Cert 112 2005-2026

What is the Cert 112

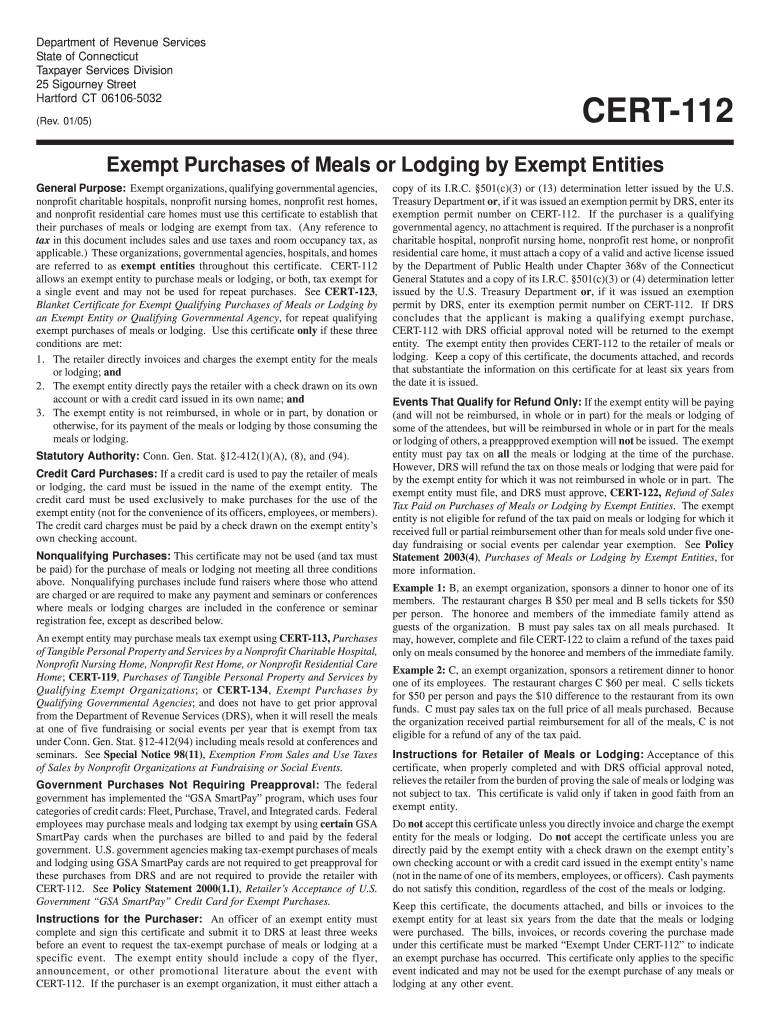

The Cert 112 is a tax exemption certificate used in Connecticut, specifically designed for exempt purchases. This form allows eligible entities to make tax-exempt purchases, which can include goods and services necessary for their operations. It is essential for businesses and organizations that qualify under specific criteria to utilize this form to avoid unnecessary tax expenditures.

How to obtain the Cert 112

To obtain the Cert 112, eligible entities must complete an application process through the Connecticut Department of Revenue Services. This typically involves providing documentation that proves the entity's qualification for tax exemption. Interested parties can access the form directly from the department's website or request it through official channels. Ensuring all necessary information is accurate and complete will facilitate a smoother application process.

Steps to complete the Cert 112

Completing the Cert 112 involves several key steps:

- Gather necessary documentation, including proof of tax-exempt status.

- Fill out the Cert 112 form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the vendor at the time of purchase.

Following these steps carefully will help ensure that the exemption is recognized and processed correctly.

Legal use of the Cert 112

The Cert 112 must be used in compliance with Connecticut state laws governing tax exemptions. It is legally binding and should only be used by entities that meet the criteria for exemption. Misuse of the form can lead to penalties, including fines and back taxes owed. Understanding the legal implications of using the Cert 112 is crucial for maintaining compliance and avoiding legal issues.

Key elements of the Cert 112

Key elements of the Cert 112 include:

- Entity name and address.

- Tax identification number.

- Type of exemption being claimed.

- Signature of an authorized representative.

These elements ensure that the form is valid and that the exemption is appropriately claimed.

Examples of using the Cert 112

Examples of using the Cert 112 include:

- A nonprofit organization purchasing supplies for community programs.

- A government agency acquiring equipment for public services.

- A school district buying educational materials for classrooms.

These scenarios highlight the diverse applications of the Cert 112 in various sectors.

Quick guide on how to complete cert 112 formpdffillercom

Your assistance manual on preparing your Cert 112

If you’re wondering how to finalize and submit your Cert 112, here are a few straightforward tips to simplify tax filing.

Initially, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and complete your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to amend details as necessary. Optimize your tax management with enhanced PDF editing, eSigning, and intuitive sharing.

Adhere to the steps outlined below to complete your Cert 112 in just a few minutes:

- Set up your account and begin handling PDFs in minutes.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Cert 112 in our editor.

- Populate the mandatory fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-valid eSignature (if necessary).

- Examine your document and correct any inaccuracies.

- Save changes, print your copy, send it to your intended recipient, and download it to your device.

Follow this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper may lead to increased errors and delayed refunds. Of course, prior to e-filing your taxes, visit the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

FAQs

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

Do I need to fill out Form 112 for a CA Articleship if I have already done B.Com. and CS before starting the CA Articleship?

No, u only need to fill form 112 if you are doing any other course while doing CA.As ur bcom n CS is completed , u need not fill form 112.

-

Do I need to fill out Form 112 of the CA articleship if I had completed BCom’s final year (regular) and only the exams are left?

I am editing this answer because of what I faced recently.I had not filled this form during articleship since nobody ever advised me and I didn’t feel the requirement of doing so as I was doing my BCom from distance education.While applying for membership you will face problem if you haven’t taken permission from your principal for BCom during articleship.You would then be required to pay ₹ 10000 (which is at present ₹ 5000 for some limited period of time) as penalty along with form 112 duly signed by your principal, only then you would be allowed to show your BCom degree officially.So please fill this form asap if you haven’t filled it earlier.

-

Do I need to fill out Form 112 for a CA Articleship if I have already done B.Com. before starting the Articleship?

If you have already completed B.Com, before joining article ship, then you need not intimate the Institute about the same.Having said that, I would recommend you to pursue M.Com through IGNOU (in tie up with ICAI), along with CA. This will help you to become a Post Graduate before you are a Chartered Accountant. If you do that, you need to intimate the Institute, that you are simultaneously pursuing another course, besides CA.The next step will be to clear National Eligibility Test (NET) or State Level Eligibility Test (SLET), and apply for Junior Research Fellowship offered by University Grants Commission (UGC), after you complete your article ship.There after, the next step is to pursue Doctorate (PhD).In the process, you will be eligible to become lecturer in any Indian College / University, if you are passionate about teaching / coaching.Otherwise, you can practice or join industry, in line with your future plans.

-

I am a CA IPCC student. Do I have to fill out form 112, if I am pursuing an MCom distance education under IGNOU University?

HI,U need to fill Form 112 at the time of joining articleship. Must fill form 112 when u join articleship otherwise u will get into trouble while apply to membership.Form 112 is required to be fill for every course pursuing with CA articleship including distance course also.You can also refer my below video for getting more information about form 112.Form 112 ICAI Very Important Information.:-

Create this form in 5 minutes!

How to create an eSignature for the cert 112 formpdffillercom

How to create an eSignature for the Cert 112 Formpdffillercom online

How to make an electronic signature for your Cert 112 Formpdffillercom in Chrome

How to generate an eSignature for putting it on the Cert 112 Formpdffillercom in Gmail

How to make an electronic signature for the Cert 112 Formpdffillercom from your smartphone

How to generate an electronic signature for the Cert 112 Formpdffillercom on iOS

How to make an electronic signature for the Cert 112 Formpdffillercom on Android devices

People also ask

-

What is Cert 112 in relation to airSlate SignNow?

Cert 112 refers to the certification that validates the compliance and security measures of airSlate SignNow. This certification ensures that your document signing and eSigning processes meet industry standards, providing peace of mind when using the platform.

-

How much does airSlate SignNow with Cert 112 cost?

The pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective for businesses of all sizes. You can find detailed pricing information on our website, and rest assured that all plans include the benefits of using Cert 112 for secure document handling.

-

What features does airSlate SignNow offer with Cert 112?

With Cert 112, airSlate SignNow offers a range of features such as secure eSigning, customizable templates, and document tracking. These features are designed to streamline your workflow while ensuring the highest level of security and compliance.

-

How can Cert 112 benefit my business?

Obtaining Cert 112 through airSlate SignNow helps enhance your business's credibility and trust with clients. It demonstrates your commitment to security and compliance, which can be a critical factor in attracting and retaining customers.

-

Does airSlate SignNow integrate with other software, and how is Cert 112 relevant?

Yes, airSlate SignNow offers seamless integrations with various software applications, including CRM and document management systems. The relevance of Cert 112 is that it ensures these integrations are secure, maintaining the integrity of your data across platforms.

-

Is Cert 112 essential for legal compliance with airSlate SignNow?

While Cert 112 is not legally mandated, it signNowly enhances your compliance posture when using airSlate SignNow. By adhering to the standards set by Cert 112, you can ensure that your document signing processes meet legal requirements and industry best practices.

-

What types of documents can I eSign using Cert 112 with airSlate SignNow?

You can eSign a wide variety of documents using airSlate SignNow, including contracts, agreements, and forms. Cert 112 ensures that all these documents are handled securely, protecting sensitive information during the signing process.

Get more for Cert 112

- Reg 481 form

- Energieovernamedocument 64884522 form

- Kalpesh chotalia font download form

- Yale university application pdf form

- Application form for convertig saving account to pmjdy account

- Ohio state resale certificate form

- Alcohol intoxication report format 446594548

- Www emdmillipore commilliporesigmalife scienceindustrial ampamp lab chemicals form

Find out other Cert 112

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation