Yes Bank Rtgs Form

What is the Yes Bank Rtgs Form

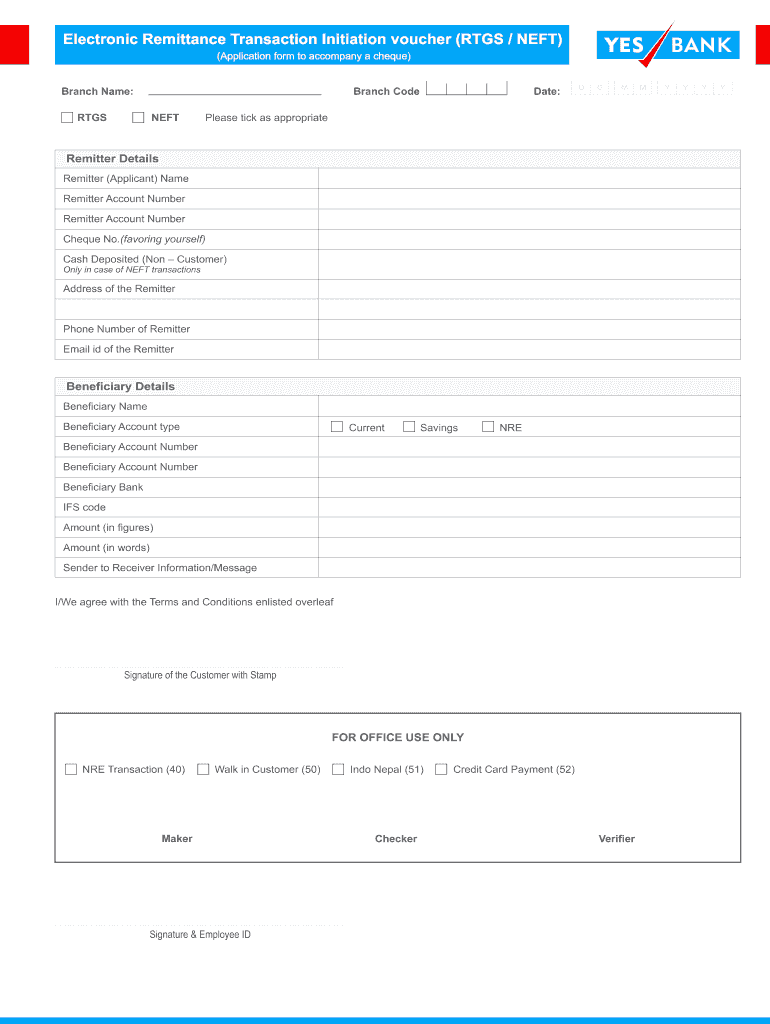

The Yes Bank RTGS form is a document used for initiating Real Time Gross Settlement (RTGS) transactions. This form is essential for transferring large sums of money between banks in real-time, ensuring that the funds are credited immediately. The RTGS system is primarily used for high-value transactions, making it a preferred choice for businesses and individuals requiring prompt payments. The form captures critical information such as the sender's and receiver's bank details, account numbers, and the transaction amount.

How to use the Yes Bank Rtgs Form

Using the Yes Bank RTGS form involves several straightforward steps. First, ensure you have the correct form, which can be downloaded in PDF format. Next, fill in the required details accurately, including your account number, the recipient's account number, and the amount to be transferred. After completing the form, review the information for any errors. Once verified, you can submit the form to your bank, either online or in person, depending on the bank's submission methods.

Steps to complete the Yes Bank Rtgs Form

Completing the Yes Bank RTGS form requires careful attention to detail. Follow these steps for a smooth process:

- Download the Yes Bank RTGS form in PDF format.

- Provide your personal information, including your name and account number.

- Enter the recipient's details, including their bank name, account number, and IFSC code.

- Specify the amount you wish to transfer and any applicable charges.

- Sign the form to authorize the transaction.

- Submit the completed form to your bank for processing.

Legal use of the Yes Bank Rtgs Form

The Yes Bank RTGS form is legally binding once it is completed and signed. It is crucial to ensure that all information is accurate to avoid any legal complications. The form complies with banking regulations and standards set by the Reserve Bank of India, making it a legitimate instrument for fund transfers. Additionally, electronic submissions of the form are also recognized legally, provided they meet the necessary compliance requirements.

Key elements of the Yes Bank Rtgs Form

Several key elements must be included in the Yes Bank RTGS form to ensure its validity and effectiveness:

- Sender's Information: Name, account number, and contact details.

- Recipient's Information: Name, account number, bank name, and IFSC code.

- Transaction Details: Amount to be transferred and any applicable charges.

- Signature: The sender's signature is required to authorize the transaction.

How to obtain the Yes Bank Rtgs Form

The Yes Bank RTGS form can be easily obtained online or at any Yes Bank branch. For online access, visit the official Yes Bank website, where you can download the form in PDF format. If you prefer to obtain a physical copy, simply visit your nearest Yes Bank branch and request the RTGS form from a bank representative. Ensure you have the necessary identification when visiting the branch.

Quick guide on how to complete yes bank rtgs form

The simplest method to obtain and authorize Yes Bank Rtgs Form

On a company-wide scale, ineffective procedures involving paper approvals can consume a signNow amount of work time. Signing paperwork like Yes Bank Rtgs Form is an inherent aspect of operations in any organization, which is why the efficiency of each contract’s lifecycle signNowly impacts the overall performance of the company. With airSlate SignNow, finalizing your Yes Bank Rtgs Form is as straightforward and swift as possible. This platform provides you with the latest version of virtually any document. Even better, you can sign it instantly without the necessity of installing external software on your computer or printing physical copies.

Steps to obtain and authorize your Yes Bank Rtgs Form

- Browse our library by category or utilize the search box to locate the form you require.

- View the form preview by selecting Learn more to confirm it’s the right one.

- Click Get form to begin editing immediately.

- Fill out your form and include any required details using the toolbar.

- When finished, click the Sign tool to authorize your Yes Bank Rtgs Form.

- Choose the signature method that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options as necessary.

With airSlate SignNow, you have everything needed to handle your documents efficiently. You can discover, complete, modify, and even send your Yes Bank Rtgs Form all in one tab without any complications. Enhance your processes with a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Why do I have to fill RTGS form if I want to transfer money from one bank to another bank?

There are multiple ways to transfer funds from one bank to another. Based on the amount being transferred (minimum amount requirement for few modes) and the time of the day for the transaction (few modes have cutoff time) the mode of transfer will be decided.Now in RTGS (as well as for NEFT and IMPS) there is no mandate for the beneficiary bank to do name validation, which means even if the beneficiary name captured in RTGS message differs from the name of the account maintained in the beneficiary bank, the funds can be credited to the account as far as account number is a valid account number and IFSC code is correct.So to avoid any possible transfer to incorrect account and to avoid later disputes (due to communicate gap/error) application forms are to be filled. Also the beneficiary account has to be captured twice in the application form. Expectation is the person filling the form will refer to the source documents twice for account number while filling the form to avoid oversight (but generally people copy the account number from top while filling the second time, so if the first time account number is wrong, second time also it will be wrong defeating the purpose).However this handled properly in online channels (mobile app & internet banking website), while capturing the account number for the first time it is masked (******) forcing the user to refer the source document for the beneficiary account while entering second time.In nutshell the application form is to avoid transfer to incorrect account and to avoid disputes.Trust i had answered your query.

-

What transfer medium is the fastest for an RTGS of large sum, through online net banking or by visiting a branch & filling out a form?

RTGS stands for Real Time Gross Settlement and is the safest and fastest way of transferring money from one bank to another. Though RTGS transfers can only happen above the sum of 2 lac rupees, any amount below this has to be transferred through NEFT.With the popularity and increased usage of online net banking amongst the lesser educated sections of the society also, it has become very easy to do fund transfers through NEFT and RTGS.You can check on the RBI’s website of the list of bank branches that do RTGS payment, as not all branches have this facility, there are only 1,00,000 bank branches in India that has the facility of RTGS.Simple steps through which you can do an RTGS online are:1. Once you have your internet banking facility activated.2. Log on to your specific bank's web portal for example Yes Bank.3. Go to your profile and select the option of beneficiary.4. Select RTGS from the inter-bank payment options available.5. Select the option provided to add a beneficiary and provide the necessary details such as name, account number, address and IFSC code of the beneficiary.6. Click the ‘accept Terms of Service (Terms & Conditions)’ button followed by ‘confirm’.7. The beneficiary added is activated within time ranging from 30 minutes to a few hours depending upon the bank and security measures. Once the beneficiary account is activated, the transfers can be done instantly.8. To remit funds to the Inter Bank Payee through RTGS / NEFT select the ‘Inter Bank Transfer’ link in the ‘Payments/Transfers’ tab.9. Select the Transaction Type – RTGS or NEFT. In your case select RTGS.10. The list of beneficiary accounts added is displayed. Enter the Amount and select the beneficiary to be credited from the list.Click on ‘Accept Terms of Service (Terms & Conditions)’ and confirm.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

Can I do RTGS from a non-branch bank to a Yes Bank account?

YES, you can request to your non home branch for a RTGS to any other bank account.There are some condition on this request( which may vary from bank to bank) :- 1. The accountholder should must present in the branch premises while request is given to the bank. 2. There is an amount limitation for a RTGS request.I request you to visit a non home branch of your bank and get an experience of it.

-

Can I fill out the improvement exam form online? If yes, then how?

Cbse improvement class 12th exam forms will be out probably in 1st wk. Of October 2017.Yes you can fill the form online on the official website of CBSE I.e www.cbse.nic.injust go on the mentioned website and check the news section if the forms are available then click on the link related to improvement exam.Then you must have to fill your previous details like Roll no, school no. , Subject selection {jee aspirant must go for all five subjects if, wants to appear} and for other general details please refer to your previous yr. Admit card.Then go for fee payment which is 200₹/subject by e-challan mode and after the completion of payment status get your reference copy.Or you can also fill the form by offline mode the forms will be available in regional Cbse office or syndicate bank branches near you.

-

What we have to fill in "remitter bank's RTGS/NEFT code" column?

NEFT code is nothing but IFSC code. IFSC stands for Indian Financial System Code . It is aunique code no. assigned each bank branch containg the following details:First four characters - Identity (Bank )Fifth Character: 0 ( default and kept for future use)Remaining six characters: Branch codeTotal 11 characterse.g. HDFC0000215 HDFC bank Rajahmundry Thus when you mention this number in your NEFT application it is understood that you are wishing to remit funds to an account holder ( a/c no. to be mentioned) to HDFC Bank Rajahmundry.The code consists of 11 Characters - First 4 characters represent the entity; Fifth position has been defaulted with a '0' (Zero) for future use; and the Last 6 character denotes the branch identity. IFSC is being identified by the RBI as the code to be used for various payment system projects within the country, and it would, in due course, cover all networked branches in the country. In due course, when all bank branches participate in electronic payment systems, they would need to have a single identifiable unique code and IFSC would serve the purpose effectively.

Create this form in 5 minutes!

How to create an eSignature for the yes bank rtgs form

How to create an electronic signature for your Yes Bank Rtgs Form online

How to create an electronic signature for your Yes Bank Rtgs Form in Chrome

How to generate an electronic signature for signing the Yes Bank Rtgs Form in Gmail

How to create an electronic signature for the Yes Bank Rtgs Form right from your smart phone

How to generate an electronic signature for the Yes Bank Rtgs Form on iOS devices

How to make an eSignature for the Yes Bank Rtgs Form on Android

People also ask

-

What is the yes bank rtgs form, and why do I need it?

The yes bank rtgs form is a document that facilitates the transfer of funds between bank accounts using the Real-Time Gross Settlement (RTGS) system. It's essential for businesses and individuals making high-value transactions, ensuring timely and secure fund transfers.

-

How can airSlate SignNow help me with the yes bank rtgs form?

airSlate SignNow allows you to quickly create, sign, and send your yes bank rtgs form electronically. Our user-friendly interface ensures that you can complete your transactions efficiently, helping you save time and reduce paperwork.

-

Are there any fees associated with using the yes bank rtgs form?

While airSlate SignNow does provide a cost-effective solution for managing your yes bank rtgs form, standard bank fees for RTGS transactions may still apply. Check with yes bank for specific charges related to RTGS transfers.

-

Can I integrate airSlate SignNow with my accounting software to manage the yes bank rtgs form?

Yes, airSlate SignNow offers seamless integration with various accounting and business applications. This ensures that your yes bank rtgs form is connected to your financial workflow, making tracking and management easier.

-

What features does airSlate SignNow provide for handling the yes bank rtgs form?

airSlate SignNow provides features such as eSignature capabilities, document templates, and workflow automation for your yes bank rtgs form. These tools enhance productivity and streamline the transaction process.

-

How secure is the transmission of my yes bank rtgs form using airSlate SignNow?

Security is a top priority at airSlate SignNow. Your yes bank rtgs form and all associated data are encrypted and handled with strict access controls to protect your sensitive information during transmission.

-

Is it possible to track the status of my yes bank rtgs form once sent?

Absolutely! With airSlate SignNow, you can easily track the status of your sent yes bank rtgs form. You'll receive real-time updates on document views and signatures, providing transparency throughout the process.

Get more for Yes Bank Rtgs Form

- Contractors affidavit of payment form

- Aar change of ownership form

- Form for organization

- Endothermic reactions vs exothermic reactions worksheet form

- Molina healthcare medicaid chip amp medicare of texas form

- Fl 345 property order attachment to judgment family law form

- Fl 328 notice regarding confidentiality of child custody evaluation report form

- Ccc 185 form

Find out other Yes Bank Rtgs Form

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself