Income Tax Withholding Authorization Form R0012x

What is the Income Tax Withholding Authorization Form R0012x

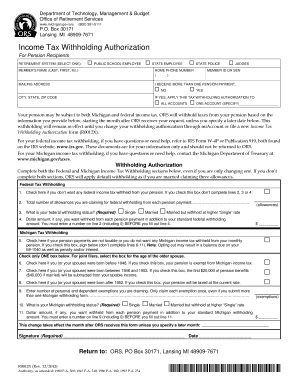

The Income Tax Withholding Authorization Form R0012x is a crucial document used by employees in the United States to authorize their employers to withhold a specific amount of federal income tax from their paychecks. This form helps ensure that the correct amount of tax is deducted based on the employee's financial situation, thereby preventing underpayment or overpayment of taxes throughout the year. By completing this form, employees can manage their tax obligations more effectively, aligning with their financial planning and tax strategies.

Steps to complete the Income Tax Withholding Authorization Form R0012x

Completing the Income Tax Withholding Authorization Form R0012x involves several straightforward steps:

- Begin by providing your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household, as this affects your withholding rate.

- Specify the amount you wish to have withheld from each paycheck, if applicable. This can be a fixed amount or based on your estimated tax liability.

- Review the form for accuracy and completeness to ensure that all required information is provided.

- Sign and date the form to validate your authorization.

How to use the Income Tax Withholding Authorization Form R0012x

Using the Income Tax Withholding Authorization Form R0012x is essential for managing your tax withholdings effectively. Once you have completed the form, submit it to your employer's payroll department. They will process your request and adjust your withholding accordingly. It is important to keep a copy of the completed form for your records. You may also need to update the form periodically, especially if you experience significant life changes, such as marriage, divorce, or a change in income.

Legal use of the Income Tax Withholding Authorization Form R0012x

The legal validity of the Income Tax Withholding Authorization Form R0012x hinges on its proper completion and submission. As an official tax document, it must comply with IRS regulations. Employers are required to honor the withholding instructions provided on the form, ensuring that the correct amount is deducted from employee wages. Additionally, both employees and employers should retain copies of the signed form for their records, as it may be needed for future reference or audits.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the Income Tax Withholding Authorization Form R0012x. Employees should refer to IRS publications for detailed instructions on how to fill out the form accurately. The IRS also outlines the importance of updating the form when there are changes in personal circumstances that could affect tax liability. Adhering to these guidelines helps ensure compliance and minimizes the risk of penalties related to incorrect withholding.

Form Submission Methods

The Income Tax Withholding Authorization Form R0012x can typically be submitted through various methods, depending on your employer's policies. Common submission methods include:

- Online submission via your employer's payroll system, if available.

- Mailing a physical copy to the payroll department.

- Delivering the form in person to ensure immediate processing.

It is advisable to confirm the preferred submission method with your employer to ensure timely updates to your withholding status.

Quick guide on how to complete income tax withholding authorization form r0012x

Complete Income Tax Withholding Authorization Form R0012x seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Income Tax Withholding Authorization Form R0012x on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Income Tax Withholding Authorization Form R0012x effortlessly

- Obtain Income Tax Withholding Authorization Form R0012x and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Decide how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Income Tax Withholding Authorization Form R0012x and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax withholding authorization form r0012x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Income Tax Withholding Authorization Form R0012x?

The Income Tax Withholding Authorization Form R0012x is a document used to authorize the withholding of income taxes from your paycheck. This form ensures that the right amount of tax is deducted, making tax season easier and preventing underpayment penalties.

-

How can I access the Income Tax Withholding Authorization Form R0012x through airSlate SignNow?

You can easily access the Income Tax Withholding Authorization Form R0012x by logging into your airSlate SignNow account. Once logged in, you can find the form in our user-friendly interface, allowing you to fill it out and sign it electronically.

-

Is the Income Tax Withholding Authorization Form R0012x secure?

Yes, the Income Tax Withholding Authorization Form R0012x is processed through our secure platform, ensuring your personal information remains safe and confidential. airSlate SignNow employs encryption technology to protect your data during transmission and storage.

-

What are the benefits of using airSlate SignNow for the Income Tax Withholding Authorization Form R0012x?

Using airSlate SignNow for the Income Tax Withholding Authorization Form R0012x streamlines the signing process, making it faster and more efficient. You can send and receive this form easily, track its status, and store it securely in one location for future reference.

-

What pricing plans does airSlate SignNow offer for e-signing the Income Tax Withholding Authorization Form R0012x?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Whether you’re a small business or a large enterprise, you can find a plan that provides access to the Income Tax Withholding Authorization Form R0012x and other essential features at a competitive price.

-

Can I integrate other applications with airSlate SignNow when using the Income Tax Withholding Authorization Form R0012x?

Absolutely! airSlate SignNow allows seamless integration with various applications, enhancing your workflow. You can easily connect tools like Google Drive, Dropbox, and CRM platforms, ensuring a smooth process for managing the Income Tax Withholding Authorization Form R0012x.

-

How quickly can I get the Income Tax Withholding Authorization Form R0012x signed?

With airSlate SignNow, the Income Tax Withholding Authorization Form R0012x can be sent and signed within minutes. Our platform's swift process eliminates the delays often associated with traditional paperwork, ensuring a fast turnaround time.

Get more for Income Tax Withholding Authorization Form R0012x

- Oref 001 doc the order form for rc spreadsheets software version 4

- General education worksheet form

- Bitte zutreffendes ankreuzen form

- A probability path solution pdf form

- Risk assessment form for staff waiting for dbs checks

- Instructions for form 1041 and schedules a b g j and k 1

- Commercial cleaning service agreement template form

- Commercial broker fee agreement template form

Find out other Income Tax Withholding Authorization Form R0012x

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document