RESET FORM PRINT FORM Texas Franchise Tax EZ Compu 2024

What is the EZ computation report?

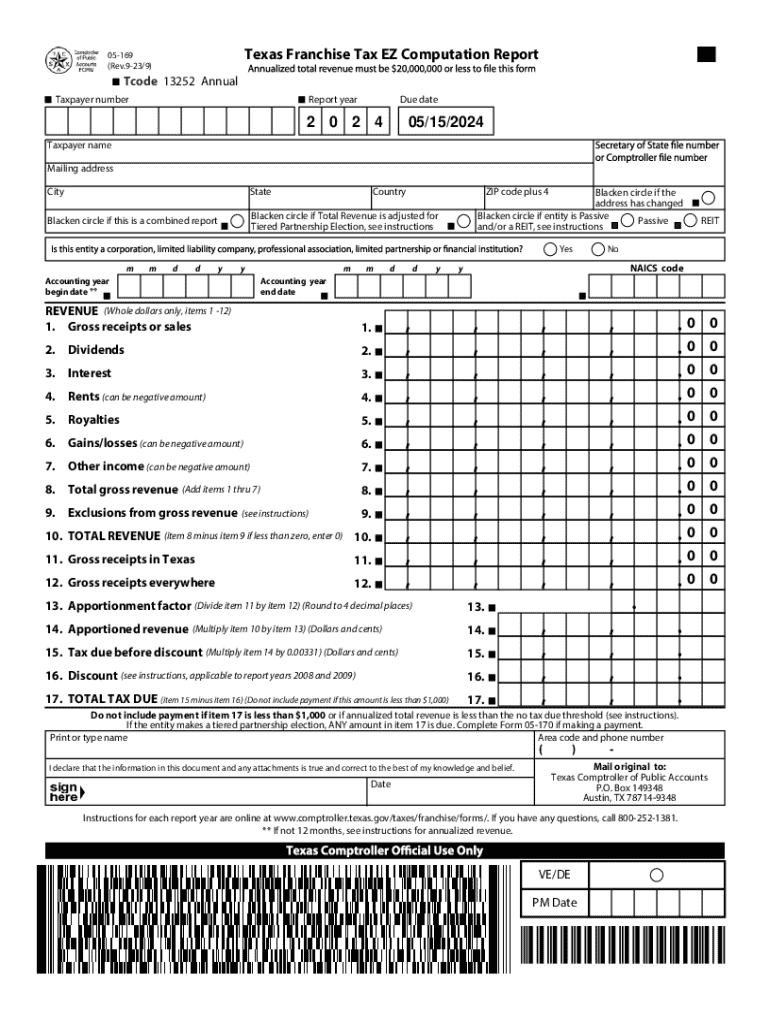

The EZ computation report is a simplified tax form used by certain businesses in Texas to report their franchise tax. This form is designed for entities that meet specific eligibility criteria, allowing them to file their taxes with less complexity than the standard franchise tax report. The primary purpose of the EZ computation report is to streamline the filing process for smaller businesses, making it easier to comply with state tax regulations.

Key elements of the EZ computation report

The EZ computation report includes several critical components that ensure accurate tax reporting. Key elements consist of:

- Business Identification: Basic information about the business, including its name, address, and taxpayer identification number.

- Revenue Reporting: A section to report total revenue, which determines the tax liability.

- Tax Calculation: A simplified formula for calculating the franchise tax owed based on reported revenues.

- Signature Section: A place for authorized representatives to sign and date the form, confirming the accuracy of the information provided.

Steps to complete the EZ computation report

Completing the EZ computation report involves several straightforward steps:

- Gather Required Information: Collect all necessary business details, including revenue figures and identification numbers.

- Fill Out the Form: Input the collected data into the appropriate sections of the EZ computation report.

- Review for Accuracy: Double-check all entries to ensure the information is correct and complete.

- Sign the Form: Have an authorized representative sign and date the report.

- Submit the Report: Choose a submission method, whether online, by mail, or in person, and send the completed form to the appropriate state agency.

Eligibility criteria for the EZ computation report

To qualify for using the EZ computation report, businesses must meet specific eligibility criteria set by the Texas Comptroller's office. Generally, these criteria include:

- The business must have total revenue below a certain threshold, which is updated periodically.

- The business must not be a member of a combined group.

- Only certain types of entities, such as corporations and limited liability companies, may qualify.

Filing deadlines and important dates

Filing deadlines for the EZ computation report are critical to avoid penalties. Typically, businesses must submit their reports by:

- The 15th day of the fourth month following the end of the entity's fiscal year.

- For entities operating on a calendar year, the deadline is April 15.

It is essential to stay informed about any changes to these dates or requirements, as they can vary from year to year.

Form submission methods

Businesses have several options for submitting the EZ computation report:

- Online Submission: Many businesses opt to file electronically through the Texas Comptroller's website, which often provides immediate confirmation of receipt.

- Mail Submission: The completed form can be printed and mailed to the designated address provided by the Texas Comptroller.

- In-Person Submission: Businesses may also choose to deliver the form directly to a local Comptroller office.

Create this form in 5 minutes or less

Find and fill out the correct reset form print form texas franchise tax ez compu

Create this form in 5 minutes!

How to create an eSignature for the reset form print form texas franchise tax ez compu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ez computation report?

An ez computation report is a streamlined document that simplifies the process of calculating and presenting data. With airSlate SignNow, you can easily create and manage these reports, ensuring accuracy and efficiency in your business operations.

-

How does airSlate SignNow help with ez computation reports?

airSlate SignNow provides tools that allow you to generate ez computation reports quickly and efficiently. Our platform enables you to automate calculations and streamline the reporting process, saving you time and reducing errors.

-

What are the pricing options for using airSlate SignNow for ez computation reports?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that fits your needs and budget, ensuring you have access to features that enhance your ez computation report generation.

-

Can I integrate airSlate SignNow with other software for ez computation reports?

Yes, airSlate SignNow supports integrations with various software applications, allowing you to enhance your ez computation report capabilities. This ensures that you can seamlessly connect your existing tools and streamline your workflow.

-

What features does airSlate SignNow offer for creating ez computation reports?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time collaboration tools. These features make it easier to create and manage your ez computation reports efficiently.

-

What are the benefits of using airSlate SignNow for ez computation reports?

Using airSlate SignNow for your ez computation reports offers numerous benefits, including increased accuracy, reduced processing time, and enhanced collaboration. Our platform empowers your team to work more effectively and make data-driven decisions.

-

Is there a mobile app for airSlate SignNow to manage ez computation reports?

Yes, airSlate SignNow offers a mobile app that allows you to manage your ez computation reports on the go. This flexibility ensures that you can access and edit your reports anytime, anywhere, enhancing your productivity.

Get more for RESET FORM PRINT FORM Texas Franchise Tax EZ Compu

Find out other RESET FORM PRINT FORM Texas Franchise Tax EZ Compu

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement