Form 940 Fillable

What is the Form 940 Fillable

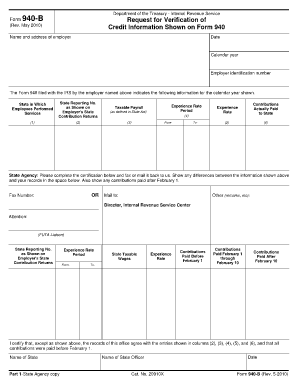

The Form 940 fillable is an essential document used by employers in the United States to report their annual Federal Unemployment Tax Act (FUTA) tax. This form is specifically designed for businesses to calculate and report their unemployment tax liability, which is a crucial aspect of payroll management. The fillable version allows for easy online completion, ensuring that employers can efficiently manage their tax obligations without the hassle of paper forms.

How to Use the Form 940 Fillable

Utilizing the Form 940 fillable is straightforward. Employers can access the form online and fill it out digitally, which streamlines the process. The form requires specific information, including the employer's identification details, total wages paid, and the amount of FUTA tax owed. By using digital tools, employers can ensure accuracy and reduce the risk of errors that may occur with handwritten submissions. Once completed, the form can be easily saved, printed, or submitted electronically, depending on the employer's preference.

Steps to Complete the Form 940 Fillable

Completing the Form 940 fillable involves several key steps:

- Access the fillable form from a reliable source.

- Enter your employer identification information, including your name, address, and Employer Identification Number (EIN).

- Provide details on the total wages paid to employees during the year.

- Calculate the FUTA tax owed based on the provided information.

- Review the information for accuracy before finalizing the form.

- Submit the form by the due date, either electronically or by mail.

Legal Use of the Form 940 Fillable

The legal use of the Form 940 fillable is governed by federal regulations regarding unemployment taxes. Employers must ensure that the information provided is accurate and complete to avoid penalties. The form must be filed annually, and compliance with the deadlines set by the Internal Revenue Service (IRS) is crucial. Using a reliable digital platform to fill out and submit the form can help ensure that it meets all legal requirements, providing peace of mind to employers.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Form 940 fillable. Generally, the form is due by January 31 of the year following the tax year being reported. If the employer pays their FUTA tax on time, they may have until February 10 to file the form. It is essential to keep track of these dates to avoid late fees and penalties, which can significantly impact a business's financial standing.

Who Issues the Form

The Form 940 fillable is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. The IRS provides guidelines and instructions for completing the form, ensuring that employers have the necessary resources to comply with federal tax laws. Understanding the source of the form is important for employers, as it ensures they are using the most current and accurate version available.

Quick guide on how to complete form 940 fillable

Complete Form 940 Fillable easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the right form and safely store it online. airSlate SignNow equips you with all the features required to create, edit, and eSign your documents quickly without interruptions. Handle Form 940 Fillable on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and eSign Form 940 Fillable effortlessly

- Obtain Form 940 Fillable and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure confidential information using tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Edit and eSign Form 940 Fillable to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 940 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable 940 form?

A fillable 940 form is an IRS document used for reporting annual Federal Unemployment Tax Act (FUTA) liability. With airSlate SignNow, you can easily create, fill out, and eSign your fillable 940 forms, ensuring compliance and streamlining your business processes.

-

How does airSlate SignNow simplify the fillable 940 process?

airSlate SignNow simplifies the fillable 940 process by providing an intuitive interface for form creation, filling, and signing. Our platform allows users to quickly input necessary information and eSign documents securely, saving time and reducing errors in your submissions.

-

Is there a cost associated with using airSlate SignNow for fillable 940 forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. With cost-effective options, you can access features that enhance your ability to manage fillable 940 forms efficiently while keeping your expenses under control.

-

Can I integrate airSlate SignNow with other applications for managing fillable 940 forms?

Absolutely! airSlate SignNow supports integration with various applications, enabling seamless workflows for managing fillable 940 forms. By connecting with your favorite tools, you can enhance productivity and reduce the hassle of switching between multiple platforms.

-

What are the benefits of using a fillable 940 form with airSlate SignNow?

Using a fillable 940 form with airSlate SignNow offers numerous benefits, including increased accuracy, reduced processing time, and enhanced security for your sensitive information. Our platform ensures that you can track and manage your forms easily, leading to better compliance and record-keeping.

-

Is it easy to share fillable 940 forms with others using airSlate SignNow?

Yes, sharing fillable 940 forms is straightforward with airSlate SignNow. You can invite others to view, fill out, and sign the document, allowing for collaboration and ensuring that all required signatures are collected efficiently.

-

How does airSlate SignNow ensure the security of my fillable 940 forms?

airSlate SignNow prioritizes the security of your fillable 940 forms by employing industry-standard encryption and secure access protocols. This means your documents are protected against unauthorized access, ensuring that sensitive information remains confidential.

Get more for Form 940 Fillable

- Osha forms 300 300a and 301 cottingham amp butler

- Xethru module communication protocol form

- Caremark forms to print

- Emory referral form

- Donation request application guidelines putters fill and form

- Www boardmantwp com zoning filespool permit application form

- D 101a form 1 es instructions estimated income tax for individuals estates and trusts

- Music band contract template form

Find out other Form 940 Fillable

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer