Form 941c1 Me

What is the Form 941c1 Me

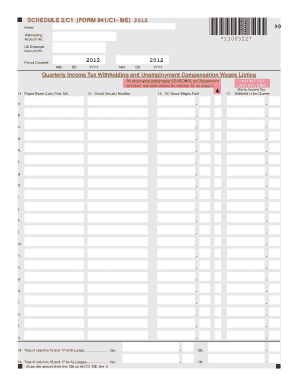

The Form 941c1 Me is an essential document used by employers in the United States to report adjustments to their previously filed Form 941, which is the Employer's Quarterly Federal Tax Return. This form is specifically designed to correct errors related to wages, tips, and taxes withheld. It is crucial for ensuring accurate tax reporting and compliance with federal regulations. By using Form 941c1 Me, employers can rectify discrepancies that may have occurred in previous filings, thereby maintaining their tax records' integrity.

How to use the Form 941c1 Me

Using the Form 941c1 Me involves a few straightforward steps. First, ensure that you have the correct version of the form, which can be obtained from the IRS website or other official sources. Next, carefully review the original Form 941 to identify the errors that need correction. Fill out the 941c1 Me by providing the necessary information, such as the employer's details and the specific adjustments being made. Once completed, the form should be submitted according to the IRS guidelines, ensuring that all corrections are accurately reflected in your tax records.

Steps to complete the Form 941c1 Me

Completing the Form 941c1 Me requires attention to detail. Follow these steps for accurate completion:

- Obtain the latest version of the Form 941c1 Me from the IRS.

- Review your previous Form 941 to determine the necessary corrections.

- Fill in your employer identification information at the top of the form.

- Indicate the specific lines that require adjustments and provide the correct amounts.

- Sign and date the form to validate your submission.

- Submit the completed form to the IRS, either electronically or by mail, as per the instructions provided.

Legal use of the Form 941c1 Me

The legal use of the Form 941c1 Me is governed by IRS regulations. It is essential that employers use this form to correct any inaccuracies in their previously filed Forms 941 to ensure compliance with federal tax laws. The adjustments made using the 941c1 Me must be accurate and supported by appropriate documentation. Failure to comply with these legal requirements can result in penalties or additional scrutiny from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 941c1 Me align with the original Form 941 submission dates. Employers should be aware of the quarterly deadlines for filing Form 941, as corrections must be submitted within a specific timeframe. Typically, the deadlines are as follows:

- For the first quarter (January to March): April 30

- For the second quarter (April to June): July 31

- For the third quarter (July to September): October 31

- For the fourth quarter (October to December): January 31 of the following year

It is crucial to submit the Form 941c1 Me promptly to avoid potential penalties for late filing.

Form Submission Methods (Online / Mail / In-Person)

The Form 941c1 Me can be submitted through various methods, providing flexibility for employers. The submission options include:

- Online: Employers can file electronically using IRS-approved e-filing software, which streamlines the process and may expedite processing times.

- Mail: The form can be printed and mailed to the appropriate IRS address, as specified in the form instructions.

- In-Person: While less common, some employers may choose to deliver the form in person at their local IRS office.

Choosing the right submission method can enhance efficiency and ensure that corrections are processed in a timely manner.

Quick guide on how to complete form 941c1 me

Accomplish Form 941c1 Me seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to design, alter, and electronically sign your documents swiftly and without delays. Oversee Form 941c1 Me on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Form 941c1 Me effortlessly

- Locate Form 941c1 Me and click on Access Form to begin.

- Utilize the features we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information using tools provided by airSlate SignNow designed specifically for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional ink signature.

- Verify the details and click on the Finish button to record your modifications.

- Choose your preferred method of sharing your form, whether by email, text message, or invitation link, or download it onto your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 941c1 Me and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941c1 me

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 941c1 Me and how is it used in my business?

Form 941c1 Me is a crucial tax form used by businesses to correct errors in their previously filed Form 941. By using this form, you can ensure accurate reporting of your employment tax liability. Proper usage of Form 941c1 Me helps prevent tax compliance issues and potential penalties.

-

How does airSlate SignNow assist with Form 941c1 Me submissions?

airSlate SignNow streamlines the process of preparing and submitting Form 941c1 Me by offering an intuitive eSignature solution. Our platform allows you to fill out, sign, and share the form securely online. This not only simplifies the submission process but also ensures that all your documents are stored safely.

-

Is there a cost associated with using airSlate SignNow for Form 941c1 Me?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including the management of Form 941c1 Me. Our plans are designed to be cost-effective while providing comprehensive features that enhance document management. You can choose a plan that aligns with your business expectations and budget.

-

What key features should I look for when using airSlate SignNow for Form 941c1 Me?

When using airSlate SignNow for Form 941c1 Me, look for features such as customizable templates, automated workflows, and robust security measures. These features enable efficient document handling and ensure compliance. Additionally, our versioning capabilities help keep track of changes made to the form.

-

Can I integrate airSlate SignNow with other software for Form 941c1 Me?

Absolutely! airSlate SignNow offers integrations with various commonly used software applications. This allows you to seamlessly connect your accounting or payroll software with our platform, making it easier to manage and file Form 941c1 Me alongside your other documents.

-

What are the benefits of using airSlate SignNow over traditional methods for Form 941c1 Me?

Using airSlate SignNow for Form 941c1 Me offers several benefits, including increased efficiency, faster turnaround times, and enhanced security. Unlike traditional methods, our platform allows for real-time collaboration and easy tracking of document states. This can signNowly reduce the headaches associated with paperwork.

-

How can I ensure the security of my Form 941c1 Me documents when using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including Form 941c1 Me, utilizing industry-standard encryption protocols. Our platform also includes multi-factor authentication and secure cloud storage to protect your sensitive information. You can confidently manage your forms without the worry of data bsignNowes.

Get more for Form 941c1 Me

Find out other Form 941c1 Me

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document