Partnership Tar Form

What is the Partnership Tar Form

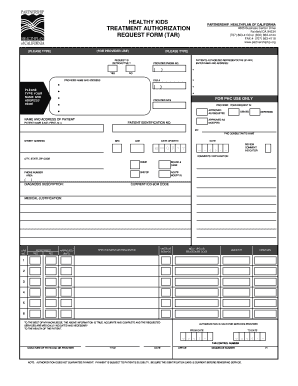

The Partnership Tar Form is a crucial document used by partnerships to report specific financial information to the IRS. This form is essential for tax compliance and helps determine the tax obligations of the partnership. It typically includes details about income, deductions, and credits that the partnership has earned during the tax year. Understanding the purpose of this form is vital for ensuring accurate reporting and compliance with federal tax laws.

How to use the Partnership Tar Form

Using the Partnership Tar Form involves several key steps. First, gather all necessary financial records, including income statements and expense reports. Next, fill out the form accurately, ensuring that all figures are correct. It is important to follow the IRS guidelines closely to avoid errors that could lead to penalties. Once completed, the form must be submitted by the designated deadline, which is typically March 15 for most partnerships. Utilizing digital tools can streamline this process, allowing for easier data entry and submission.

Steps to complete the Partnership Tar Form

Completing the Partnership Tar Form involves a systematic approach:

- Gather Information: Collect all financial documents, including income and expense records.

- Fill Out the Form: Enter all required information accurately, ensuring to follow the form's instructions.

- Review for Accuracy: Double-check all entries for any errors or omissions.

- Submit the Form: File the completed form by the deadline, either electronically or by mail.

By following these steps, partnerships can ensure that their tax reporting is accurate and timely.

Legal use of the Partnership Tar Form

The legal use of the Partnership Tar Form is governed by IRS regulations. This form must be completed and filed in accordance with federal tax laws to ensure that the partnership meets its legal obligations. Failure to file the form correctly can result in penalties and interest on unpaid taxes. It is essential for partnerships to understand the legal implications of their submissions and maintain compliance with all relevant tax laws.

Required Documents

To complete the Partnership Tar Form, several documents are typically required:

- Financial Statements: Income statements and balance sheets that detail the partnership's financial performance.

- Expense Records: Documentation of all business expenses incurred during the tax year.

- Previous Tax Returns: Copies of prior year tax returns may be needed for reference.

- Partnership Agreement: A copy of the partnership agreement outlining the terms and conditions of the partnership.

Having these documents ready will facilitate a smoother completion process for the Partnership Tar Form.

Filing Deadlines / Important Dates

Filing deadlines for the Partnership Tar Form are critical for compliance. Typically, partnerships must file their forms by March 15 of each year. If the deadline falls on a weekend or holiday, the due date may be extended to the next business day. It is advisable for partnerships to mark these dates on their calendars and prepare in advance to avoid late submissions, which could incur penalties.

Quick guide on how to complete partnership tar form

Complete Partnership Tar Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct version and securely store it online. airSlate SignNow provides all the features necessary to create, modify, and eSign your documents quickly without delays. Handle Partnership Tar Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Partnership Tar Form with ease

- Find Partnership Tar Form and click Get Form to begin.

- Make use of the tools provided to complete your document.

- Emphasize key sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new versions. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Partnership Tar Form and ensure exceptional communication during every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the partnership tar form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a partnership tar form and how is it used?

A partnership tar form is a document used to outline the terms of a partnership agreement. It is critical for establishing mutual obligations and expectations between partners in a business. Using airSlate SignNow, you can easily create, send, and eSign partnership tar forms securely and efficiently.

-

How can I create a partnership tar form using airSlate SignNow?

Creating a partnership tar form with airSlate SignNow is straightforward. Simply choose a template or start from scratch, fill in the necessary details, and customize it to fit your needs. Once your form is ready, you can send it for eSignature instantly.

-

Is airSlate SignNow affordable for small businesses creating partnership tar forms?

Yes, airSlate SignNow offers competitive pricing plans that are designed to accommodate businesses of all sizes, including small businesses. With its cost-effective solutions, you can efficiently manage your partnership tar forms without breaking the bank.

-

What features does airSlate SignNow offer for managing partnership tar forms?

AirSlate SignNow provides several features for managing partnership tar forms, including drag-and-drop document editing, customizable templates, and secure eSigning capabilities. These features streamline the process, making it easier to manage your partnerships efficiently.

-

Can I integrate airSlate SignNow with other tools for handling partnership tar forms?

Yes, airSlate SignNow offers seamless integrations with a variety of software tools, including CRM and document management systems. This allows you to manage your partnership tar forms alongside other business processes for improved efficiency.

-

How secure is my data when using airSlate SignNow for partnership tar forms?

AirSlate SignNow prioritizes your data security with advanced encryption and compliance with regulations like GDPR. When you use our platform for partnership tar forms, you can be confident that your sensitive information is protected.

-

What are the benefits of using airSlate SignNow for partnership tar forms?

Using airSlate SignNow for partnership tar forms offers several benefits, including time-saving automation, enhanced security, and improved collaboration. You can quickly prepare and finalize your partnership agreements, helping you focus on growing your business.

Get more for Partnership Tar Form

- Consent form for science fair projects with volunteer participants iusd

- Vovim baghie form

- The twenties woman answer key form

- Stylist pull request form

- Completing an airplane certificate of insurancer form

- Preliminary application nyc gov home nyc form

- Single song publishing agreement form

- Personal savings account application form first citizens bank

Find out other Partnership Tar Form

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online