940 Schedule B Form

What is the 940 Schedule B

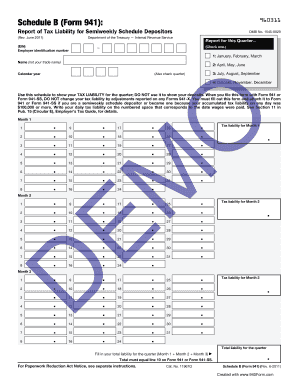

The 940 Schedule B is a supplementary form used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax liability. This form is specifically designed for those who have a tax liability of $500 or more during the year. It provides detailed information about the employer's tax payments and helps the IRS track the payment history of unemployment taxes. Understanding this form is essential for compliance with federal tax regulations.

Steps to complete the 940 Schedule B

Completing the 940 Schedule B involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN) and details of your tax payments.

- Fill out the form, ensuring that all sections are completed accurately, including the total FUTA tax liability and any payments made.

- Review the form for accuracy to avoid potential penalties or delays in processing.

- Sign and date the form to certify the information provided is correct.

- Submit the completed form along with your Form 940 to the IRS by the specified deadline.

How to obtain the 940 Schedule B

The 940 Schedule B can be obtained directly from the IRS website or through tax preparation software. It is essential to ensure that you are using the most current version of the form, as tax regulations may change from year to year. If you prefer a physical copy, you can also request one from the IRS by calling their customer service line.

Legal use of the 940 Schedule B

Using the 940 Schedule B legally requires compliance with IRS regulations. Employers must accurately report their FUTA tax liability and ensure that all payments are made on time. Failure to comply with these requirements can result in penalties, including interest on unpaid taxes. It is crucial to maintain accurate records and documentation to support the information reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the 940 Schedule B align with the annual Form 940 submission. Typically, the due date for filing is January 31 of the following year. If you have made timely payments throughout the year, you may qualify for an extension, allowing you to file by February 10. It is important to mark these dates on your calendar to ensure compliance and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The 940 Schedule B can be submitted in several ways:

- Online: If you are filing electronically, ensure that your tax software supports the submission of Form 940 and its schedules.

- Mail: You can print the completed form and send it to the appropriate IRS address based on your location.

- In-Person: While in-person submission is less common, you can visit a local IRS office for assistance.

Quick guide on how to complete 940 schedule b

Handle 940 Schedule B effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents promptly without delays. Manage 940 Schedule B on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign 940 Schedule B effortlessly

- Obtain 940 Schedule B and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Let go of worries about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign 940 Schedule B and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 940 schedule b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule B tax form?

The Schedule B tax form is a tax document required by the IRS to report interest and ordinary dividends. This form is typically filed alongside Form 1040 for individual income tax returns. Understanding how to fill out the Schedule B tax form is essential for accurate tax reporting.

-

How can airSlate SignNow assist with the Schedule B tax form?

airSlate SignNow provides an efficient platform to send, sign, and manage your Schedule B tax form electronically. With our easy-to-use solution, you can ensure that all necessary signatures are obtained, making your tax filing process faster and more secure. The convenience of digital document management simplifies dealing with important tax forms.

-

Is there a cost associated with using airSlate SignNow for the Schedule B tax form?

airSlate SignNow offers a cost-effective solution with various pricing plans suitable for different business needs. The pricing may vary based on features and the volume of documents processed. Investing in our platform can save you time and streamline your Schedule B tax form preparation.

-

What features does airSlate SignNow offer for completing the Schedule B tax form?

Our platform includes features such as document templates, electronic signatures, and customizable workflows to facilitate the completion of your Schedule B tax form. Users can collaborate in real-time, track the progress of the document, and ensure compliance. These features enhance efficiency and accuracy in tax preparation.

-

Can airSlate SignNow integrate with accounting software for the Schedule B tax form?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, allowing you to manage your Schedule B tax form alongside your financial records. This integration simplifies the process of organizing tax documents and ensures all information is accurately reflected in your financial reports. Our solution enhances overall efficiency for businesses.

-

How secure is my data when using airSlate SignNow to manage the Schedule B tax form?

airSlate SignNow prioritizes the security of your data with robust encryption and compliance with industry standards. Your Schedule B tax form and other sensitive documents are securely stored and shared. We take extensive measures to protect your information, giving you peace of mind while managing your tax documents.

-

What are the benefits of eSigning my Schedule B tax form with airSlate SignNow?

eSigning your Schedule B tax form with airSlate SignNow offers numerous benefits, including speed, convenience, and legal validity. Electronic signatures simplify the signing process, eliminating the need for printing and scanning. This feature can signNowly reduce turnaround times for your tax submissions.

Get more for 940 Schedule B

Find out other 940 Schedule B

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now