and submit their forms online, maintaining compliance with legal standards.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for compliance with the City of Burien B O Tax. Typically, businesses must file their tax returns annually, with specific deadlines set by the city. It is important to check the official city website or contact the local tax office for the most current dates, as these can vary from year to year. Missing a deadline may result in late fees or penalties.

Required Documents

When completing the City of Burien B O Tax form, certain documents are required to substantiate your filing. These may include financial statements, proof of business registration, and any prior tax returns. Having these documents ready will facilitate a smoother filing process and help ensure that your submission is complete and accurate.

Form Submission Methods

The City of Burien B O Tax can be submitted through various methods, providing flexibility for businesses. Forms can be filed online through the city's tax portal, mailed to the tax office, or delivered in person. Each method has its own processing times, so businesses should choose the one that best fits their needs and ensure that they retain proof of submission.

Penalties for Non-Compliance

Failure to comply with the City of Burien B O Tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to understand their obligations and ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete city of burien b o tax

Complete City Of Burien B O Tax effortlessly on any device

Digital document management has become popular among organizations and individuals alike. It offers a perfect eco-friendly option to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle City Of Burien B O Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest method to edit and eSign City Of Burien B O Tax without hassle

- Find City Of Burien B O Tax and then click Get Form to begin.

- Make use of the tools we provide to fill in your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign City Of Burien B O Tax and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of burien b o tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Burien B O tax, and how does it affect my business?

The city of Burien B O tax is a business and occupation tax imposed on businesses operating within the city of Burien. It is important for businesses to understand this tax as it impacts their overall operating costs. Compliance is essential for avoiding penalties, and using tools like airSlate SignNow can help streamline the eSigning of necessary tax documents.

-

How can airSlate SignNow help with filing the city of Burien B O tax?

airSlate SignNow allows businesses to easily create, edit, and sign documents required for filing the city of Burien B O tax. With our intuitive platform, you can quickly gather necessary signatures, ensuring that your tax documents are submitted on time. This saves you valuable time and reduces the risk of errors in your submissions.

-

What are the pricing options for airSlate SignNow when dealing with the city of Burien B O tax?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. Whether you are a small business needing basic features or a larger enterprise requiring advanced capabilities, we have a plan that suits your needs. Our cost-effective solutions make it easier to manage documentation related to the city of Burien B O tax without breaking the bank.

-

Is airSlate SignNow suitable for all types of businesses in Burien regarding B O tax compliance?

Yes, airSlate SignNow is designed to cater to a wide range of businesses, including sole proprietorships, LLCs, and corporations. Our platform's flexibility allows any business operating in Burien to comply with the city of Burien B O tax requirements efficiently. You'll find our solution user-friendly, making compliance simple regardless of your business type.

-

What features does airSlate SignNow offer specifically for managing city of Burien B O tax documents?

airSlate SignNow provides features such as templates for tax documents, electronic signatures, and real-time tracking of document status. These tools are particularly beneficial for managing city of Burien B O tax forms, ensuring that all necessary paperwork is completed accurately and promptly. The ease of use and document security also enhances the overall filing experience.

-

Can airSlate SignNow integrate with other software to help with city of Burien B O tax?

Yes, airSlate SignNow offers integrations with various accounting and tax software which can streamline your process for the city of Burien B O tax. Linking our platform with your existing tools allows for seamless data transfer and document management. This integration capability enhances your efficiency in handling B O tax compliance.

-

What are the benefits of using airSlate SignNow for the city of Burien B O tax?

Using airSlate SignNow allows businesses to simplify their process for managing the city of Burien B O tax. The automation of document creation and the signing process reduces the administrative burden and enhances turnaround times. Additionally, the platform's security features ensure that sensitive tax information remains protected throughout the process.

Get more for City Of Burien B O Tax

- 1997 1099 form

- Form 8288 rev august 1998 us withholding tax return for dispositions by foreign persons of us real property interests

- 2011 tax return elizabeth warren form

- Where to fax irs form 3911 1997

- Ss4 98 1998 form

- Irs form w8 ben pdf

- Irs form 12509 1999

- Instruction 8866 rev september 2005 internal revenue service form

Find out other City Of Burien B O Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors