Et 85 Form

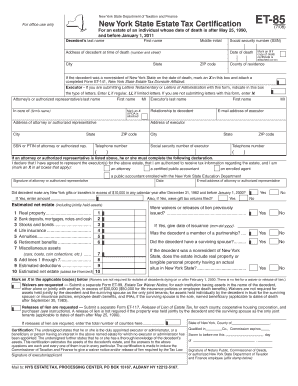

What is the ET 85?

The ET 85 is a specific form used in New York State for tax purposes, particularly related to the taxation of certain income or benefits. This form is crucial for individuals and businesses to report specific financial information accurately. Understanding the ET 85 is essential for ensuring compliance with state tax regulations and avoiding potential penalties.

How to Use the ET 85

Using the ET 85 involves filling out the required sections accurately to reflect your financial situation. It's important to gather all necessary information before starting the form, including income details and any applicable deductions. Once the form is completed, it can be submitted electronically or via traditional mail, depending on your preference and the guidelines provided by the state.

Steps to Complete the ET 85

Completing the ET 85 requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Fill out the form, ensuring that all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the form either online through an approved platform or by mailing it to the appropriate tax authority.

Legal Use of the ET 85

The ET 85 must be filled out and submitted in accordance with New York State tax laws. This form serves as a legal document, and its accuracy is vital for compliance. Failure to complete the form correctly can result in penalties or delays in processing your tax return. It is advisable to keep a copy of the submitted form for your records.

Key Elements of the ET 85

Several key elements must be included when filling out the ET 85:

- Personal Information: Provide your name, address, and Social Security number.

- Income Details: Accurately report all sources of income relevant to the form.

- Deductions: Include any deductions you are eligible for to reduce your taxable income.

- Signature: Ensure that the form is signed to validate the information provided.

Form Submission Methods

The ET 85 can be submitted through various methods, allowing flexibility for users. You can choose to:

- Submit the form online using a secure eSignature platform.

- Mail the completed form to the designated tax office.

- Deliver the form in person at a local tax office if preferred.

Quick guide on how to complete et 85

Manage Et 85 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools needed to create, alter, and eSign your documents rapidly without delays. Handle Et 85 on any device using airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The simplest way to modify and eSign Et 85 with ease

- Acquire Et 85 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that task.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate the reprinting of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Et 85 and ensure excellent communication throughout every phase of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the et 85

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ET 85 feature offered by airSlate SignNow?

The ET 85 feature within airSlate SignNow refers to our advanced electronic signature capabilities that ensure secure and legal digital agreements. This feature streamlines the signing process, making it quick and intuitive for users, thereby enhancing productivity for businesses.

-

How much does using ET 85 with airSlate SignNow cost?

The cost of using the ET 85 feature with airSlate SignNow varies depending on the chosen subscription plan. Our pricing structure is designed to be cost-effective, offering various tiers that can accommodate different business needs while leveraging the complete functionality of the ET 85 feature.

-

What are the key benefits of using the ET 85 feature?

Using the ET 85 feature with airSlate SignNow offers numerous benefits including improved document turnaround time and enhanced security through encrypted signatures. Additionally, businesses can reduce costs associated with paper-based processes and improve overall efficiency in their workflows.

-

Can ET 85 be integrated with other software applications?

Yes, the ET 85 feature is designed to integrate seamlessly with various software applications. airSlate SignNow supports integrations with popular platforms such as Salesforce, Google Workspace, and Microsoft Office, allowing users to maintain their existing workflows while utilizing the powerful eSigning capabilities.

-

Is the ET 85 feature compliant with legal standards?

Absolutely, the ET 85 feature complies with major eSignature laws such as the ESIGN Act and UETA. This compliance ensures that all electronic signatures created with airSlate SignNow hold legal validity, making them suitable for various business and legal transactions.

-

How can I get started with the ET 85 feature?

Getting started with the ET 85 feature is simple. You can sign up for a free trial on the airSlate SignNow website, where you can explore the ET 85 capabilities and see firsthand how it can benefit your business without any commitment.

-

What types of documents can be signed using the ET 85 feature?

The ET 85 feature allows users to sign a wide range of documents, from contracts and agreements to invoices and consent forms. This flexibility makes airSlate SignNow a versatile tool for businesses looking to digitize their paperwork.

Get more for Et 85

Find out other Et 85

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free