Form M 4p

What is the Form M-4P

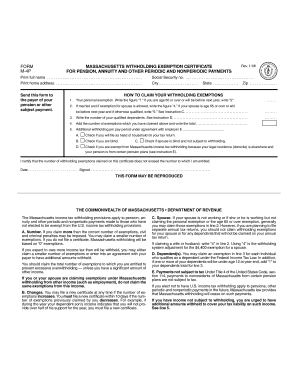

The Form M-4P is a specific document used in the United States for tax purposes, particularly related to income withholding. It is designed to help employers and employees manage tax withholding accurately. This form provides essential information about the employee's tax situation, allowing for the correct amount of federal and state taxes to be withheld from their paychecks. Understanding the purpose and requirements of the Form M-4P is crucial for both employers and employees to ensure compliance with tax regulations.

How to Use the Form M-4P

Using the Form M-4P involves several straightforward steps. First, the employee must fill out the form with accurate personal information, including their name, address, and Social Security number. Next, they need to indicate their filing status and any additional allowances they wish to claim. Once completed, the form should be submitted to the employer, who will use it to determine the appropriate withholding amount. It is important for employees to review their withholding periodically, especially after significant life changes such as marriage or the birth of a child, to ensure that the information remains accurate.

Steps to Complete the Form M-4P

Completing the Form M-4P requires careful attention to detail. Follow these steps for successful completion:

- Begin by entering your personal information, including your full name and address.

- Provide your Social Security number to ensure accurate identification.

- Select your tax filing status, which can affect your withholding rate.

- Indicate the number of allowances you are claiming, which can help reduce your taxable income.

- Review the form for accuracy before submitting it to your employer.

Legal Use of the Form M-4P

The legal use of the Form M-4P is governed by federal and state tax laws. It is essential for employers to maintain compliance with these regulations when using the form. The information provided on the form must be accurate and up to date, as incorrect information can lead to improper withholding and potential penalties. Employers are responsible for ensuring that the form is properly filed and that the withholding amounts are calculated based on the information provided. Additionally, employees should keep a copy of their completed form for their records.

Key Elements of the Form M-4P

The Form M-4P includes several key elements that are crucial for accurate tax withholding:

- Personal Information: Essential details such as name, address, and Social Security number.

- Filing Status: Indicates whether the employee is single, married, or head of household.

- Allowances: The number of allowances claimed can affect the withholding amount.

- Signature: The employee must sign the form to validate the information provided.

Form Submission Methods

The Form M-4P can be submitted through various methods, depending on the employer's preferences. Common submission methods include:

- Online Submission: Many employers allow employees to submit forms electronically through secure portals.

- Mail: Employees can also print the form and send it via postal mail to their employer's HR department.

- In-Person: Submitting the form in person can be beneficial for immediate verification and processing.

Quick guide on how to complete form m 4p

Complete Form M 4p effortlessly on any device

Online document management has become increasingly popular with companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Form M 4p on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to modify and eSign Form M 4p effortlessly

- Obtain Form M 4p and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information carefully and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Form M 4p while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m 4p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is m 4p and how does it relate to airSlate SignNow?

m 4p is a crucial component of airSlate SignNow that enables businesses to streamline their document handling processes. With m 4p, users can send and eSign documents efficiently, ensuring faster turnaround times and improved productivity.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow is competitive and designed to suit various business needs. You can choose from different plans, including the m 4p package, that provides cost-effective solutions based on document volume and user requirements.

-

What features are included in the m 4p offering?

The m 4p offering includes essential features like secure eSigning, document templates, team collaboration tools, and tracking capabilities. These features help businesses create a seamless workflow for managing documents effectively.

-

How can I benefit from using m 4p with airSlate SignNow?

Using m 4p with airSlate SignNow enhances your business efficiency by simplifying the document signing process. With its user-friendly interface and robust features, you can save time, reduce errors, and improve customer satisfaction.

-

Is m 4p suitable for small businesses?

Yes, m 4p is an ideal solution for small businesses looking to optimize their document processes. Its affordability and ease of use make it accessible for organizations of all sizes, helping small businesses to compete effectively.

-

Can I integrate m 4p with other software tools?

Absolutely! airSlate SignNow supports integration with various software tools, enhancing the functionality of m 4p. This includes popular applications like Google Drive, Salesforce, and more to streamline your workflows.

-

What types of documents can I send using m 4p?

With m 4p, you can send a wide range of documents, including contracts, agreements, and forms. This versatility allows businesses to handle different document types seamlessly while ensuring compliance and security.

Get more for Form M 4p

- Paf test of single word reading form

- Motion fee info form scca 233 1 doc adobe designer template judicial state sc

- Beeg fq form

- Sunshine otc catalog form

- South dakota child custody modification forms

- Sponsorship template for an airline form

- Find the slope and y intercept for each equation answer key form

- Odm online registration form

Find out other Form M 4p

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer