Business Income and Expense Worksheet Form

What is the Business Income and Expense Worksheet

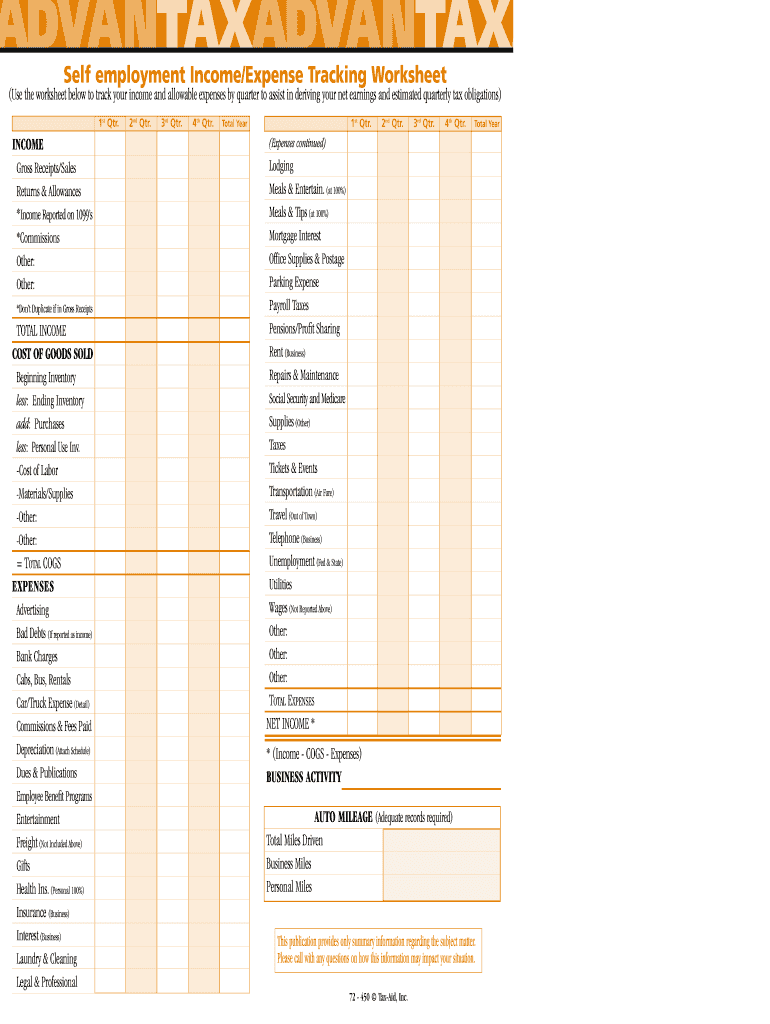

The Business Income and Expense Worksheet is a crucial tool for self-employed individuals and small business owners in the United States. This worksheet helps track income and expenses throughout the year, simplifying the process of preparing taxes. By organizing financial data, users can identify deductible expenses, which can significantly lower taxable income. This document is especially useful for freelancers, independent contractors, and small business owners who need to report their earnings accurately to the IRS.

How to Use the Business Income and Expense Worksheet

Using the Business Income and Expense Worksheet involves several straightforward steps. First, gather all relevant financial documents, including receipts, invoices, and bank statements. Next, categorize income and expenses into sections such as business income, operating expenses, and capital expenditures. As you fill out the worksheet, ensure that each entry is accurate and reflects the actual amounts spent or earned. This organized approach not only aids in tax preparation but also provides insights into business performance.

Steps to Complete the Business Income and Expense Worksheet

Completing the Business Income and Expense Worksheet requires careful attention to detail. Follow these steps for effective completion:

- Start by entering your business name and contact information at the top of the worksheet.

- List all sources of income, including sales and services, in the designated section.

- Document all business-related expenses, categorizing them into appropriate groups such as office supplies, travel, and utilities.

- Calculate total income and total expenses to determine net profit or loss for the year.

- Review the worksheet for accuracy and completeness before filing.

IRS Guidelines

The IRS provides specific guidelines for completing the Business Income and Expense Worksheet. It is essential to follow these guidelines to ensure compliance and maximize deductions. The IRS requires that all income be reported, and only legitimate business expenses can be deducted. Familiarizing yourself with IRS Publication 535, which covers business expenses, can help clarify what qualifies as a deductible expense. Adhering to these guidelines is crucial for avoiding potential audits and penalties.

Filing Deadlines / Important Dates

Understanding filing deadlines is vital for self-employed individuals. Typically, the deadline for filing federal income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, self-employed individuals may need to make estimated tax payments quarterly. Keeping track of these important dates ensures timely filing and helps avoid late fees or interest charges.

Required Documents

To accurately complete the Business Income and Expense Worksheet, certain documents are necessary. These include:

- Receipts for all business expenses.

- Invoices for income received.

- Bank statements reflecting business transactions.

- Previous year’s tax return for reference.

Having these documents organized and accessible will streamline the process of filling out the worksheet and preparing your tax return.

Digital vs. Paper Version

Choosing between a digital or paper version of the Business Income and Expense Worksheet can impact efficiency. Digital versions allow for easy editing, automatic calculations, and secure storage. Additionally, using digital tools can facilitate e-signatures and streamline the submission process. In contrast, paper versions may be preferred by those who are more comfortable with traditional methods. Ultimately, the choice depends on personal preference and comfort with technology.

Quick guide on how to complete self employment income expense tracking worksheet form

Complete Business Income And Expense Worksheet effortlessly on any gadget

Online document management has become widely adopted by companies and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed papers, enabling you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Business Income And Expense Worksheet on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

The easiest way to alter and eSign Business Income And Expense Worksheet seamlessly

- Locate Business Income And Expense Worksheet and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Business Income And Expense Worksheet to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What form can I fill out as a self-employed individual to make my CPA’s job easier?

A QuickBooks Trial Balance and Detailed General Ledger - printed and in Excel format. Work with your CPA to create an appropriate chart of accounts for your business. And use a good bookkeeper to keep your books. If your books look good, the CPA will ask some question to gain comfort and then accept your numbers with little further investigation.Please do not bring a boxful of crumpled receipts. You will pay more for your CPA to uncrumple them and categorize them. If you are a really small business, a legal pad sheet categorizing your receipts. If your receipts are a mess, or your books a mess, your CPA needs to ask a lot more questions and spend a lot more time gaining comfort with your books. Bad books from a shady client means a lot of grief for the CPA and a lot more fees.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

Is it necessary to register as self-employed when I make no income, but I want to claim business expenses? I am starting out as a DJ, and I bought gear already.

If you want to be able to claim anything, then yes, you have to register as self-employed or a business.You can only offset your expenses if you have a business to register them against, naturally. However, it depends on your place of abode - which country you’re in - as to the best way to sort things. I’d ask around, or just call your tax office and ask them.Best of luck!

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the self employment income expense tracking worksheet form

How to make an electronic signature for the Self Employment Income Expense Tracking Worksheet Form in the online mode

How to generate an electronic signature for your Self Employment Income Expense Tracking Worksheet Form in Google Chrome

How to make an eSignature for putting it on the Self Employment Income Expense Tracking Worksheet Form in Gmail

How to generate an eSignature for the Self Employment Income Expense Tracking Worksheet Form from your mobile device

How to make an electronic signature for the Self Employment Income Expense Tracking Worksheet Form on iOS

How to create an electronic signature for the Self Employment Income Expense Tracking Worksheet Form on Android

People also ask

-

What is a self employed tax deductions worksheet?

A self employed tax deductions worksheet is a tool designed to help self-employed individuals track and organize their deductible expenses throughout the year. It simplifies the process of identifying expenses that can lower your taxable income, making tax season less stressful and more efficient.

-

How can airSlate SignNow help with the self employed tax deductions worksheet?

airSlate SignNow enables users to seamlessly send and eSign their self employed tax deductions worksheet and related documents. This electronic solution enhances accessibility, allowing you to manage your tax information securely from anywhere, ensuring you never miss a deadline.

-

What features are included in the self employed tax deductions worksheet?

The self employed tax deductions worksheet includes sections for detailing various deductible expenses, such as home office costs, business travel, and supplies. With airSlate SignNow, you can also include electronic signatures and send documents for quick approvals.

-

Is the self employed tax deductions worksheet available in different formats?

Yes, the self employed tax deductions worksheet can be customized in various formats such as PDF and Word through airSlate SignNow. This flexibility ensures that you can work with your preferred document type, making tax preparation easier and more convenient.

-

Does airSlate SignNow offer integration with accounting software for the self employed tax deductions worksheet?

Absolutely! airSlate SignNow integrates with popular accounting software, allowing for a more streamlined process when managing your self employed tax deductions worksheet. This integration helps you sync your expenses and simplify reporting, saving you valuable time.

-

What are the benefits of using airSlate SignNow for my self employed tax deductions worksheet?

Using airSlate SignNow for your self employed tax deductions worksheet offers enhanced efficiency and ease of use. The platform allows you to save, share, and secure your documents online, ensuring that your important tax information is accessible whenever you need it.

-

How much does it cost to use airSlate SignNow for preparing the self employed tax deductions worksheet?

AirSlate SignNow offers flexible pricing plans tailored to fit various business needs, making it cost-effective for managing your self employed tax deductions worksheet. Pricing may vary based on the number of users and the features you require, so it’s best to check their website for detailed information.

Get more for Business Income And Expense Worksheet

- Florida auto insurance card template 101075546 form

- International driving permit template form

- Vfs courier form filled sample 82018230

- Rheumatology mcqs with answers pdf form

- Cdtfa 230 rev 1 8 17 form

- Private road maintenance agreement pdf form

- Secondment agreement template form

- The brent school emblem the lion stands for braver form

Find out other Business Income And Expense Worksheet

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now