Irs B1 22a 1 Means Test Form

What is the IRS B1 22A 1 Means Test

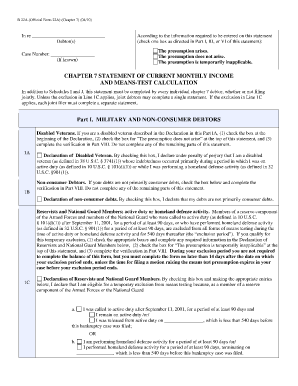

The IRS B1 22A 1 means test is a crucial form used to determine eligibility for certain tax-related benefits and obligations, particularly in relation to bankruptcy filings. This test assesses whether an individual's income exceeds the median income for their state, which can significantly impact their ability to file for Chapter 7 bankruptcy or qualify for payment plans. Understanding this form is essential for taxpayers navigating financial difficulties, as it helps clarify their legal standing and options.

How to Use the IRS B1 22A 1 Means Test

Using the IRS B1 22A 1 means test involves a straightforward process. Taxpayers must first gather their financial information, including income, expenses, and family size. The next step is to compare their average monthly income against the median income for their state, which can be found on the IRS website. If the taxpayer's income is below the median, they may qualify for a more favorable bankruptcy filing. It is important to accurately complete this form to ensure compliance with IRS regulations.

Steps to Complete the IRS B1 22A 1 Means Test

Completing the IRS B1 22A 1 means test involves several key steps:

- Gather necessary financial documents, including pay stubs, tax returns, and bank statements.

- Calculate your average monthly income over the past six months.

- Determine your household size to find the appropriate median income level for your state.

- Compare your average monthly income to the state median income.

- Complete the form accurately, providing all required information.

- Review the form for any errors before submission.

Legal Use of the IRS B1 22A 1 Means Test

The legal use of the IRS B1 22A 1 means test is vital for individuals considering bankruptcy. This form must be filled out correctly to ensure that the process adheres to legal standards. By accurately reporting income and expenses, taxpayers can demonstrate their financial situation to the court, which is essential for receiving the appropriate relief under bankruptcy law. Failure to complete this form properly can lead to legal complications or dismissal of the bankruptcy case.

Eligibility Criteria for the IRS B1 22A 1 Means Test

Eligibility for the IRS B1 22A 1 means test primarily depends on the taxpayer's income level in relation to the state median income. Key criteria include:

- Household size, which affects the median income threshold.

- Income type, including wages, bonuses, and other sources.

- Monthly expenses, which may be deducted from total income to determine disposable income.

Meeting these criteria is essential for determining whether an individual qualifies for bankruptcy relief under Chapter 7.

Required Documents for the IRS B1 22A 1 Means Test

To complete the IRS B1 22A 1 means test, taxpayers must provide several key documents:

- Recent pay stubs or proof of income for the last six months.

- Tax returns from the previous year.

- Bank statements that reflect monthly expenses.

- Documentation of any additional income sources, such as rental income or alimony.

Having these documents ready ensures a smooth and accurate completion of the means test, which is essential for legal compliance.

Quick guide on how to complete irs b1 22a 1 means test

Complete Irs B1 22a 1 Means Test effortlessly on any device

The management of online documents has become increasingly popular for businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Handle Irs B1 22a 1 Means Test on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and electronically sign Irs B1 22a 1 Means Test with ease

- Locate Irs B1 22a 1 Means Test and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Irs B1 22a 1 Means Test and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs b1 22a 1 means test

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS B1 22A 1 means test?

The IRS B1 22A 1 means test is a financial assessment used to determine eligibility for certain tax benefits or assistance programs. It evaluates an individual's income against established thresholds. Understanding this test is crucial for anyone engaged in financial planning or seeking to apply for relevant IRS programs.

-

How can airSlate SignNow assist with IRS B1 22A 1 means test documentation?

airSlate SignNow facilitates the preparation and signing of documents related to the IRS B1 22A 1 means test. With its intuitive interface, users can easily create, send, and e-sign necessary forms online. This not only streamlines the paperwork process but also ensures compliance with IRS standards.

-

Is there a cost associated with using airSlate SignNow for the IRS B1 22A 1 means test?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Users can choose a plan that fits their budget while benefiting from features essential for managing IRS B1 22A 1 means test documents. The service is recognized for being a cost-effective solution in the e-signing market.

-

What features does airSlate SignNow offer for managing IRS B1 22A 1 means test forms?

AirSlate SignNow provides features such as customizable templates, secure e-signatures, and automated reminders to enhance efficiency in managing IRS B1 22A 1 means test forms. These features ensure that all documentation is completed accurately and on time, reducing the risk of errors.

-

Can airSlate SignNow integrate with other applications for IRS B1 22A 1 means test processes?

Absolutely! airSlate SignNow seamlessly integrates with various applications like CRM and document management systems to enhance the IRS B1 22A 1 means test process. This integration allows for a smoother workflow, enabling users to manage documents all in one place.

-

How does airSlate SignNow ensure the security of IRS B1 22A 1 means test documents?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption protocols and complies with industry standards to protect IRS B1 22A 1 means test documents. Users can trust that their sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for e-signing IRS B1 22A 1 means test documents?

Using airSlate SignNow for e-signing IRS B1 22A 1 means test documents offers numerous benefits, including time savings and increased efficiency. The ability to sign from anywhere, coupled with real-time tracking, simplifies the signing process. As a result, users can focus more on their core tasks.

Get more for Irs B1 22a 1 Means Test

Find out other Irs B1 22a 1 Means Test

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online