Ct W4 Form

What is the CT W4?

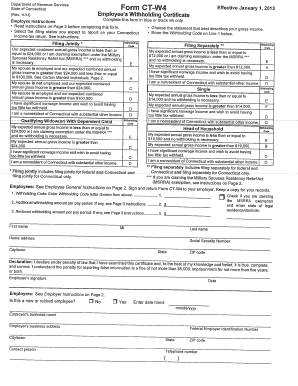

The CT W4 form is a state-specific document used by employees in Connecticut to determine the amount of state income tax withholding from their paychecks. This form is essential for both employees and employers, as it helps ensure compliance with state tax regulations. The information provided on the CT W4 allows employers to calculate the appropriate withholding amount based on the employee's personal circumstances, such as marital status and number of allowances claimed.

How to Use the CT W4

To use the CT W4 effectively, employees should complete the form accurately and submit it to their employer. The form requires personal information, including the employee's name, address, and Social Security number. Additionally, employees must indicate their filing status and the number of allowances they wish to claim. It is important to review the form periodically, especially when there are changes in personal circumstances, such as marriage, divorce, or the birth of a child, as these factors can affect withholding amounts.

Steps to Complete the CT W4

Completing the CT W4 involves several straightforward steps:

- Gather personal information, including your Social Security number and address.

- Choose your filing status: single, married, or head of household.

- Determine the number of allowances you want to claim based on your situation.

- Complete any additional sections, such as specifying any additional withholding if desired.

- Sign and date the form before submitting it to your employer.

Legal Use of the CT W4

The CT W4 is legally binding when completed and submitted correctly. It must comply with state tax laws, ensuring that the information provided is accurate and truthful. Employers are required to use the information from the CT W4 to calculate the correct amount of state income tax to withhold from employees' wages. Failure to comply with withholding regulations can result in penalties for both employees and employers.

State-Specific Rules for the CT W4

Connecticut has specific rules regarding the completion and submission of the CT W4. Employees must ensure that they are aware of any changes in state tax laws that may affect their withholding. Additionally, the state may update the CT W4 form periodically, so it is crucial to use the most current version available. Employers are responsible for keeping records of the CT W4 forms submitted by their employees and must ensure that withholding practices align with state regulations.

Filing Deadlines / Important Dates

While there are no specific filing deadlines for submitting the CT W4, it is advisable to complete the form before starting a new job or when there are changes in personal circumstances. Employees should also be aware of the annual tax filing deadline, which is typically April 15, as this date may influence their withholding decisions. Staying informed about any updates to state tax laws is essential for ensuring compliance throughout the year.

Quick guide on how to complete ct w4 100050508

Complete Ct W4 effortlessly on any device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Ct W4 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign Ct W4 with ease

- Obtain Ct W4 and select Get Form to begin.

- Utilize the available tools to complete your form.

- Highlight important sections of your files or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Ct W4 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct w4 100050508

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT W4 form and why is it important?

The CT W4 form is a crucial document for employees in Connecticut, allowing them to declare their state income tax withholding preferences. It's important because it helps ensure the correct amount of taxes is withheld from your paycheck, preventing any surprises during tax season.

-

How can airSlate SignNow help with filling out the CT W4?

airSlate SignNow provides a simple and efficient platform to electronically sign and complete the CT W4 form. With our user-friendly interface, users can easily input their information, ensuring that their form is filled out accurately and securely.

-

Is using airSlate SignNow for the CT W4 form secure?

Yes, airSlate SignNow employs advanced security measures to protect your documents, including the CT W4 form. Our platform uses encryption and secure data storage, ensuring that your sensitive information remains confidential.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to meet the varied needs of our users. Our plans provide access to essential features like eSigning and document management, ensuring that filling out forms like the CT W4 is both affordable and convenient.

-

Can I integrate airSlate SignNow with other applications for managing my CT W4?

Absolutely! airSlate SignNow integrates smoothly with various applications, allowing you to manage your CT W4 alongside your existing tools. This feature enhances workflow efficiency, making it easier to handle your paperwork.

-

What features does airSlate SignNow offer for managing the CT W4?

airSlate SignNow includes features such as reusable templates, automated reminders, and real-time tracking for your CT W4 forms. These tools streamline the signing process, ensuring timely submission and compliance with state regulations.

-

How does airSlate SignNow enhance the user experience for completing the CT W4?

Our platform is designed with a focus on usability, providing a step-by-step process for completing the CT W4 form. This ease of use reduces errors and speeds up the process, making it accessible for individuals and businesses alike.

Get more for Ct W4

- Independent caregiver itemized bill amp daily visit note form

- Monteia mundy form

- Operational risk management orm assessment netc navy form

- Printable durable healthcare power of attorney florida form

- Funding agreement template form

- Fundraiser agreement template form

- Funds transfer agreement template form

- Fund management agreement template form

Find out other Ct W4

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now