How to Fill Property Return Form

Understanding the property return form

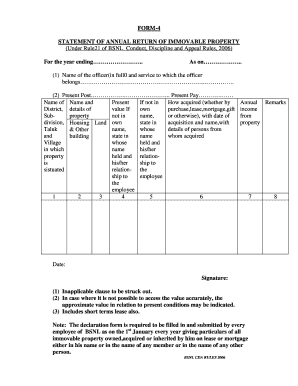

The property return form is a crucial document used in various contexts, particularly in real estate and tax reporting. It serves as a formal declaration of property ownership and related details, often required by local governments or tax authorities. This form can vary by state, but it generally includes information about the property, such as its location, size, and assessed value. Understanding the nuances of this form can help ensure compliance with local regulations and avoid potential penalties.

Steps to complete the property return form

Filling out the property return form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information about the property, including its legal description, address, and any relevant tax identification numbers. Next, accurately fill in the form, paying close attention to details such as property type and ownership structure. Once completed, review the form for any errors and ensure all required signatures are present. Finally, submit the form according to the guidelines provided by your local authority.

Legal use of the property return form

The property return form holds legal significance, as it is often used to determine property taxes and assess compliance with local laws. When filled out correctly, it serves as a legally binding document that can be referenced in disputes or audits. It is essential to ensure that all information provided is truthful and complete, as inaccuracies could lead to legal repercussions or financial penalties. Understanding the legal implications of this form can help property owners navigate their responsibilities effectively.

Required documents for the property return form

When preparing to complete the property return form, certain documents may be required to support the information provided. Commonly needed documents include proof of ownership, such as a deed or title, previous tax assessments, and any relevant property surveys. Depending on the jurisdiction, additional documentation may be necessary, such as proof of improvements made to the property or records of any rental income generated. Having these documents ready can streamline the completion process and ensure accuracy.

Form submission methods

The property return form can typically be submitted through various methods, depending on local regulations. Common submission methods include online filing through the local tax authority's website, mailing a physical copy of the form, or delivering it in person to the appropriate office. Each method may have specific requirements regarding deadlines and supporting documents, so it is important to verify the preferred submission method for your jurisdiction to ensure timely processing.

Filing deadlines and important dates

Filing deadlines for the property return form can vary by state and locality, making it essential for property owners to stay informed about specific dates. Generally, property return forms must be submitted annually, often by a set date in the spring. Missing the deadline can result in penalties or additional fees, so tracking important dates and setting reminders can help ensure compliance. It is advisable to check with local tax authorities for the most accurate and up-to-date information regarding deadlines.

Examples of using the property return form

There are various scenarios in which the property return form may be utilized. For instance, a homeowner may need to file this form when reporting changes in property ownership or when applying for tax exemptions. Additionally, real estate investors may use the form to report rental properties and associated income. Understanding these examples can help property owners recognize when and how to use the property return form effectively, ensuring they meet their legal obligations.

Quick guide on how to complete how to fill property return form

Complete How To Fill Property Return Form smoothly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed materials, as you can easily find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without interruptions. Handle How To Fill Property Return Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to alter and eSign How To Fill Property Return Form effortlessly

- Find How To Fill Property Return Form and click on Get Form to commence.

- Leverage the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to preserve your modifications.

- Select your preferred method of delivering your form—via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Alter and eSign How To Fill Property Return Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to fill property return form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a property return form and how can airSlate SignNow help?

A property return form is a document used to report property-related information, such as changes in ownership or value. airSlate SignNow simplifies the process by allowing you to easily create, send, and eSign your property return forms, ensuring efficiency and accuracy.

-

How much does it cost to use airSlate SignNow for property return forms?

airSlate SignNow offers competitive pricing plans to suit various business needs. You can choose from monthly or annual subscriptions, which provide access to features that streamline the management of your property return forms at an affordable rate.

-

What features does airSlate SignNow offer for managing property return forms?

With airSlate SignNow, you can create custom property return forms, automate workflows, and track document status in real-time. The platform also allows secure eSigning and storage of documents, making it a comprehensive solution for managing your property return forms.

-

Are there any benefits to using airSlate SignNow for property return forms?

Using airSlate SignNow for property return forms provides numerous benefits, including reduced turnaround times, enhanced document security, and improved collaboration among team members. These advantages lead to a smoother process and greater efficiency in handling your property returns.

-

Can I integrate airSlate SignNow with other applications for property return forms?

Yes, airSlate SignNow offers seamless integration with various third-party applications, including CRMs and document management systems. This enables you to better manage your property return forms and ensures a more efficient workflow across your organization's tools.

-

Is it easy to create a property return form using airSlate SignNow?

Absolutely! airSlate SignNow features an intuitive interface that allows users to easily create property return forms from scratch or by using existing templates. This user-friendly design ensures you can set up your documents quickly and efficiently, regardless of your technical skills.

-

How does airSlate SignNow ensure the security of my property return forms?

airSlate SignNow prioritizes the security of your property return forms by utilizing advanced encryption and compliance measures. This ensures that your documents are protected and that sensitive information remains confidential during the eSigning and storage process.

Get more for How To Fill Property Return Form

- Health declaration form deped editable

- Justicecourtsjohannesburg magistrates court civil sectionhome form

- Adult full assessment form

- Bd professional samples form

- Van t hof rijnland huur opzeggen form

- Nis sangre grande form

- Daily inspections city of wildomar form

- Inedible kitchen grease transporter registration application personal use form

Find out other How To Fill Property Return Form

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter