TC 40, Utah Individual Income Tax Return Utah State Tax Tax Utah Form

What is the TC 40, Utah Individual Income Tax Return?

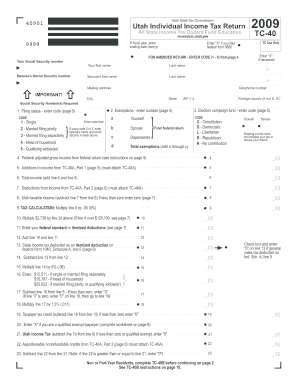

The TC 40 is the official form used for filing individual income taxes in the state of Utah. This form is essential for residents who need to report their income, claim deductions, and calculate their tax liability. It is designed to help taxpayers comply with state tax laws and ensure accurate reporting of income earned during the tax year. The TC 40 captures various income sources and allows taxpayers to apply for credits and deductions specific to Utah, making it a critical document for fulfilling state tax obligations.

Steps to complete the TC 40, Utah Individual Income Tax Return

Completing the TC 40 involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements. Next, fill out personal information, including your name, address, and Social Security number. Then, report your total income, ensuring to include all relevant sources. After calculating your deductions and credits, determine your tax liability. Finally, review the completed form for accuracy before submitting it to the Utah State Tax Commission.

How to obtain the TC 40, Utah Individual Income Tax Return

The TC 40 form can be obtained through multiple channels. It is available for download directly from the Utah State Tax Commission's website, where taxpayers can access the most current version of the form. Additionally, physical copies may be available at local tax offices or public libraries. For those who prefer digital options, various tax preparation software programs also include the TC 40, allowing for electronic completion and submission.

Legal use of the TC 40, Utah Individual Income Tax Return

The TC 40 is legally recognized as a valid document for reporting income and calculating tax obligations in Utah. To ensure its legal standing, the form must be completed accurately and submitted by the filing deadline. Electronic submissions via e-filing are accepted, provided they adhere to the regulations set forth by the Utah State Tax Commission. It is essential to retain copies of the submitted form and any supporting documents for future reference and compliance verification.

Filing Deadlines / Important Dates

Filing deadlines for the TC 40 are crucial for taxpayers to meet to avoid penalties. Generally, the deadline for submitting the TC 40 is April 15 of the following year after the tax year ends. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers may also request an extension, which allows for additional time to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

When filing the TC 40, certain documents are required to support the information provided on the form. Taxpayers should gather their W-2 forms from employers, 1099 forms for any freelance or contract income, and records of other income sources. Additionally, documentation for deductions and credits, such as receipts for charitable contributions or medical expenses, should be collected. Having these documents on hand simplifies the process and ensures accurate reporting of income and tax liability.

Quick guide on how to complete tc 40 utah individual income tax return utah state tax tax utah

Prepare TC 40, Utah Individual Income Tax Return Utah State Tax Tax Utah effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed papers, allowing you to find the right template and securely keep it online. airSlate SignNow provides all the resources you require to create, adjust, and electronically sign your documents swiftly without delays. Handle TC 40, Utah Individual Income Tax Return Utah State Tax Tax Utah on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The simplest way to adjust and electronically sign TC 40, Utah Individual Income Tax Return Utah State Tax Tax Utah with ease

- Obtain TC 40, Utah Individual Income Tax Return Utah State Tax Tax Utah and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any gadget of your choice. Modify and electronically sign TC 40, Utah Individual Income Tax Return Utah State Tax Tax Utah and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 40 utah individual income tax return utah state tax tax utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TC 40, Utah Individual Income Tax Return and why is it important?

The TC 40, Utah Individual Income Tax Return, is the official form for filing individual income taxes in Utah. It is important because it ensures compliance with Utah State Tax laws, allowing individuals to accurately report their income and potentially claim deductions. Filing the TC 40 correctly helps avoid penalties and ensures a smooth tax process.

-

How can airSlate SignNow help with filing the TC 40, Utah Individual Income Tax Return?

airSlate SignNow simplifies the process of completing and submitting the TC 40, Utah Individual Income Tax Return. With its user-friendly eSigning feature, you can easily gather signatures, send documents securely, and ensure everything is in order before submitting to Utah State Tax authorities. This streamlines your tax filing process.

-

What features does airSlate SignNow offer for handling tax documents like the TC 40?

airSlate SignNow offers features such as eSigning, document templates, and cloud storage, which are essential for handling tax documents like the TC 40, Utah Individual Income Tax Return. These features enhance efficiency by reducing paperwork and facilitating fast access to important tax documents, ensuring a hassle-free tax filing experience.

-

Is there a cost associated with using airSlate SignNow for tax document management?

Yes, airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. These plans are designed to be cost-effective, making it a smart choice for managing documents related to the TC 40, Utah Individual Income Tax Return and other tax-related filings. You can choose a plan based on the features that best suit your requirements.

-

Can airSlate SignNow integrate with accounting software for filing the TC 40, Utah Individual Income Tax Return?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to handle the TC 40, Utah Individual Income Tax Return. This integration allows for automatic data transfer, reducing the need for manual entry and ensuring that your tax documents are accurate and up-to-date.

-

What are the benefits of using airSlate SignNow for eSigning the TC 40, Utah Individual Income Tax Return?

Using airSlate SignNow for eSigning the TC 40, Utah Individual Income Tax Return provides numerous benefits, including speed, security, and convenience. It allows you to sign documents from anywhere at any time, signNowly reducing the time it takes to finalize your tax return. Moreover, all signatures are securely stored, ensuring compliance with Utah State Tax requirements.

-

How does airSlate SignNow ensure the security of my TC 40, Utah Individual Income Tax Return documents?

airSlate SignNow prioritizes the security of your documents, including those related to the TC 40, Utah Individual Income Tax Return. It employs industry-standard encryption, secure data storage, and compliance with regulations to protect sensitive information. This ensures that your tax documents remain confidential and secure during the filing process.

Get more for TC 40, Utah Individual Income Tax Return Utah State Tax Tax Utah

Find out other TC 40, Utah Individual Income Tax Return Utah State Tax Tax Utah

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure