1040ez Form

What is the 1040ez Form

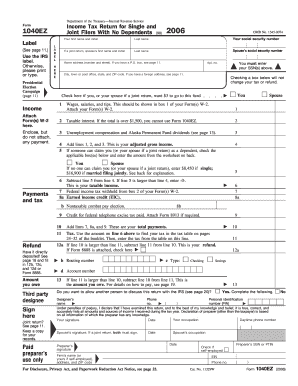

The 1040ez form is a simplified tax return form used by eligible taxpayers in the United States. It is designed for individuals with straightforward tax situations, allowing them to report their income and claim certain tax credits. The 1040ez form is particularly useful for those who do not itemize deductions and have a taxable income below a specific threshold. This form streamlines the filing process, making it easier for taxpayers to complete their returns accurately and efficiently.

How to use the 1040ez Form

Using the 1040ez form involves several straightforward steps. First, gather all necessary documents, including W-2 forms from employers and any other income statements. Next, fill out the form by entering your personal information, such as your name, address, and Social Security number. After that, report your income, calculate your tax, and apply any eligible credits. Finally, review the completed form for accuracy before submitting it to the IRS. The simplicity of the 1040ez form allows for quick completion, making it an ideal choice for many taxpayers.

Steps to complete the 1040ez Form

Completing the 1040ez form involves a series of methodical steps:

- Gather your income documents, including W-2s and any other relevant statements.

- Fill in your personal details, such as name, address, and Social Security number.

- Report your total income from all sources, ensuring accuracy.

- Calculate your adjusted gross income, if applicable.

- Determine your tax liability based on the provided tax tables.

- Apply any eligible tax credits, such as the Earned Income Tax Credit.

- Sign and date the form before submitting it to the IRS.

Legal use of the 1040ez Form

The 1040ez form is legally recognized by the IRS for filing income tax returns. To ensure its legal validity, taxpayers must provide accurate information and adhere to all IRS guidelines. The form must be signed and dated by the taxpayer, and electronic submissions must comply with eSignature laws. Utilizing a secure digital platform can enhance the legal standing of the submitted form by providing an audit trail and ensuring compliance with applicable regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 1040ez form typically align with the standard tax season in the United States. For most taxpayers, the deadline to file is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to filing dates and to consider filing for an extension if additional time is needed to complete the return accurately.

Eligibility Criteria

To qualify for using the 1040ez form, taxpayers must meet specific eligibility criteria. This includes having a taxable income below a certain limit, typically set by the IRS. Additionally, the taxpayer must be under the age of seventy and cannot claim dependents. The form is intended for those who do not itemize deductions and have income derived solely from wages, salaries, or taxable interest. Understanding these criteria is crucial for ensuring that the 1040ez form is the appropriate choice for filing.

Quick guide on how to complete 1040ez form 5304831

Prepare 1040ez Form with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed papers, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents efficiently without delays. Manage 1040ez Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related tasks today.

The most effective way to edit and eSign 1040ez Form effortlessly

- Find 1040ez Form and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which only takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign 1040ez Form to guarantee excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040ez form 5304831

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040 ez form 2022?

The 1040 ez form 2022 is a simplified version of the IRS Form 1040 used for filing individual income tax returns. It's designed for taxpayers with straightforward financial situations, allowing for a faster and easier filing process. By using the 1040 ez form 2022, eligible individuals can expedite their tax returns.

-

Who is eligible to use the 1040 ez form 2022?

Eligibility for the 1040 ez form 2022 is generally limited to single or married filing jointly taxpayers with no dependents. You must have taxable income under a specific threshold and meet other criteria, such as not claiming tax credits. Understanding these guidelines ensures you can take full advantage of the 1040 ez form 2022.

-

How can I fill out the 1040 ez form 2022 online?

Filling out the 1040 ez form 2022 online is simple and can be done through various e-filing platforms. These platforms often provide guided assistance and automatic calculations, making it easier to complete your return accurately. Utilizing a digital solution for the 1040 ez form 2022 can save you time and reduce errors.

-

What features does airSlate SignNow offer for signing the 1040 ez form 2022?

airSlate SignNow offers a user-friendly platform for electronically signing the 1040 ez form 2022. Our solution ensures that your documents are secure and compliant with legal standards. With features like real-time tracking and customizable signatures, you can manage your tax forms efficiently.

-

Is there a cost associated with using airSlate SignNow for the 1040 ez form 2022?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including cost-effective options for individuals and small businesses. By choosing the right plan, you can efficiently handle the 1040 ez form 2022 along with other documents at a competitive price. Visit our website for detailed pricing information.

-

How does airSlate SignNow integrate with tax software for the 1040 ez form 2022?

airSlate SignNow can seamlessly integrate with popular tax software solutions, allowing users to import and export the 1040 ez form 2022 easily. This capability enhances your workflow, making it simpler to manage tax documents alongside other financial forms. Integration ensures that your data is consistent and accessible.

-

What are the benefits of using airSlate SignNow for the 1040 ez form 2022?

Using airSlate SignNow for the 1040 ez form 2022 provides numerous benefits, including faster turnaround times and reduced paperwork. It also enhances collaboration, enabling multiple parties to review and sign documents electronically. Our solution simplifies the entire signing process, making it efficient and effective.

Get more for 1040ez Form

- Spouse consent letter for loan form

- Nfcu delaration of forgery fraud form

- St louis withholding tax forms

- Eagle scout rank bapplicationb intake cover page form

- Omico traffic accident report form old mutual zimbabwe oldmutual co

- Hsb online registration form

- Amos p form

- Miami dade fat oil grease discharge control operating application form

Find out other 1040ez Form

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast