Attach This Form to Form it 212 Tax Ny

Understanding the Attach This Form To Form IT 212 Tax NY

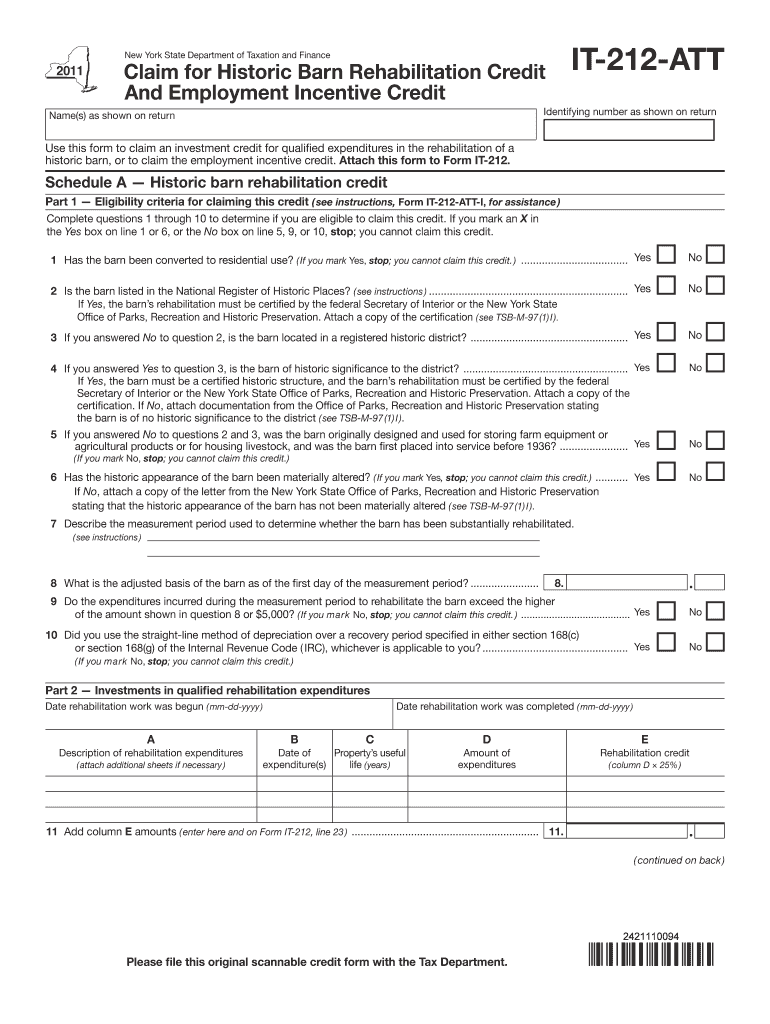

The "Attach This Form To Form IT 212 Tax NY" is a supplementary document that is required when filing your New York State tax return. This form is specifically designed to provide additional information that supports the main Form IT 212. It is essential for taxpayers who need to report specific deductions or credits related to their New York State taxes. By attaching this form, you ensure that your tax return is complete and compliant with state regulations.

Steps to Complete the Attach This Form To Form IT 212 Tax NY

Completing the "Attach This Form To Form IT 212 Tax NY" involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Fill out the form accurately, ensuring that all required fields are completed.

- Double-check the information for accuracy, particularly your Social Security number and income figures.

- Sign and date the form, as an unsigned form may lead to processing delays.

- Attach the completed form to your main Form IT 212 before submission.

Required Documents for the Attach This Form To Form IT 212 Tax NY

To successfully complete the "Attach This Form To Form IT 212 Tax NY," you will need to provide several supporting documents. These may include:

- W-2 forms from all employers for the tax year.

- 1099 forms for any additional income sources.

- Receipts or documentation for any deductions or credits you are claiming.

- Previous year’s tax returns, if applicable, to reference any carryover items.

Filing Deadlines for the Attach This Form To Form IT 212 Tax NY

It is crucial to be aware of the filing deadlines associated with the "Attach This Form To Form IT 212 Tax NY." Typically, the deadline for filing your New York State tax return, including this form, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Ensure that your form is submitted by this date to avoid penalties.

Form Submission Methods for the Attach This Form To Form IT 212 Tax NY

The "Attach This Form To Form IT 212 Tax NY" can be submitted through various methods to accommodate different preferences:

- By mail: Send the completed form to the appropriate New York State tax office address.

- Online: If you are using tax software, you may be able to submit the form electronically as part of your tax return.

- In-person: You can also deliver the form directly to a local tax office if you prefer personal assistance.

Legal Use of the Attach This Form To Form IT 212 Tax NY

Using the "Attach This Form To Form IT 212 Tax NY" is legally mandated for taxpayers who need to provide additional information for their New York State tax filings. Failure to attach this form when required can result in delays in processing your tax return or even penalties for non-compliance. It is important to understand the legal implications and ensure that all necessary forms are submitted correctly.

Quick guide on how to complete attach this form to form it 212 tax ny

Complete [SKS] effortlessly on any device

Managing documents online has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight crucial sections of your documents or conceal sensitive information with tools that airSlate SignNow offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure superior communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Attach This Form To Form IT 212 Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the attach this form to form it 212 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can I attach this form to Form IT 212 Tax NY using airSlate SignNow?

To attach this form to Form IT 212 Tax NY, simply upload your document to airSlate SignNow, select the necessary fields, and ensure that all required information is filled out. Our platform allows you to easily integrate and manage your forms, making the process seamless and efficient.

-

What features does airSlate SignNow offer for attaching forms?

airSlate SignNow provides a variety of features for attaching forms, including customizable templates, electronic signatures, and document tracking. These features ensure that you can efficiently attach this form to Form IT 212 Tax NY while maintaining compliance and security.

-

Is there a cost associated with using airSlate SignNow to attach this form to Form IT 212 Tax NY?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that best fits your requirements for attaching this form to Form IT 212 Tax NY, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software to manage Form IT 212 Tax NY?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to streamline your workflow. By integrating with your existing systems, you can easily attach this form to Form IT 212 Tax NY and enhance your document management process.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like Form IT 212 Tax NY offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the process of attaching this form, ensuring you can focus on what matters most—your business.

-

Is airSlate SignNow user-friendly for attaching forms?

Yes, airSlate SignNow is designed with user experience in mind. The intuitive interface makes it easy to attach this form to Form IT 212 Tax NY, even for those who may not be tech-savvy, ensuring a smooth experience for all users.

-

How secure is airSlate SignNow when attaching sensitive tax forms?

Security is a top priority at airSlate SignNow. When you attach this form to Form IT 212 Tax NY, your documents are protected with advanced encryption and compliance with industry standards, ensuring that your sensitive information remains safe.

Get more for Attach This Form To Form IT 212 Tax Ny

- Form bp a761 055 residential drug abuse program notice to inmate

- Form bp a774 012 referral of incident for contract employee internal affairs

- Form bp a783 041 hierarchy level 4 approving official bop 10102573

- Form bp a805 060 informed consent for oral and maxillofacial surgery

- Form bp a807 060 information on vaccination consent declination for influenza vaccine bop

- Bp a822 form

- Operations memorandum 011 code psychology treatment program for high security inmates bop form

- Program statement 5380 07 financial responsibility program inmate bop form

Find out other Attach This Form To Form IT 212 Tax Ny

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement